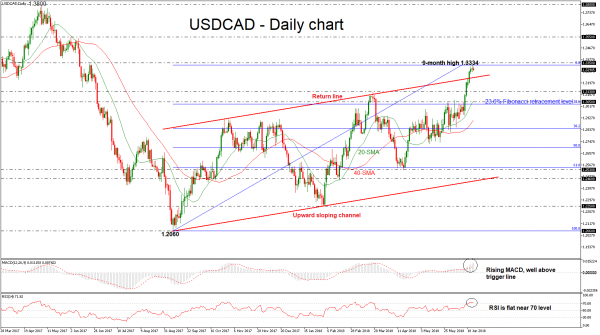

USDCAD edged sharply higher over the previous six days successfully penetrating the nine-month ascending sloping channel to the upside. The price recorded a fresh one-year high of 1.3334 during yesterday’s session, however, today it started the day in negative territory.

Short-term momentum indicators are also pointing to a continuation of the bullish bias. However, the RSI is above the 70-overbought level and is looking overstretched. The MACD oscillator is rising well above the trigger line in the positive area. Also, the moving averages are following the price action to the upside.

If price action remains above the upward sloping channel, there is scope to test the next immediate resistance of 1.3350. Rising above it would see prices re-test the 1.3550 key level, taken from the peak on June 2017, creating a significant resumption of the uptrend.

In case of a bearish correction and a slip below the return line, then the focus would shift to the downside towards the 1.3130 support. More downside movement could increase the negative pressure and challenge the 23.6% Fibonacci retracement level of the upleg from 1.2060 to 1.3334, which holds near the 1.3050 support hurdle.

When looking at the bigger picture, the pair has a clear rising trend as it exited from the channel in the previous days and the medium-term strong momentum is expected to remain.