The major event for today is the Bank of England’s (BoE) interest rate decision and monetary policy statement. The most likely outcome is that the BoE keep rates on hold and the vote count remains the same but the focus will be on the possibility of a rate hike in August. The BoE wanted to see signs of stronger growth but data have been mixed with industrial output, construction and trade being weak, inflation unchanged in May and retail sales picking up. Wage growth, one of the most important indicators, has been muted and in line with expectations. If the monetary policy statement is dovish, the policy divergence with the US will drive the GBPUSD pair lower. However, a hawkish tone which revives hopes of rate hikes this year would give a lift to the British Pound. BoE Governor Mark Carney is also due to speak this evening so will have a chance to elaborate on the outlook.

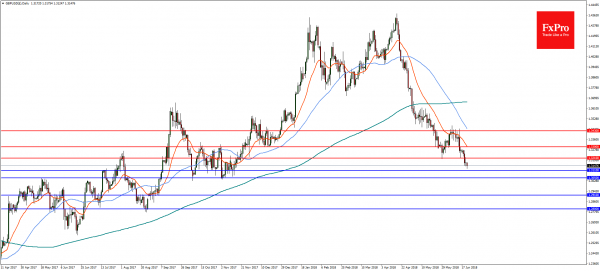

GBPUSD

On the daily chart, GBPUSD is testing the 50% retracement of the lows of September 2016 near 1.3110. A break of that level will see the bearish trend continue to support at 1.3050, 1.2910 and then the 61.8% retracement at 1.2800. The pair needs to regain the 1.3300 level to change the outlook but faces near term resistance at 1.3210.

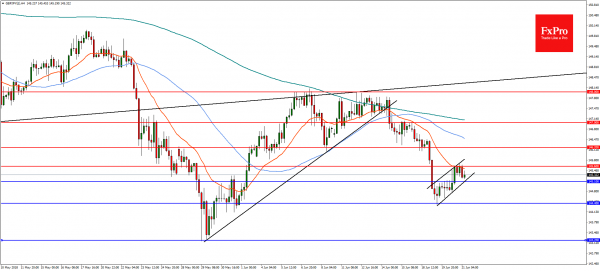

GBPJPY

In the 4-hourly timeframe, GBPJPY is forming a bear flag with a measured target of 142.20. The pair needs to break the 145.10 level to open the way to a downside move with supports at the 38.2% retracement of the September 2016 lows at 144.40 followed by 143.20. A reversal above 145.60 will find resistance at 146.20.