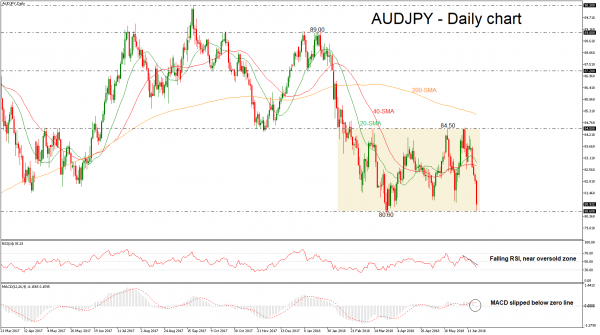

AUDJPY is set to record the fourth straight bearish day with strong momentum as it posted a fresh 12-week low near 80.61 on Tuesday. In the medium-term, the price has been developing within a trading range since mid-February with upper band the 84.50 resistance level and lower band the 80.60 support level.

The RSI is currently increasing negative momentum towards the threshold of 30, while the MACD is slowing down in negative territory, both hinting that the next move in prices could be on the downside rather than on the upside. Furthermore, the 20-simple moving average (SMA) is ready to touch the 40-SMA, creating a bearish cross.

Should the market extend losses and the price plummets below the consolidation area, this could drive the pair lower towards the 79.00 handle, identified by the high on September 2016.

Conversely, an upside correction could push the pair until the 40-SMA first at 82.72 and then at the 20-SMA at 82.89. Steeper advances, though, could move AUDJPY north towards the 84.50 upper band, fully reversing this and last week’s rally.

In the medium-term, the outlook remains negative since prices hold below all the moving average lines and the bearish cross between the 20- and the 40-day SMAs is near.