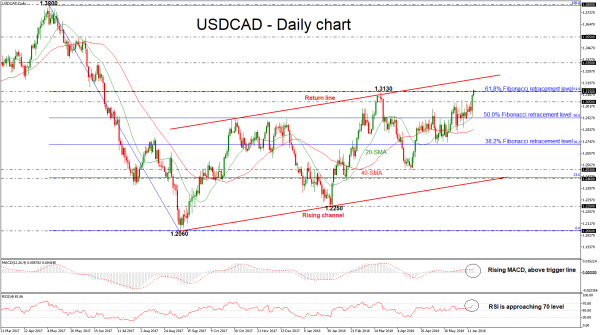

USDCAD has been surging seen Thursday’s trading session, creating a fresh one-year high of 1.3140. The price is trying to surpass the 61.8% Fibonacci retracement level of the downleg from 1.3800 to 1.2060, around 1.3130, increasing the chances for more aggressive advances. The technical indicators continue to send bullish signals, suggesting that the strengthens in the market is not over yet.

The RSI is currently increasing positive momentum towards its threshold of 70 and is pointing upwards, while the MACD oscillator remains in positive territory and climbed above its trigger line. Both are hinting that the next moves in prices could be on the upside rather than on the downside. It is worth mentioning that the price is developing well above the 20- and 40-simple moving averages in the daily timeframe.

Should the market extend gains above the 61.8% Fibonacci, this would send prices towards the return line of the upward sloping channel, near the 1.3200 handle. A climb above the pattern would suggest a stronger bullish structure and challenge the 1.3350 resistance level, taken from the high on June 2017.

Conversely, the next support should come from the 1.3050 before being able to retest the 50.0% Fibonacci mark of 1.2930. A dip below this region would drive the price towards the 40-SMA near 1.2840 at the time of writing. Further losses could drive the pair until the 38.2% Fibonacci of 1.2720.

Having a look at the bigger picture, USDCAD has been trading within an ascending sloping channel since September 2017.