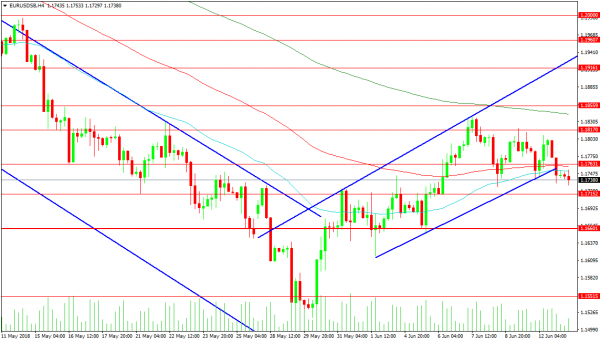

The EURUSD pair is trading in a range at the moment between 1.18350 and 1.17200 as we head into the FOMC meeting today and the ECB meeting tomorrow. Technically price has broken down in four hour from the 3 touch trend line shown on the chart but this move will need to be confirmed soon with a drop under support at 1.17200 or the volatility associated with the FOMC meeting can set the pair on a different path. For today and tomorrow we need to push out our view to take in the wider levels of support and resistance that may be needed as a result of central bank action. Support is strong below 1.16600 with a drop to 1.15515 possible and a revisit of last month’s low at 1.15096 followed by support at 1.14579.

The resistance at the high of last week may well be tested over the next 36 hours at 1.18395 with the 200 period MA at 1.18419. A level of interest close by is 1.18559 with these levels all combining to provide a relatively strong area of resistance. However as mentioned, reaction to the central banks can see price push through this zone. Above 1.19000 the 1.19161 level comes into play with the 1.19607 level guarding the way to 1.20000.