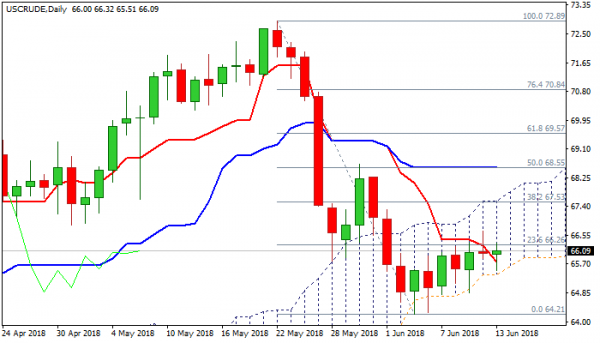

WTI oil price bounced after testing daily cloud base ($65.38) on Wednesday, keeping strong rising support which underpins recovery rally from $64.21 (05 June low). Series of higher lows and higher highs define near-term uptrend, but recovery was so far mild and keeping well below pivotal barrier at $67.53 (daily cloud top / Fibo 38.2% of $72.89/$64.21 fall). Release of US API crude stocks data on Tuesday impacted oil price negatively, as data showed crude inventories rose 0.83 million barrels vs expected draw of 2.7 million barrels. Focus turns towards release of US EIA weekly crude stocks report, due later today, to gauge the strength of demand in the US. Weekly crude stocks are forecasted for 1.44 million barrels draw, compared to 2 million barrels build previous week, which would boost oil price if release comes at/below expectations. Conversely, oil price may drop on negative outcome today (build of crude inventories). Daily cloud base marks key support and close below it would weaken near-term structure and risk return to $64.21 low. Daily studies are bearishly aligned and support negative scenario for now.

Res: 66.68, 67.63, 67.85, 68.55

Sup: 65.38, 64.84, 64.21, 63.81