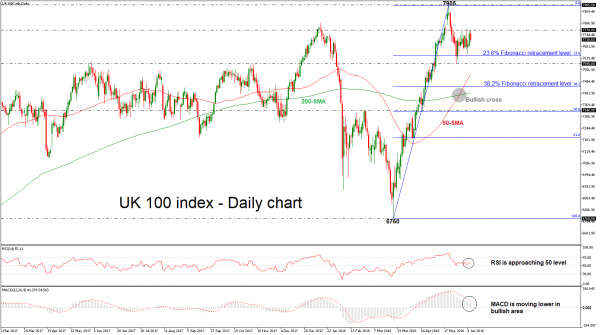

UK 100 index is looking more neutral as prices have struggled below the 7770 key resistance level and also touched a couple of times the 23.6% Fibonacci retracement level of 7633 of the upleg from 6760 to 7905, in the previous days. Hence, the upside momentum appears to be running out of steam as the short-term technical indicators are moving lower.

In the daily timeframe, the RSI indicator is pointing down near the threshold of 50, while the MACD oscillator is falling below its trigger line in the positive territory.

Should the pair manage to strengthen its positive momentum, the next resistance could come around the all-time high of 7905. Above this level, the next target could come in the 8000 psychological area, creating a new high.

However, if prices are unable to break the 7770 level in the next few sessions, the risk would shift back to the downside, with the 23.6% Fibonacci of 7633 once again coming into focus. A drop below this zone would signal a downtrend movement until the 7590 support. The next key support to watch lower down is the 38.2% Fibonacci of 7467.

Looking at the medium-term, the 50- and 200-simple moving averages posted a bullish crossover at the end of May, raising chances for further increases.