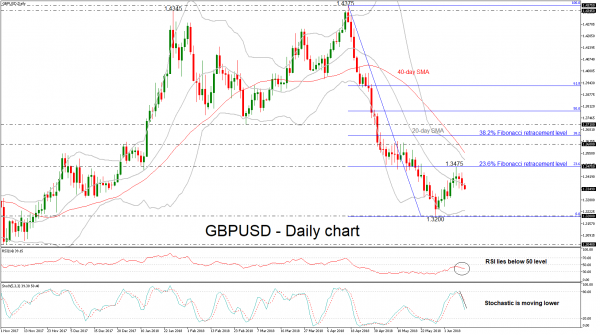

GBPUSD has been underperforming in the past two days, after the strong pullback on the 23.6% Fibonacci retracement level of the downleg from 1.4375 to 1.3200, around the 1.3475 barrier. The bearish picture in the short term is further supported by the technical indicators and the moving averages.

In the daily timeframe, the RSI indicator is moving in the negative territory and is sloping slightly to the downside, extending the scenario for further bearish movement. Moreover, the %K line of the stochastic oscillator is holding below the %D line approaching the oversold zone. As a side note, the price is still trading marginally below the mid-level of the Bollinger Band (20-day SMA).

Should prices continue to head lower, immediate support could come at the six-month low of 1.3200. A drop below this area would take the pair closer to the 1.3040 level and significantly strengthen the negative medium-term structure.

To the upside, there is an immediate resistance of the 23.6% Fibonacci of 1.3475, while above that, the next major resistance to watch is the 1.3600 psychological level. However, the price needs to surpass the upper boundary of the Bollinger band and the 40-day SMA before challenging the aforementioned psychological hurdle.

Overall, GBPUSD started an aggressive downtrend rollercoaster after it touched the 1.4375 resistance level last April and failed to complete a strong retracement movement.