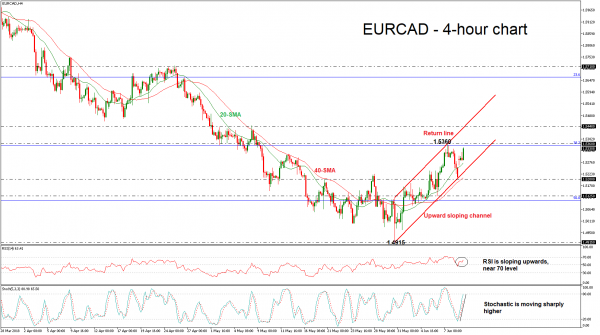

EURCAD moved higher so far on Monday and jumped above the 20- and 40-simple moving averages (SMAs) in the 4-hour chart. The pair has been consolidating within an upward sloping channel since May 30 and is in progress to turn the medium-term outlook from negative to positive.

From the technical point of view, the RSI indicator is sloping upwards in the bullish territory and is approaching the 70 level, while the %K line of the stochastic oscillator is ready to enter the overbought zone with strong momentum.

If the bulls maintain their movement, the next level to have in mind is the 38.2% Fibonacci retracement level of the upleg from 1.4050 to 1.6150, around the 1.5360 resistance barrier. If the price overcome this area, it could open the door for the 1.5440 hurdle, identified by May 8.

On the flip side, a dip below the 20-SMA could drive the pair to re-challenge the 1.5200 handle, which coincides with the 40-SMA in the near-term. If that level does not hold and the price breaks it to the downside, it would shift the focus south again and hit the 1.5125 support level.

Overall, EURCAD is extending its gains and is on the way to post a bullish correction in the short-term timeframe.