First, a review of last week’s forecast:

EUR/USD. The basic forecast for this pair, supported by the majority of analysts, assumed its growth to the zone of 1.1800-1.1830. The pair went up indeed, fixing the week’s high at 1.1839. So, taking into account the standard backlash, the forecast turned out to be absolutely correct. A rebound followed, and, as a result, the pair completed the trading session at the horizon 1.1770;

GBP/USD. The forecast for this pair was very similar to that for the EUR/USD. 60% of experts had expected that the pound could rise to the level of 1.3420, and, in case of its breakdown, reach the zone 1.3500. It actually happened so – on Thursday, June 08, having broken the resistance of 1.3420, the pair briefly managed to rise to the height of 1.3470, then the bulls’ strength dried up, and the pair met the end of the week 70 points lower – in the zone 1.3400;

USD/JPY. Recall that last week the opinions of both analysts and indicators were divided into three almost equal parts – one-third voted for the fall of the pair, one-third were for its growth and another third voted for the sideways trend. And, as is often the case in such situations, everyone was right: the pair first grew to 110.25, then fell back to support 109.20, then again grew up and completed the five-day period almost in the same place where it started, in the zone of 109.55;

Cryptocurrencies. As was said earlier, almost all major cryptopairs have been recently repeating the movements of their leader, BTC/USD. And the bitcoin, in turn, draws the Pennant and, constantly reducing volatility, continues to consolidate in the horizon area slightly above 7,000. So, if you look at the chart of D1, it is clearly visible that this “father” of all virtual currencies moved strictly horizontally in an extremely narrow corridor 7.345 – 7.730 for the whole week. It was followed in the sideways trend by all the major altcoins, and the attempt of the Ethereum and the Litecoin to break away from the leader and break through up at the beginning of the week, was unsuccessful, as expected. As a result, they returned to the initial levels: the Ethereum to around $600 per coin, and the Litecoin to $118.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

EUR/USD. President Donald Trump’s opponents must be very upset – to their great disappointment, his economic policy brings positive results: the number of jobs in the US in 2018 grew by more than a million, the inflation reached the Federal Reserve’s target of 2%, the trade deficit is declining, and the gross domestic product is growing. All this leads to the dollar strengthening, which plays against American importers, and it also leads to the discontent among the financial elites of many countries whose currencies have now reached the historic lows.

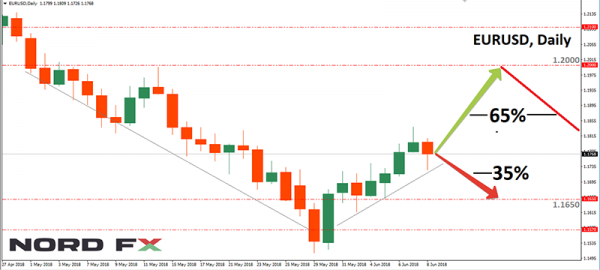

As a result, the overwhelming majority of experts (65%), supported by graphical analysis on H4 and D1 and 70% of oscillators, believe that the correction which started last week, will continue, but the pair’s growth will be limited by the resistance in the zone of 1.2000. (In case of a breakdown when the pair fixes above, the next target is 100 points higher).

As for the supports, the main ones are located at the levels of 1.1650 and 1.1570;

As for the pair GBP/USD, the correction to the level of 1.3615 is expected to continue by 65% of analysts. The next resistance is at the height of 1.3700, however, only 45% of experts vote for such growth. Graphical analysis on D1 also believes that the correction will be completed in the zone 1.3615, after which the pound sterling will continue its decline. The support levels are 1.3200, 1.3125 and 1.3040;

But as for the Japanese yen, according to the readings of graphical analysis, on the contrary, it should strengthen its position. As a result, the pair USD/JPY may fall to the level of 108.00. However, only 40% of experts agreed with this scenario, 50% supported the growth of the pair, and another 10% are for the sideways trend. The oscillators do not have obvious signals either – on H4,most of them side with the bears, and on D1 the advantage is smoothly passed to the bulls. Resistances are at horizons 110.25 and 111.40;

As for the main cryptocurrencies, their extremely low volatility does not allow us to speak of any stable trends emerging. And we are talking not only about the short-term forecast, but also about the forecast up to the end of this year. Thus, many analysts predict a gradual drying up of this market and a decrease in its capitalization. In this regard, the most likely target for the bitcoin for December 2018. is named as12,500 instead of previously announced 15,000.