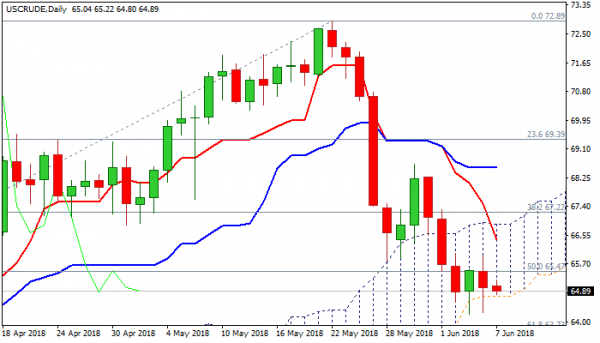

WTI oil price remains in red on Thursday and holds near two-month lows ($64.21/26) but downside attempts were so far contained by the base of rising daily Ichimoku cloud ($64.74).

Cloud base acts as strong support as spikes in past two days probed below cloud base but repeatedly failed to close below.

Concerns over rising US production keep the oil price under pressure, which was increased on surprise rise of US oil inventories.

EIA report, released on Wednesday, showed build of crude stocks by 2.07 million barrels as expectations were for 2 million barrels draw, following strong fall in crude inventories by 3.62 million barrels previous week.

Technical studies are bearish and add to negative near-term outlook as bearish momentum continues to strengthen and daily MA’s created multiple bear-crosses.

The action of past two days remains capped by broken 100SMA ($65.32), while falling 10SMA tracks the fall since 24 May.

Further consolidation above cloud base could be likely near-term scenario before bears resume. The notion is supported by reversal of slow stochastic from the oversold territory.

Extended upticks above 100SMA should be capped by falling 10SMA ($66.21) to keep bears intact.

Eventual break and close below rising daily cloud would signal bearish continuation and expose target at $63.73 (Fibo 61.8% of $58.06/$72.89 upleg).

Only sustained break above daily cloud top ($66.88) would sideline bears and signal stronger correction.

Res: 65.32, 65.95, 66.21, 66.88

Sup: 64.74, 64.21, 63.73, 63.19