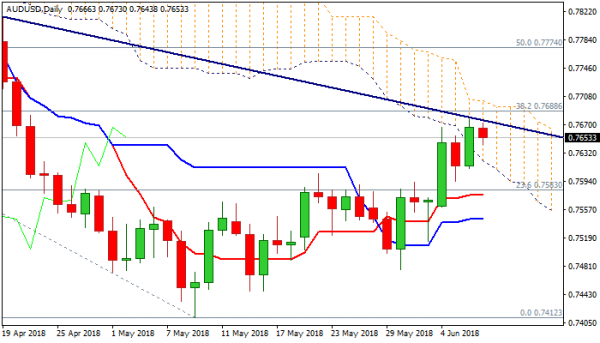

The Aussie dollar holds in red in early European trading after upside attempts were repeatedly capped by bear-trendline at 0.7674 (drawn off 0.7988, 11 Feb high) and additional pressure came from weaker than expected Australia’s trade data.

April trade surplus narrowed to A$ 0.977B from previous month’s A$ 1.73B surplus and also fell below expectation at A$0.98B.

Double failure and subsequent easing validates trendline resistance, the lower boundary of strong resistance zone between 0.7674 (trendline) and 0.7688 (Fibo 61.8% of 0.8135/0.7412 fall).

Bulls may show stronger hesitation here and may hold in extended consolidation before fresh attempts higher.

However, risk of pullback exists as bullish structure could be hurt by weakening momentum and overbought slow stochastic on daily chart.

Extended dips should hold above 0.7610 (daily cloud base / 55SMA) to keep bulls in play for renewed attack at trendline / Fibo barriers.

Sustained break higher would trigger stops parked above and spark fresh bullish acceleration towards next strong barriers at 0.7729 (100SMA) and 0.7752 (200SMA).

Negative scenario on break and close below daily cloud would risk deeper fall and put bulls on hold.

Res: 0.7674, 0.7688, 0.7718, 0.7729

Sup: 0.7643, 0.7630, 0.7610, 0.7588