The Aussie dollar eases in early trading on Tuesday, consolidating Monday’s strong advance (the biggest one-day rally since 21 Mar). The pair was up 1.10% on Monday, driven by upbeat Australian data and weaker greenback.

The RBA released its policy decision today, keeping interest rates unchanged as expected, while the central bank’s statement was barely changed from the previous meeting in May, suggesting that the RBA may stay on hold for some time.

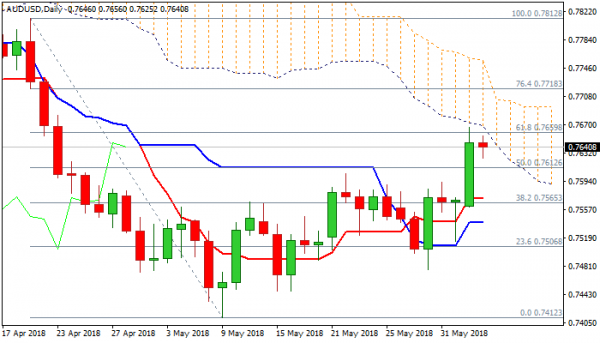

The decision had a little impact to the Aussie, with easing driven by techs, as slow stochastic is overbought on daily chart and momentum is turning south.

Bulls show signs of fatigue on approach to strong barriers at 0.7660 (Fibo 61.8% of 0.7812/0.7412 bear-leg which was cracked on Monday and stays intact today) and 0.7669 (base of falling daily cloud).

Also, initial attempt to penetrate weekly cloud (cloud base lays at 0.7641) was so far unsuccessful, adding to growing pressure.

Corrective dip is likely to precede fresh upside, with 0.76 zone expected to ideally contain dips and keep bullish near-term structure intact.

Bulls need sustained break above 0.7660 Fibo barrier and daily cloud base to signal continuation and expose targets at 0.7703 (daily cloud top) and 0.7718 (Fibo 76.4% of 0.7812/0.7412).

Initial bearish signal could be expected on loss of 0.76 handle, while reversal would be signaled on return and close below rising 10SMA (0.7572).

Res: 0.7660, 0.7669, 0.7718, 0.7736

Sup: 0.7625, 0.7615, 0.7600, 0.7572