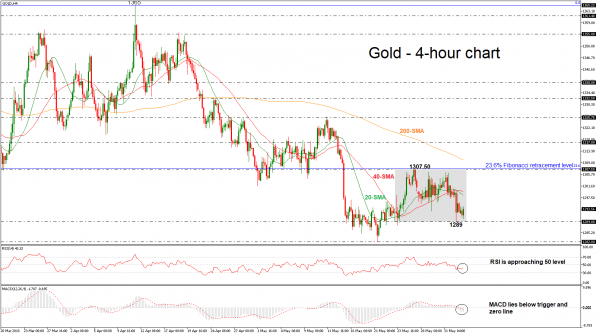

Gold remains under pressure and risk is still to the downside as prices continue to drift lower from the 1300 psychological level. It is worth mentioning that the precious metal has been developing within a sideways channel since May 23 with upper boundary the 1307.50 resistance level and lower boundary the 1289 support barrier. The short-term technical indicators are bearish and point to more weakness in the market.

Looking at the 4-hour chart, gold prices are looking capped by the 20 and 40-simple moving averages which are negatively aligned after a bearish crossover that took place last Friday. The Relative Strength Index (RSI) is holding in the negative zone, while the MACD lies below its trigger and zero lines.

The next target to have in mind if the price slips below the range is the May 21 low at 1282. At this stage, the market would likely see a resumption of the downtrend and put in place a lower low at 1270, near the 38.2% Fibonacci retracement level of the upleg from 1122 to 1366.

Upsides moves are likely to find resistance at the 1307.50. This is the 23.6% Fibonacci mark and if the price successfully surpasses it, it would retest the 200-simple moving average in the 4-hour chart around 1310.70. Rising above this area would help shift the focus to the upside towards 1317.

In the short-term, the bearish phase remains in play especially if gold prices continue to trade below the 23.6% Fibonacci and under the 1300 key level, while the 200-day SMA is acting as strong resistance level near 1310.