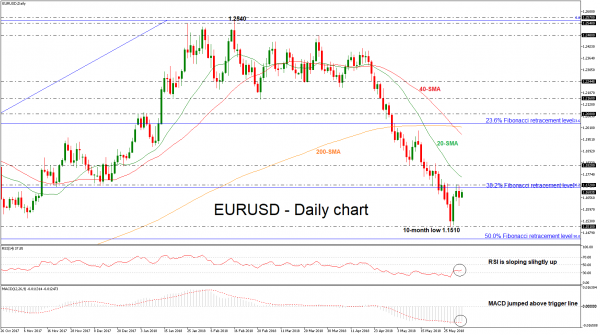

EURUSD is on course for a possible bullish retracement following the rebound on the 10-monnth low around 1.1510. The sharp sell-off, especially in the past seven weekly sessions, has shifted the long-term outlook from positive to negative. However, the momentum indicators in the near-term are supportive for the bullish correction.

From the technical point of view, in the daily timeframe, the RSI indicator is sloping slightly to the upside above the threshold of 30, while the MACD oscillator jumped above its trigger line in the bearish territory.

Immediate resistance is being provided by the 38.2% Fibonacci retracement level, near 1.1720 of the upleg from 1.0340 to 1.2540, as prices bounced back near this level after briefly tumbling below it. Moreover, should prices rise higher, the next resistance would likely come from the 1.1820 barrier but the price first needs to surpass the 20-day simple moving average (SMA). A jump above this region should extend gains towards the 200-day SMA near 1.2015, slightly below the 23.6% Fibonacci mark.

In case of a downward attempt, EURUSD would likely meet support at the 10-month low near 1.1510. A break below this significant level would endorse downside pressure and challenge the 50.0% Fibonacci of 1.1450. Steeper declines should drive the common currency until the 1.1300 handle, taken from the high on November 2016.

In the bigger picture, the bullish picture turned to bearish, with the moving averages all pointing downwards. However, should prices pare the previous weeks’ losses, this would risk shifting the long-term picture to a positive one again.