WTI oil price moved higher on Friday after falling 1.7% previous day as report of further rise in US oil production offset positive impact from a massive draw in US crude inventories (3.6 million barrels vs forecasted draw of 0.4 million barrels. Traders are trying to understand the divergence between two benchmarks, WTI and Brent, as the US oil ended day in red after post-data fall while Brent recovered most of losses and closed positively on Thursday.

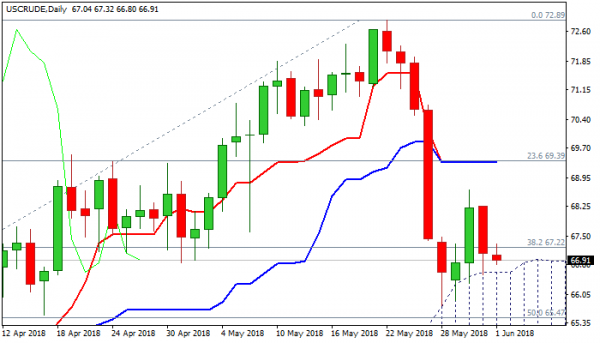

The WTI continues to trade above rising daily cloud (cloud top lays at $66.61 today) which contained repeated attacks in past four days and marks significant support.

Markets remain concerned about rumors that OPEC and non-OPEC oil producers may ease their agreement to cut production until the end of 2018 in order to further tighten oil markets.

Negative momentum and bearish setup of 10/20/30SMA’s and fresh strength of the dollar weigh on oil price.

Also, repeated failure to clearly break above cracked pivotal Fibo barrier at $68.50 (38.2% of $72.89/$65.79) adds to negative near-term outlook.

Daily cloud top is under pressure, but break below and close within the cloud is needed to generate stronger bearish signal.

Alternative scenario requires weekly close above $68.50 Fibo barrier to ease persisting bearish pressure.

Res: 67.44, 68.26, 68.50, 69.03

Sup: 66.80, 66.61, 66.34, 65.79