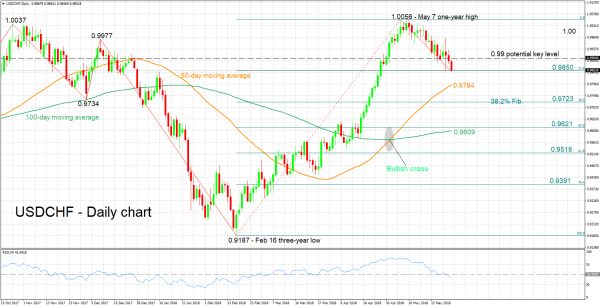

USDCHF has lost 2% of its value after reaching a one-year high of 1.0056 in early May. Earlier on Thursday, the pair touched a one-month low of 0.9847.

The RSI continues to fall, having crossed below the 50 neutral-perceived level. This is indicative of the bearish short-term bias that is in place.

The region around the 23.6% Fibonacci retracement level of the February 16 to May 7 upleg at 0.9850 seems to be providing immediate support; this mark was violated earlier in the day, but the price subsequently moved back above it. Steeper losses might meet additional support around the current level of the 50-day moving average at 0.9794 – including the 0.98 round figure – and the 38.2% Fibonacci mark at 0.9723.

On the upside, resistance may come around the 0.99 handle which may be of psychological importance. The 1.00-parity level would be eyed next in case of stronger bullish movement, with May 7’s one-year high of 1.0056 lying not far above.

In terms of the medium-term outlook, it continues to look mostly positive with price action still taking place above both the 50- and 100-day MA lines – a bullish (golden) cross was also recorded in early May when the 50-day MA moved above the 100-day one. However, the declines from recent weeks have brought the price not far above the 100-day MA. A drop below this level would set a more neutral picture in the medium-term.

Overall, the short-term outlook is looking bearish and the medium-term outlook appears predominantly bullish.