For the 24 hours to 23:00 GMT, the EUR rose 0.46% against the USD and closed at 1.1745 on Friday, after Germany’s industrial output rose at a faster than expected pace in May.

On the data front, Germany’s seasonally adjusted industrial production rebounded 2.6% on a monthly basis in May, higher than market expectations for a rise of 0.3%. In the previous month, industrial production had recorded a revised drop of 1.3%.

The US Dollar weakened against basket of currencies on Friday, following the rise in unemployment rate and slower wage growth.

Data showed that US unemployment rate unexpectedly rose to 4.0% in June, compared to a rate of 3.8% in the previous month. Market participants had anticipated unemployment rate to record a steady reading. Further, the nation’s average hourly earnings of all employees rose by 0.2% on a monthly basis in June, undershooting market expectations for an advance of 0.3%. Average hourly earnings of all employees had advanced 0.3% in the preceding month. On the contrary, non-farm payrolls climbed by 213.0K in June, more than market expectations for an advance of 195.0K. Non-farm payrolls had registered a revised increase of 244.0K in the prior month. Additionally, trade deficit narrowed to a 19-month low level of $43.1 billion in May, amid growing fears of retaliatory tariffs and more than market expectations for a deficit of $43.6 billion. In the previous month, trade deficit had recorded a revised reading of $46.1 billion.

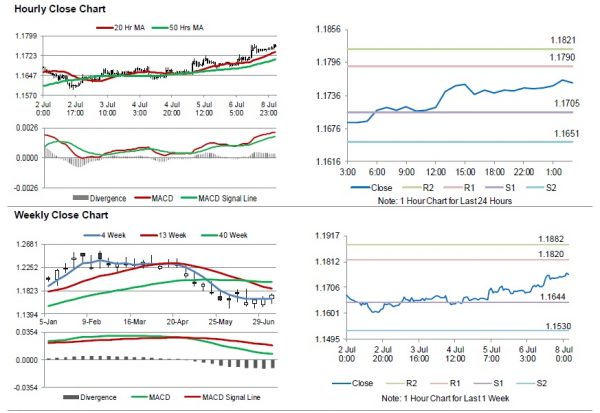

In the Asian session, at GMT0300, the pair is trading at 1.1759, with the EUR trading 0.12% higher against the USD from Friday’s close.

The pair is expected to find support at 1.1705, and a fall through could take it to the next support level of 1.1651. The pair is expected to find its first resistance at 1.1790, and a rise through could take it to the next resistance level of 1.1821.

Moving ahead, investors would keep an eye on the Euro-zone’s Sentix investor confidence index for July and Germany’s trade balance data for May, slated to release in a few hours. Later in the day, the US consumer credit for May, will keep investors on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.