Chinese official PMI data for May are scheduled for release on Thursday at 0100 GMT. Manufacturing activity, which is expected to attract most interest, is anticipated to marginally ease though still remain in expansion territory. In the bigger picture, besides data releases, trade talks between the US and China continue taking place and have the capacity to act as market movers.

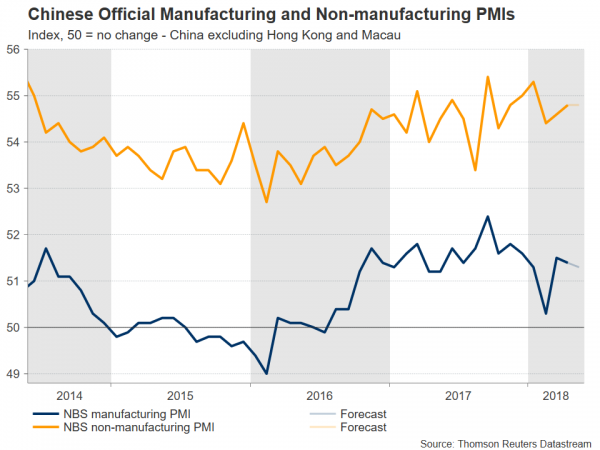

Data releases due on Thursday are projected to show China’s official manufacturing PMI coming in at 51.3 from April’s 51.4, and the respective non-manufacturing (services) PMI remaining at 54.8 for the second straight month; a reading above 50 denotes sectoral expansion. Despite the services sector gaining greater prominence over the last number of years as part of the efforts to rebalance – and might be argued to diversify – the Chinese economy, the data on manufacturing activity are expected to be gathering more interest than those on non-manufacturing PMI.

Should the number on manufacturing indeed be released above 50, this would constitute nearly two straight years of expansion in the sector as gauged by the purchasing managers’ index and attest to the resilience of the world’s second largest economy, despite fears for a slowdown in 2018. Such fears are partly owed to efforts by the Communist party to rein in excessive debt levels that could eventually lead to a credit crisis.

The private Caixin/Markit manufacturing and non-manufacturing PMI figures, which focus on small and mid-size businesses, as opposed to the official data which are broader in nature, are due on Friday and Tuesday next week correspondingly, and will also be attracting attention. The Caixin manufacturing PMI is forecast to mirror the move in the official data, ticking down to 51.0 from April’s 51.1. Related to the Caixin data, it is notable that some analysts are warning that rising credit defaults are signaling growing pressure on small and medium-sized firms.

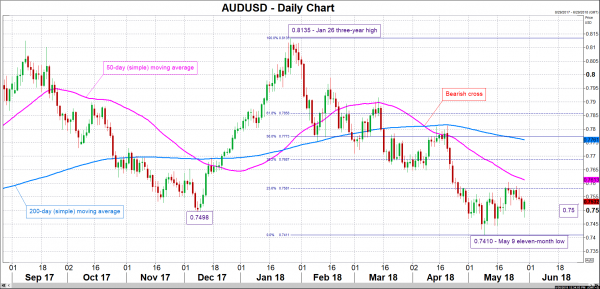

In FX markets, Australia’s close economic ties with China – the former is the latter’s largest export and import partner – have rendered the Australian dollar a liquid proxy for China’s economy. In this respect, besides the yuan, the aussie will also be monitored as the PMI data go public; a strong Chinese economy is seen as aussie-positive.

A data beat might lead to buying interest for the aussie/dollar pair. Resistance to advances could come around the 23.6% Fibonacci retracement level of the January 26 to May 9 downleg at 0.7581, with the region around this point also encapsulating the 0.76 round figure. Stronger bullish movement might meet additional barriers around the current level of the 50-day moving average line at 0.7613 and the 38.2% Fibonacci mark at 0.7687. Weaker-than-anticipated figures on the other hand, could put AUDUSD under downside pressure. Support to losses might initially emerge around the 0.75 handle – the area around this level includes a bottom from December at 0.7498 – with steeper losses increasingly bringing into focus the 11-month low of 0.7410 recorded on May 9.