Here are the latest developments in global markets:

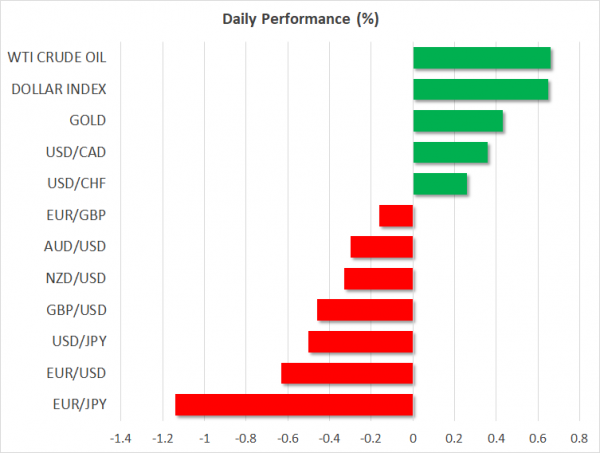

FOREX: The euro continued to bleed as the European trading session unfolded, with euro/ dollar touching 1.1506 at its lowest, this being a nadir last experienced in July last year. Political uncertainty in Italy, and to a lesser extent in Spain, were seen as factors behind the common currency’s decline. The traditional safe-haven yen gained ground versus both the dollar and the euro, most notably the latter; euro/yen was down by more than 1% at 1045 GMT, having earlier hit 125.04, its lowest since late June 2017. The dollar’s index against a basket of six major currencies traded 0.65% higher despite losing ground against the Japanese currency – the euro carries greater weight in the index. Specifically, it (the dollar index) exceeded the 95 handle at its peak, recording its highest since November. In other notable movements: pound/dollar posted a six-month low of 1.3203 and dollar/loonie hit a more than one-month high of 1.3042. NAFTA negotiations and the direction of oil prices (see below) are affecting the latter; the Canadian economy heavily depends on oil exports.

STOCKS: Main European indices extended yesterday’s losses to trade sharply lower. The pan-European Stoxx 600 is down by 1.4%, with all sectors trading in the red and financials being the worst underperformer. In this respect, it warrants mention that Italian banks are seen as among Europe’s most troubled. Efforts were made in previous months to restore their sustainability, but current developments may be seen as derailing such attempts, also potentially raising questions over contagious effects on other European banks. The blue-chip Euro Stoxx 50 is down by 1.6%, with the UK FTSE 100, German DAX and French CAC 40 all down by more than 1.3%. The Italian FTSE MIB and Spanish IBEX 35 are the biggest decliners relative to other European blue-chip benchmarks, trading lower by 3.1% and 2.6% respectively. US futures were pointing to a lower open for the major Wall Street indices.

COMMODITIES: WTI and Brent crude are both trading higher by around 0.6%, at $66.91 and $75.47/barrel respectively. Both benchmarks suffered considerable losses recently; for perspective, the two touched their highest since late 2014 last week of $72.83 and $80.49 per barrel correspondingly. The recent retreat came on the back of investors bracing for potential supply increases by the likes of Saudi Arabia and Russia. Gold was 0.4% higher at $1,303.09 an ounce, with safe-haven flows on the back of political uncertainties dominating downside pressure stemming from a stronger US currency; the yellow metal is denominated in dollars and tends to weaken whenever the greenback strengthens.

Day ahead: US consumer confidence on the horizon; European politics and other geopolitical developments eyed

Tuesday’s calendar is light data-wise, featuring the release of consumer confidence data out of the US. Perhaps most market sensitive during today’s trading – not just for currency, but also equity and bond markets – will be any updates on the Italian political situation, as well as other developments on the geopolitical front.

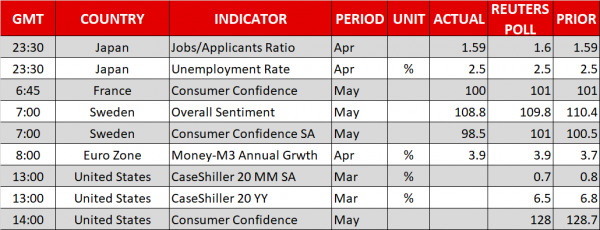

The CaseShiller indices gauging US housing prices for March will be made public at 1300 GMT, while the day’s most important release, namely the Conference Board’s consumer confidence index, is slated for release at 1400 GMT. The relevant index is anticipated to decline to 128.0 in May, from April’s 128.7.

Italian President Sergio Mattarella’s decision to veto the 5-Star Movement and League’s nominee for the position of economy minister – on the grounds of him being a critic of the euro currency – added a new twist to the Italian political “saga”. The two anti-establishment parties, which only a few days ago appeared within breathing distance of forming a government, are now preparing for fresh elections. The two have been gaining momentum lately and new elections may see them come out even stronger, especially in light of Mattarella being viewed in the public’s eyes as resisting the popular will. The euro, which hit fresh multi-month lows versus the greenback and the yen earlier on Tuesday, is expected to be sensitive to updates on the issue.

While not gaining much attention at the moment but also euro-related, Rajoy’s minority government in Spain appears fragile after recent corruption allegations, and should it collapse it is likely to be perceived as another euro-negative factor, at least in the short-term. More updates on the issue are expected as the week unfolds; Rajoy will face a confidence vote on Friday.

In geopolitics, the US-North Korea summit may be revived, with the parties involved seemingly making efforts for the Trump-Kim meeting to take place around mid-June in Singapore. In this respect, it is interesting that European political uncertainty appears to overshadow, at least at the moment, any positive developments relating to a more constructive US-North Korean relationship in the future.

Meanwhile, the stage is set for more trade talks between the US and China in the days to come. US Commerce Secretary Wilbur Ross who will be meeting EU trade chief Cecilia Malmstrom on Wednesday, will be travelling to Beijing on Saturday for more trade talks. Also notable is that exemptions to US steel and aluminum tariffs are – unless extended – set to expire on June 1.

European Central Bank board member Sabine Lautenschlager will be speaking about monetary policy in Frankfurt, which is hosting a Finance Summit, at 1530 GMT.