The US dollar was up against majors pairs on Friday ahead of the release of employment data in America. On a weekly basis the greenback gained against the CAD, EUR and GBP but lost ground against the JPY, AUD and CHF after five days that featured various geopolitical developments. Holidays in the United Kingdom and the United States will make for a short trading week, but one that will be filled with economic data releases alongside new reports from US-China and US-North Korea relations.

- Bank of Canada (BoC) to keep rate unchanged at 1.25%

- G7 Finance meetings to kick off on May 31

- NFP to add 190,000 jobs to US economy on Friday

Dollar Bounced Back as Tensions Ease on Friday

The EUR/USD lost 0.88 percent in the last five days. The single currency is trading at 1.1665 after the dollar recovered some ground after North Korea issued some comments that indicated that the June 12 meeting is still a possibility even if the US is not a part of the peace process and would be willing to meet with President Trump. The US Central bank made it clear it is willing to let economy run hot which was taken as a dovish statement by the markets. The Fed notes from the May Federal Open Market Committee (FOMC) meeting were not as hawkish as expected but central bank members still see the need to keep hiking rates albeit rising inflation would not be a deciding factor at this time to dictate the pace of rate hikes. A June rate lift has been fully priced in by the market with another two more rate hikes this year a strong possibility.

The Fed’s minutes were slightly dovish, the European Central Bank (ECB) notes from the lates monetary policy meeting were also released the same week with a very neutral view on the European economy. On the one hand growth could slow down further button the other the current expansion remains solid. The ECB continued to not give any hints on what it plans to do in September when its massive quantitive easing program comes to an end. The central bank has a new headache as it has begun to lock horns with the newly formed Italian government’s plans to approve new spending projects that could break the EU budget rules.

Italy has a 132 percent debt to GDP ratio which is above the 60 percent permitted by the EU. Greece has a similar ratio which in itself will be a mark against the EUR as the EU will face its toughest challenge from a euro sceptic government in the new 5 Star movement and League coalition.

The biggest economic release in the market will come on Friday, June 1 with the publication of the U.S. non farm payrolls (NFP) report at 8:30 am EDT. The forecast is calling for a gain of 190,000 jobs after a strong 164,000 gain last month. Hourly wages will be in focus with a gain of 0.3 percent expected. The Fed is not worried about the US economy staying above 2 percent for long but it will be a decisive factor in the number of rate hikes in 2018.

Pound Lower as BoE Warns of Brexit Disruption

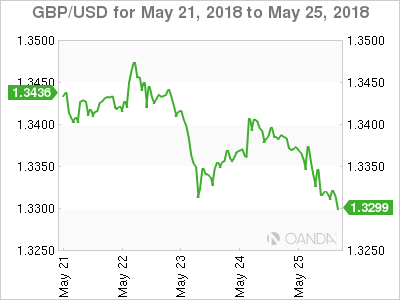

The GBP/USD lost 1.06 percent during the week. The currency pair is trading at 1.3315 after Bank of England (BoE) Governor Mark Carney issued a warning on the dangers of Brexit. The more disruptive the breakup, the more exceptional the measures from the central bank will have to be in order to shield the economy from the negative effects.

The pound is down 1.06 percent versus the dollar this week and 0.27 versus the euro as talks between London and Brussels ended in friction on Thursday. Governor Carney said that if there is a smooth transition the central bank could take a more traditional path, but if there is a disorderly exit the BoE would have to act with a potential rate cut in the cards similar to the post Brexit referendum outcome in 2016.

Yen Stumbles on Friday but Still Gaining on Uncertainty

The USD/JPY lost 1.17 percent during the past five trading sessions. The currency pair is trading at 109.45 with the Yen one of the biggest beneficiaries of risk aversion. US President Donald Trump put the peace summit on standby on Thursday after accusing North Korea of anger and hostility. The meeting would have marked the first time a sitting president of the US met with his North Korean counterpart.

The market reacted with investors selling riskier assets and looking for safe havens. Stocks fell while metals gained. Gold broke above $1,300. In the currency market the Japanese yen rose 1.14 percent versus the US dollar.

Market events to watch this week:

Tuesday, May 29

- 10:00am USD CB Consumer Confidence

- 5:00pm NZD RBNZ Financial Stability Report

- 8:00pm JPY BOJ Gov Kuroda Speaks

Wednesday, May 30

- 8:15am USD ADP Non-Farm Employment Change

- 8:30am USD Prelim GDP q/q

- 10:00am CAD BOC Rate Statement

- 10:45am CHF SNB Chairman Jordan Speaks

- 9:00pm NZD ANZ Business Confidence

- 9:30pm AUD Private Capital Expenditure q/q

Thursday, May 31

- All Day G7 Meetings

- 8:30am CAD GDP m/m

- 11:00am USD Crude Oil Inventories

Friday, June 1

- 4:30am GBP Manufacturing PMI

- All Day G7 Meetings

- 8:30am USD Average Hourly Earnings m/m

- 8:30am USD Non-Farm Employment Change

- 8:30am USD Unemployment Rate

- 10:00am USD ISM Manufacturing PMI

*All times EDT