Here are the latest developments in global markets:

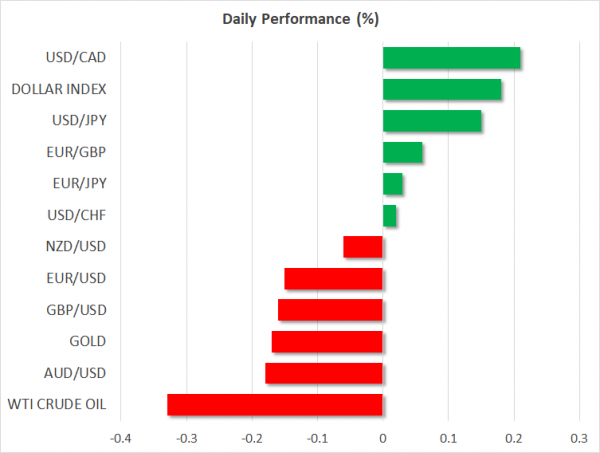

FOREX: The US dollar index – which tracks the greenback’s performance against a basket of six major currencies – is nearly 0.2% higher on Friday, ahead of a speech by Fed Chairman Jerome Powell. The index pulled back a little yesterday, mirroring a similar dip in longer-term US Treasury yields.

STOCKS: US markets closed lower on Thursday, as news that President Trump had cancelled his summit with North Korea weighed on risk sentiment. The Dow Jones fell by 0.30%, while the Nasdaq Composite and S&P 500 declined by 0.02% and 0.20% respectively. That said, sentiment seems to have reversed following a plea from North Korea overnight for a meeting “at any time”, with futures tracking the Dow, S&P, and Nasdaq 100 all pointing to a higher open today. In Asia, Japan’s Nikkei 225 ticked up by 0.06%, but the Topix edged down 0.22%. In Hong Kong, the Hang Seng fell 0.47%. Meanwhile in Europe, futures tracking the major indices were a sea of green, pointing to a notably higher open for all benchmarks today.

COMMODITIES: Oil prices tumbled yesterday and are lower today as well, amid hints from major producers that they may “open the taps” soon and increase production. WTI is down by nearly 0.35% on Friday and Brent by 0.45%, after Russian Energy Minister Alexander Novak hinted on Thursday that the OPEC & non-OPEC supply cuts may be slowly phased out after next month’s OPEC meeting. In precious metals, gold is down by almost 0.2% today, giving back some of the gains it posted yesterday following the cancellation of the US-North Korea summit. Prices surged to break back above the psychological $1300 mark but remain stuck below the crucial 200-day moving average, which keeps the technical picture cautiously negative for now.

Major movers: Risk aversion lingers as geopolitics come back under the spotlight

Another round of risk aversion hit the markets on Thursday, this time following news on the geopolitical front that US President Trump had canceled his planned summit with North Korea’s leader. The news ignited renewed demand for safe-haven currencies such as the Japanese yen and Swiss franc, while gold prices jumped as well. Yields on 10-year US Treasuries declined, signaling that investors turned back to bonds amid a flight to safety, while US equity markets closed lower.

Friday seems to be a different story though, with most of the aforementioned moves starting to reverse during the Asian trading session. Safe havens are lower, US equity futures are pointing to a higher open and US Treasury yields are up, all of which suggest that the pessimistic sentiment is easing. The reversal is likely owed to headlines overnight signaling North Korea is softening its stance even further, after the nation released a statement suggesting it is “open to resolving problems” with the US “at any time in any way”.

This was quite a sudden change of heart from North Korea, considering that just a couple of days ago it hinted at a “nuclear-to-nuclear showdown” with the US, which was also the reason cited by Trump for calling off the summit. While the motivation behind this turnaround is far from clear, in the market’s eyes it appears North Korea’s plea for a new meeting was a positive development that reduces the risk of further escalation.

Elsewhere, the minutes from the latest ECB meeting did not reveal anything new. If anything, the account was slightly on the dovish side, as it indicated that policymakers thought a more pronounced weakening of demand cannot be ruled out and that the uncertainty surrounding the outlook had increased. The euro reacted little to the release and finished the day lower against the yen and the pound, but higher versus the dollar.

The political situation in Italy, which has not been cleared up yet, and the continued signs of a loss of momentum in Eurozone’s economy are still posing headwinds for the common currency. That said, the recent dip in US Treasury yields appears to have taken some steam out of the dollar, which has probably been a factor keeping euro/dollar from touching fresh lows.

Day ahead: UK GDP, US durable goods and University of Michigan survey on the agenda; geopolitics also monitored

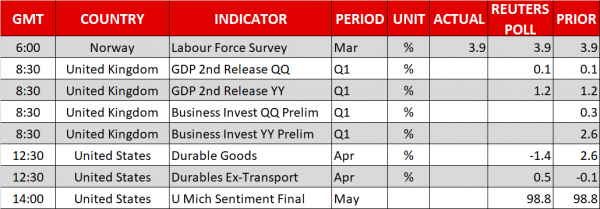

Friday’s economic calendar is rather light, featuring the second release of Q1 GDP growth out of the UK, durable goods orders out of the US and the University of Michigan’s survey on consumer sentiment.

At 0830 GMT, updated estimates on Q1 GDP growth will be made public out of the UK. The pace of growth is expected to be confirmed at 0.1% q/q and 1.2% y/y, reflecting a slowdown relative to Q4’s respective figures of 0.4% q/q and 1.4% y/y. First-quarter preliminary data on Q1 UK business investments are scheduled for release at the same time.

US durable goods orders for April are due at 1230 GMT. Orders are anticipated to decline for the second straight month, and specifically to contract by 1.4% m/m after rising by 2.6% in March. The previous month’s figures also reflected the largest fall in demand for machinery in almost two years. Core durable goods, that exclude transport, will also be watched by market participants.

Also out of the US is the University of Michigan final survey gauging consumer morale in May. The relevant index is expected to be confirmed at 98.8, the same as in April. Other information, such as the sub-index on inflation expectations, will also be of interest.

Of importance to currency markets, but also equity, commodity and fixed income ones, are geopolitical developments as well. After yesterday’s US-North Korea summit fallout, North Korea expressed willingness to get into talks, easing some concerns. Any updates on the story will be closely watched as they can affect flows in and out of safe-haven assets, such as gold. Another story that will be monitored pertains to the Italian political situation and on the individuals the two anti-establishment parties – 5-Star Movement and League – will choose to serve on key government positions.

The US Baker Hughes oil rig count is due at 1700 GMT.

Fed chief Jerome Powell together with numerous regional Fed presidents, Bank of England Governor Mark Carney, ECB executive board member Benoit Coeure and Bundesbank President Jens Weidmann – considered by some as Mario Draghi’s likely successor to head the ECB – will be among those attending the Riksbank’s 350th conference. Specifically, Powell will be participating in a discussion on “Financial Stability and Central Bank Transparency” at 1320 GMT.

Also on the agenda is the St. Petersburg Forum. Russian President Vladimir Putin, French President Emmanuel Macron, Japanese Prime Minister Shinzo Abe and IMF Managing Director Christine Lagarde will be among those participating in panel discussions. Meanwhile, European Union finance ministers will be discussing the latest developments on Brexit deliberations in Brussels.

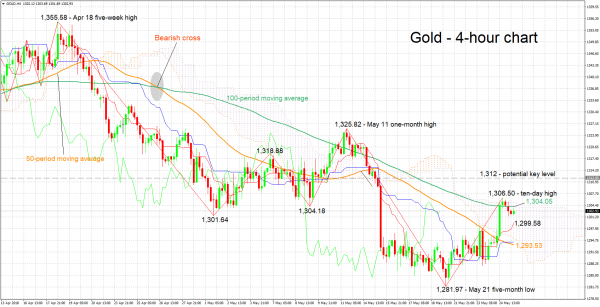

Technical Analysis: Gold close to 10-day high; bullish momentum seems to ease

Gold touched a 10-day high of 1,306.50 on Thursday, while it is currently trading in proximity to this peak. The Tenkan-sen is above the Kijun-sen line, this being a positive short-term signal, though notice that the Kijun-sen has flatlined. The latter is an indication that bullish momentum is easing.

Rising geopolitical uncertainty is likely to boost the safe-haven perceived asset. Immediate resistance seems to be taking place around the current level of the 100-period moving average line at 1,304.05. The area around this level includes a bottom from the recent past (1,304.18), yesterday’s 10-day high (1,306.50), and the Ichimoku cloud top (1,305.36). Further above, the region around 1,312 was congested in previous weeks and may be of significance.

Conversely, easing uncertainty could divert funds out of gold and into riskier assets. Support to declines might come around the current level of the Tenkan-sen at 1,299.58; the region around this encapsulates the 1,300 round figure and a trough from early May at 1,301.64. Sharper losses would turn the attention to the area around the 50-period MA at 1,293.53.

Gold is denominated in dollars and the direction of the greenback can also affect the precious metal; a weaker US currency is projected to support the yellow metal and vice versa.