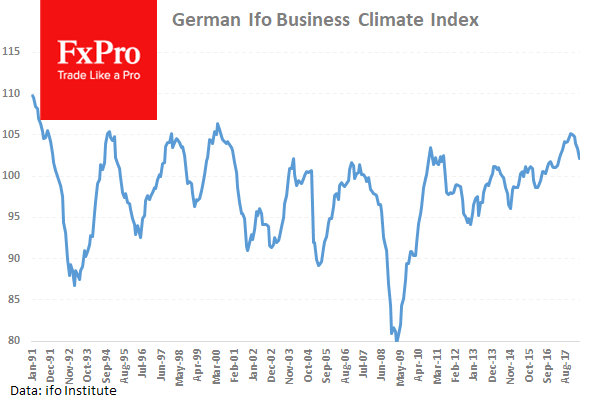

At 08:00 GMT, German IFO – Current Assessment (May) is expected to come in at 105.5 from 105.7 previously. IFO – Expectations (May) is expected to be 98.5 from 98.7 prior. IFO – Business Climate (May) is expected at 102.0 v 102.1 previously. The data is still expected to show a weakening business climate in Germany following on from the fall in the March data. This data cannot be ignored as it surveys 7,000 businesses and is a leading indicator of economic direction. EUR crosses can see a spike in volatility should actual released data differ from the expected consensus.

At 08:00 GMT, German IFO – Current Assessment (May) is expected to come in at 105.5 from 105.7 previously. IFO – Expectations (May) is expected to be 98.5 from 98.7 prior. IFO – Business Climate (May) is expected at 102.0 v 102.1 previously. The data is still expected to show a weakening business climate in Germany following on from the fall in the March data. This data cannot be ignored as it surveys 7,000 businesses and is a leading indicator of economic direction. EUR crosses can see a spike in volatility should actual released data differ from the expected consensus.

At 12:00 GMT, RBA Assistant Governor Bullock is due to speak at De Nederlandsche Bank’s Housing Market seminar, in Amsterdam. Audience questions are expected to follow. AUD pairs can move in reaction to comments made during this event.

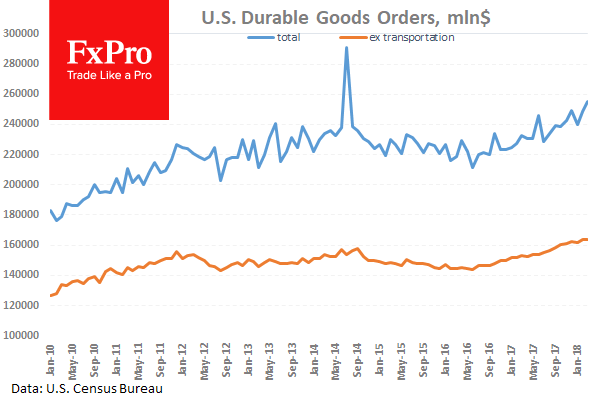

At 12:30 GMT, US Durable Goods Orders ex Transportation (Apr) are expected to come in at 0.5% from 0.0% previously. Durable Goods Orders (Apr) is expected at -1.4%% against 2.6% previously. This data series diverged last month with ex-transports missing expectations and the headline data exceeding its consensus. This divergence is expected to continue but the data is expected to show a fall in headline data and a rise in ex-transports. USD crosses can be moved by this data.

At 13:15 GMT, ECBs Coeure is expected to speak today at a high-level panel at Sveriges Riksbank’s 350th anniversary celebration in Stockholm, Sweden. EUR crosses can be moved by comments made during this speech.

At 13:20 GMT, Fed Chair Powell and BOE Governor Carney are both due to participate in a panel discussion titled “The future of central banking?” at the Sveriges Riksbank Anniversary Conference, in Stockholm. USD and GBP crosses can see spikes in volatility during this event.

At 15:45 GMT, FOMC Member Bostic and Kaplan are due to deliver speeches at this time. USD crosses can see spikes in volatility during this time.

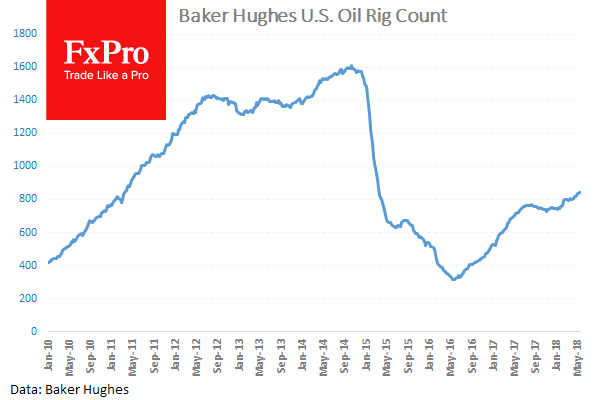

At 17:00 GMT, Baker Hughes US Rig Count numbers will be released. The prior number last Friday showed that there were 844 Oil rigs in operation. Oil is close to the highest levels in recent times, but has slipped on the back of a bigger than expected build in inventories on Wednesday. This data can set the tone for traders as they look to the week ahead.

At 19:20 GMT, German Buba President Weidmann is due to speak at the Sveriges Riksbank Anniversary Conference, in Stockholm. EUR crosses can see spikes in volatility during this event.