Here are the latest developments in global markets:

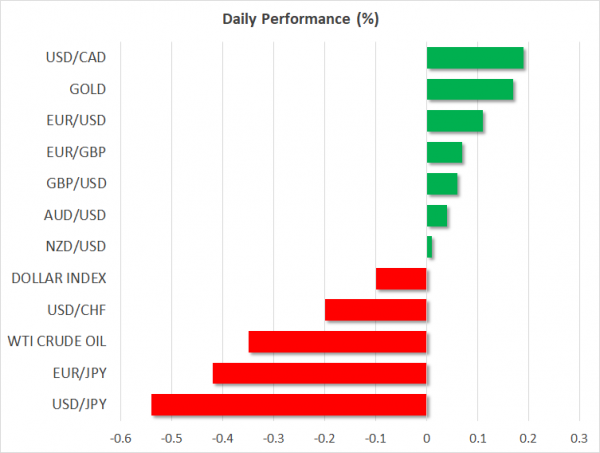

FOREX: The US dollar index is down by 0.1% on Thursday, after the Fed minutes downplayed expectations for three more rate increases this year. Note though, that the index touched its highest level for 2018 yesterday, before the minutes triggered a pullback. The yen continued to advance, while both the euro and sterling retreated following soft economic data.

STOCKS: Wall Street closed higher yesterday despite signals from the White House that more tariffs may be coming, boosted by the Fed minutes which played down expectations for aggressive rate hikes this year. The Nasdaq Composite advanced 0.64%, while the S&P 500 and Dow Jones climbed by 0.32% and 0.21% respectively. Futures tracking the Dow, S&P, and Nasdaq 100, are all currently in negative territory, pointing to a slightly lower open today. In Asia, Japan’s Nikkei 225 and the Topix plunged 1.1% and 1.2% correspondingly, as the latest surge in the yen dampened the prospects for Japanese exporters. In Hong Kong, the Hang Seng was up, but only by 0.07%. In Europe, futures tracking the major indices were all in the green, with the only exception being the German DAX 30.

COMMODITIES: Oil prices edged down on Wednesday and are trading lower today as well, after the weekly EIA crude inventory data surprisingly showed a massive build in stockpiles, instead of the anticipated drawdown. WTI fell by 0.35% and Brent by 0.4% today, though both benchmarks remain elevated close to the multi-year highs they achieved recently. Some talk that OPEC is considering to “open the taps” soon and offset any declines in output from Venezuela and Iran may have aided the pullback. In precious metals, gold is up by nearly 0.2% today, extending gains from yesterday. The metal is currently trading near $1,296 per ounce, and looks to be headed for a test of the psychological $1,300 level.

Major movers: Dollar advance halted by Fed minutes; euro and sterling lose ground as yen roars back

The minutes from the Fed’s May policy meeting confirmed the Committee would be comfortable allowing inflation to overshoot its 2% inflation goal for a while without raising rates more aggressively. And while policymakers signaled that another hike is likely needed “soon”, cementing expectations for such action in June, they stopped short of indicating support for faster rate hikes than they have already penciled in.

These signals likely enhanced the narrative the Fed will only raise rates another two times this year, and not three as several investors expect. In fact, while two more 25bps are still fully priced in for 2018, the implied probability for a third one has fallen to below 10% according to the Fed fund futures. The yields on 10-year US Treasuries dipped, while the dollar tumbled, giving back some of the gains it had posted earlier.

On the trade front, President Trump announced yesterday the US is considering tariffs on imported cars and trucks, once again pouring cold water on expectations the “trade war” narrative is about to quiet down. Unlike the previous tariffs aimed mainly at China though, these ones seem to be directed predominantly towards Germany and Japan, both of which export a considerable number of automobiles to the US.

Meanwhile, the yen skyrocketed yesterday on safe-haven flows, gaining roughly 200 pips against both the euro and the pound, which were on the back foot following soft data out of the eurozone and UK respectively. The euro stumbled after the bloc’s PMIs for May fell by more than expected, adding credence to the theme that the economy is losing momentum and the ECB may be even more hesitant to head for the stimulus-exit door. The currency still seems vulnerable to some more downside in the near-term, especially if the ECB minutes today confirm policymakers are becoming warier.

In the UK, sterling was pressured by disappointing inflation data. The headline CPI rate surprisingly ticked down instead of remaining unchanged as projected, while the core rate declined by more than anticipated. The fact that inflation is declining faster than the Bank of England (BoE) expects, lessens the pressure on policymakers to raise interest rates. Indeed, the implied probability for a BoE hike in August fell to 32% and in case the UK retail sales figures disappoint today as well, that percentage could drift even lower, and the pound may follow suit.

In emerging markets, Turkey’s central bank raised interest rates by 300bps in an emergency move to arrest the lira’s freefall. While the currency rebounded – erasing the hefty losses it had posted yesterday – it has since started to weaken again and remains close to all-time lows, perhaps signaling that more needs to be done before the situation stabilizes.

Day ahead: UK retail sales, ECB minutes and US home sales on the horizon

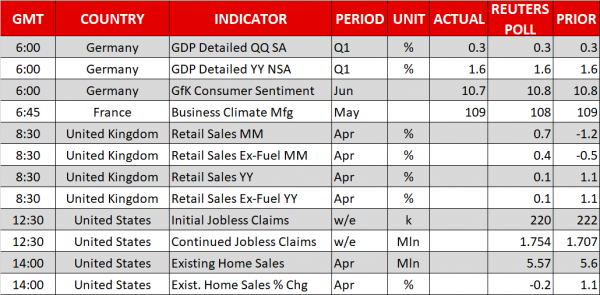

The highlights in terms of releases out of Thursday’s calendar are expected to be UK retail sales, the ECB’s official record of its latest meeting, and US existing home sales.

At 0830 GMT, the UK will be on the receiving end of retail sales data for the month of April. Sales are forecast to rise by 0.7% m/m, exhibiting a notable rebound relative to March when they contracted by 1.2%. However, the yearly rate of growth is anticipated at just 0.1%; this is due to an exceptionally strong reading in April of last year. Core retail sales, the measure that excludes fuel, will also be monitored. Sterling suffered yesterday – falling to a five-month low of 1.3303 versus the US currency – on the back of weaker-than-anticipated CPI figures. It will be interesting to see whether today’s release can allow the currency to move from the aforementioned multi-month nadir.

The European Central Bank will be releasing the minutes pertaining to its late April meeting at 1130 GMT. An upbeat sounding ECB that views the recent softness in eurozone data as not worrisome is likely to boost the euro; the implication being that policymakers remain committed to further scale down the Bank’s Asset Purchase Programme in Q4 and then completely phase it out by the end of the year. The opposite holds true as well.

Weekly jobless claims and existing home sales data will be released out of the US at 1230 GMT and 1400 GMT respectively. Existing home sales are projected to decrease by 0.2% m/m in April after rising by 1.1% in March.

Policymakers sharing remarks during today’s trading include Bank of England Governor Mark Carney (0800 GMT) and outgoing New York Fed President William Dudley (0815 GMT – the New York Fed President holds permanent voting rights within the FOMC). They will both be speaking at the BoE Markets Forum 2018, while Carney will also be appearing before the London’s Society of Professional Economists at 1910 GMT. Comments by ECB chief economist Peter Praet (0830 GMT and 1030 GMT), regional Fed Presidents Raphael Bostic (voter – 1435 GMT), Robert Kaplan (non-voter – 1435 GMT) and Patrick Harker (non-voter – 1800 GMT) are also on the agenda.

Meanwhile, US President Trump considering to impose new tariffs on imported cars, and the political situation in Italy are two other stories that will be closely followed during today’s trading. With respect to Trump, an interview of his on the “Fox and Friends” show will be airing today at 1000 GMT.

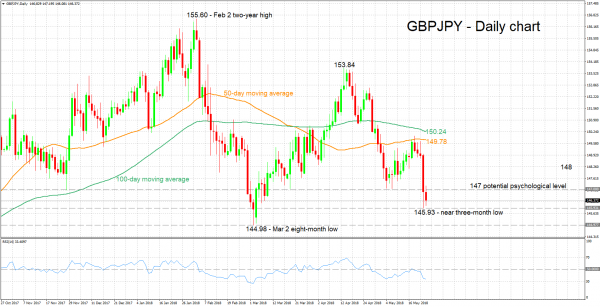

Technical Analysis: GBPJPY short-term bearish, not far above 3-month low

GBPJPY posted a near three-month low of 145.93 during Wednesday’s trading, while it is currently trading roughly 40 pips above that level. The RSI is in bearish territory below 50 and continues to decline, supporting the case for negative short-term momentum.

Stronger-than-expected UK retail sales data are anticipated to boost the pair. Resistance to advances might come around the 147 and 148 round figures.

Conversely, poor data releases are likely to amplify losses. Support to a falling GBPJPY could come around yesterday’s low of 145.93 (including the 146 handle). Further below and in case of steeper losses, the eight-month low of 144.98 from early May would be eyed next.