Here are the latest developments in global markets:

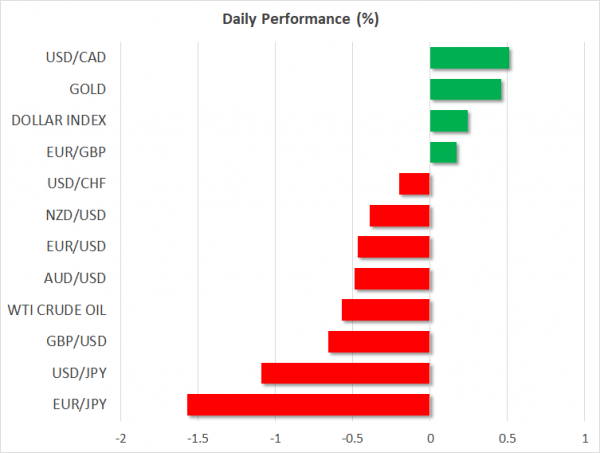

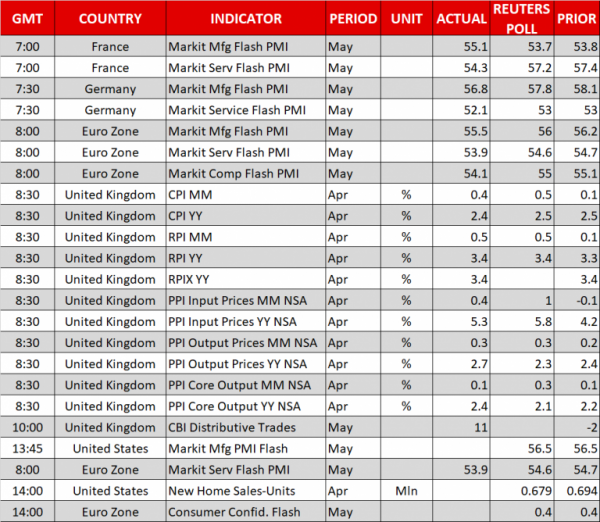

FOREX: The spur from optimism in US-China trade talk was weakened quickly today and the markets are trading lower. The Japanese yen surged broadly today and was trading as the strongest one against major currencies. Dollar/yen plunged by 1.12%, slipping below the 110.00 handle ahead of the FOMC minutes later in the day. However, the US dollar index moved higher by 0.27%, approaching again the 5-month high of 93.94. The Euro edged sharply lower by 1.58% versus the Japanese yen, recording a new 9-month low of 128.34, following negative readings in Eurozone and German preliminary Markit PMIs. The manufacturing PMI in Germany fell to the lowest level in 15 months of 56.8 in May compared with 58.1 in April while services decelerated to a 20-month low of 52.1 in May compared with 53.0 in April. The Flash Eurozone manufacturing PMI fell to 55.5 in May from 56.2 before, the slowest expansion since March 2017, while services declined to 53.9 from 54.7 previously, a 16-month low. Moreover, euro/dollar headed lower by 0.47% to 1.1722, creating a fresh 6-month trough. UK inflation dropped to 2.4% in April from 2.5% the preceding month, sending pound/dollar lower to 1.3347 (-0.65%), 5-month low. Commodity-linked currencies are also struggling moving lower[repetition], with aussie/dollar moving lower by 0.51% to 0.7536. Kiwi/dollar dipped by 0.40% at 0.6905 and dollar/loonie was higher by 0.51% at 1.2882. Meanwhile, the Turkish lira tumbled 3.93% against the US dollar completing a new record low.

STOCKS: European stocks were in the red at 1000 GMT on Wednesday, dragged down by the deterioration in risk sentiment. The benchmark European STOXX 600 dived by 1.01%, while the blue-chip Euro STOXX 50 was down by 1.32%. The German DAX 30 fell by 1.55% after a rebound on the 3-month high. The French CAC 40 was down by 1.19% and the Spanish IBEX 35 fell by 1.57%, while the British FTSE 100 declined by 0.72% following the touch on the new high of 7,903.50 yesterday. In the US, even though the S&P, Dow Jones, and the Nasdaq all dropped yesterday, futures tracking these indices are currently in the red, pointing to a lower open today.

COMMODITIES: Oil prices continued to decline below 3 ½ -year highs on Wednesday after reports that OPEC could increase supply to offset supply declines in Iran and Venezuela as well as to slow down the recent rally in oil prices which was characterized by Washington as going too far. West Texas Intermediate (WTI) crude oil dipped by 0.65% to $71.73 per barrel, while Brent crude oil plummeted by 0.89% to $78.86 per barrel. In precious metals, gold moved higher by 0.48% to $1,297.06 before the release of the minutes from the Federal Reserve’s last policy meeting, while copper prices plunged by 2.65% to 3.0365.

Day ahead: FOMC meeting minutes to clear up inflation approach; Eurozone flash consumer confidence in focus

The FOMC meeting minutes will be the main highlight of the day as investors are eagerly waiting for policymakers to explain the word “symmetric” used in the latest rate statement to describe the inflation target. The addition of this word was taken as a signal that the Fed will probably leave inflation to overshoot the 2.0% goal without changing its rate trajectory. If this is the case, then the dollar could lose ground on speculation that the Fed will not raise interest rates faster this year if inflation climbs above 2.0%. Any comments on economic growth could attract attention as well, given the removal of the sentence “the economic outlook has strengthened in recent months”, which hinted that economic expansion may have lost steam.

Earlier at 1345 GMT, US flash Markit PMI readings for the month of May could move the dollar before the release of the FOMC meeting minutes. Expectations are for the manufacturing PMI to remain unchanged at 56.5, at the highest level in over three years, while the Services PMI is seen slightly higher at 54.9 compared to 54.6 in April. Should the numbers prove better than expected, which would suggest that US GDP growth could rebound in the second quarter as analysts are projecting, the greenback could gain some ground.

Meanwhile, developments on the trade front and the North Korea story will remain under the spotlight. Yesterday the US President, Donald Trump, surprised markets by saying that he was not “really” satisfied with US-China trade talks, a few days after the US Treasury Secretary announced that both countries had agreed to suspend proposed import tariffs. Moreover, he notified that North Korea must meet conditions for the June 12 summit to go ahead, spurring doubts whether the event could even take place.

Meanwhile, in the Eurozone, initial estimates on consumer confidence for May delivered at 1400 GMT could be the next challenge for the euro after today’s flash Markit PMI readings disappointed. According to analysts, the gauge is expected to stand at 0.4% in May as in April – the highest print recorded since February. The political situation in Italy is anticipated to continue to weigh on the euro as two Eurosceptic parties are set to form the next government. Still, the parties need an approval for their proposed candidate, Giuseppe Conte, to be the new Prime Minister.

In other data, New Zealand will see the release of trade figures at 2345 GMT.

Ongoing Brexit negotiations will be in focus in the pound market.

In oil markets, the Energy Information Administration is scheduled to publish its weekly report on US oil inventories at 1430 GMT and it would be interesting to see whether crude oil inventories continued to decline for the third consecutive week. Recall that on Tuesday, the API numbers showed a smaller reduction in US crude stocks for the week ending May 18.

As of today’s public appearances, Minneapolis Fed President Neel Kashkari (non-voting FOMC member in 2018) will be participating in a moderated Q&A session on “New Energy Economic Reality” before the Williston Basin Petroleum Conference at 1815 GMT.

In equities, Ralph Lauren and Tiffany & Co are among companies releasing quarterly results today; both will be reporting before the US market open.