US flash IHS Markit Manufacturing Purchasing Managers Index (PMI) will come into focus on Wednesday at 1345 GMT to indicate whether April’s upturn in the manufacturing sectors stretched into May. If this is the case, an upbeat report could provide evidence that GDP growth in the world’s biggest economy may rebound in the second quarter, as analysts’ project.

According to initial forecasts, the US manufacturing PMI is said to remain unchanged at 56.5 in May, at the highest level recorded since October 2014 and above the threshold of 50 separating growth from contraction in the industry’s business activities. In April, the same survey showed that growth in goods production was the fastest since the beginning of the year thanks to increased new order volumes and new clients. But at the same time input costs were rising at a rapid pace never seen in seven years, with companies such as Harley-Davidson and Ford Motor being among firms to blame recently-announced tariffs on steel for higher material costs. Although Trump’s tax cuts in effect since the start of the year free up capital for investment, inflation could increase faster due to trade protectionism, leading the Fed to raise rates quicker. That could create doubts on whether economic expansion can advance later this year. Business confidence could also deteriorate if expensive raw materials make US products less competitive.

Meanwhile, the service PMI is projected to inch up to 54.9 from 54.6, probably driving the composite PMI above the previous mark of 54.9.

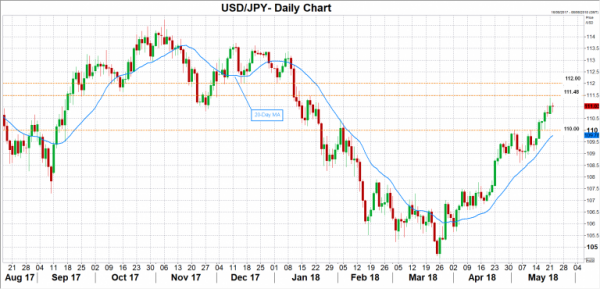

Turning to forex markets, better-than-expected PMI readings could lift dollar/yen towards 111.48, taken from the January 18 peak, on signs that GDP growth could strengthen in the second quarter. If the market manages to overcome that level, then the 112.00 round level could attract traders’ attention.

Alternatively, a miss in data could see the pair seek support at 110.00, a frequently congested area which if breached could lead the price even lower towards the 20-day simple moving average, currently at 109.78.

FOMC meeting minutes released on Wednesday at 1800 GMT are expected to attract a greater share of attention though, as investors are looking for a detailed explanation behind the new word “symmetric” used to describe the inflation target. Should the minutes signal that the Fed plans to leave prices to pick up above the target without accelerating the pace of rate hikes, then dollar/yen could weaken.