Canada will see the release of both inflation and retail sales figures on Friday at 1230 GMT, with investors looking eagerly for signs of further economic recovery that could increase chances for a tighter monetary policy this year, given the Bank of Canada’s data dependence. Forecasts are for headline inflation to remain elevated above the mid-point of the BoC target range in April, while retail sales are expected to slip slightly in March. Still, with NAFTA talks on thin ice and household debt at elevated levels, a significant positive surprise may be needed in the data in order to boost the odds for a rate rise at the BoC upcoming policy meeting.

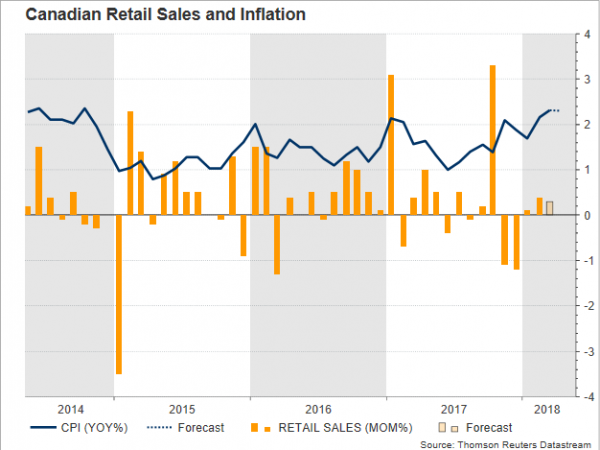

According to analysts, the Canadian headline consumer price index (CPI) is said to have increased by 2.3% y/y in April, the same as in March – the highest growth recorded since October 2014 –, with rising energy prices probably continuing to hold the measure above the 2.0% midpoint of the BoC target range of 1-3.0% on an annual basis. Still, as the BoC Governor Stephen Poloz said recently, a spike above the central bank’s 2.0% mid-point should not warrant a rate hike, as the factors underpinning the measure could be transitory. However, should the numbers surpass forecasts by far, speculation for a rate rise at the end of May could climb, driving the odds of this event above the current 40.83% according to Canadian overnight index swaps. An increase in the core CPI measure, as well as in the inflation gauges utilized by the Canadian central bank (CPI-trim, CPI-median, CPI-common), which trim for volatility and hence help policymakers to have a clear view of how inflation trends look like, could enhance these chances even further.

Regarding Canadian retail sales, businesses in the industry enjoyed a sales growth of 0.4% m/m in February on the back of gains in the car industry; this was the highest expansion since October. In March, though, a decline in demand for vehicles could have pressured the relevant reading, with analysts projecting it to slow down to 0.3% instead. Excluding automobiles, retail sales are projected to have risen by 0.5% m/m after posting no growth in the previous month. Yet, retailers could have done much better if households were less stressed about mounting debt levels. On May 1, Governor Poloz stated that the average Canadian owed $1.70 for every dollar of income earned per year after taxes, with the ratio of debt to disposable income continuing to rise, reaching fresh record high levels. On the other hand, employment stats in March indicated that average hourly earnings picked up from 3.1% to 3.3% y/y and full-time job positions rose at a faster pace.

Besides debt concerns, policymakers should also assess progress in the NAFTA talks before they decide whether to reduce monetary stimulus. But after nine months of talks, the member countries of the free-trade agreement, Canada, Mexico and the US, remain deadlocked on how to deliver an attractive agreement. Time is fast running out as the negotiating teams are rushing to find a common ground by Thursday, a deadline set by the House Speaker Paul Ryan in order for the deal to make it to Congress this year. The US Trade Representative, Robert Lighthizer said on Wednesday, though, that today’s deadline will probably not be met, signaling that conditions could get more complicated ahead of the Mexican presidential elections in July and the US mid-term elections in November. This in return could probably add further pressure to business sentiment and hence put the BoC on hold for longer than expected.

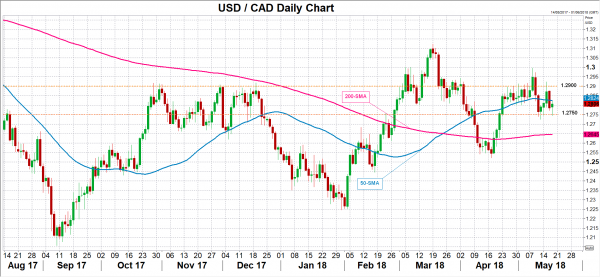

In forex markets, dollar/loonie could lose strength if the data impress – especially on the inflation front – encouraging investors that a BoC rate hike could be on the cards this month, or that the central bank could use a more hawkish tone. However, investors think that policymakers will likely raise borrowing costs in July, with the implied probability by futures markets currently running around 80%, giving some space for trade uncertainties to clear up. In the event of a positive data surprise dollar/loonie could look for immediate support around 1.2750, a frequently tested area. A break below from here could also send the pair down to the 1.2700 round level before the market heads towards the 200-day MA currently at 1.2645.

In the alternative scenario, worse-than-expected numbers could work in favor of the US dollar, driving the price up to the 50-day MA, which fluctuates around 1.2840. Further above, a stronger resistance could come from the 1.2900 psychological level, which has provided resistance several times in the past.