Wednesday May 16: Five things the markets are talking about

Investors continue to grapple with worries around global trade, growth and geopolitics.

Overnight in Asia, equities dipped after N. Korea’s Pyongyang abruptly called off talks with Seoul, throwing a U.S/N. Korean summit into doubt, while surging bond yields stateside has re-energized market worries about faster Fed interest rate hikes that could curtail global demand.

Note: A cancellation of the June 12 summit in Singapore could see tensions on the Korean peninsula flare again. If talks do break down, President Trump may no longer feel that he needs to keep China content, which could escalate global trade tensions again.

In Europe, unlike its southern counterparts, stocks have opened a tad higher despite yesterday’s spike in yields, while the ‘big’ dollar is trading flat. Crude oil prices have eased a tad ahead of today’s EIA inventory reports (10:30 am EDT).

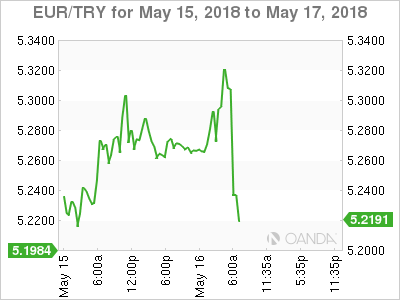

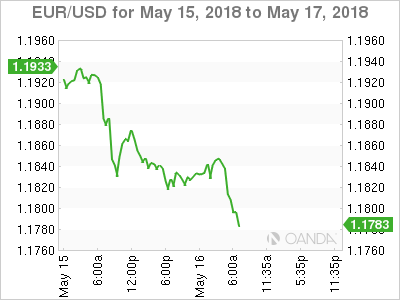

Also in Europe, the focus is on Italian politics as the two populist parties – Five-Star and league – negotiate a coalition. Leaked draft documents have pushed the EUR (€1.1796) to test new yearly lows.

On tap: China’s Vice Premier, Liu He, is expected in Washington this week for more trade talks.

1. Stocks mixed results

Asian markets produced some mixed results, carrying forth Wall Streets knocked sentiment from a spike in Treasury yields.

In Japan, stocks fell after Pyongyang called off talks with Seoul, throwing Trump’s U.S/N. Korean summit into question. Not helping equities was Japanese data indicating that their domestic economy contracted more than expected in Q1 (-0.6%). The Nikkei ended -0.4% lower while the broader Topix fell -0.3%.

Down-under, Aussie stocks bucked the trend with the S&P/ASX 200 advancing +0.3%, while in S. Korea, the Kospi struggled for traction, rallying +0.05%.

In Hong Kong, stocks barely changed on trade worries. Investors are waiting for news on a second round of U.S/China trade talks in Washington this week. The Hang Seng index ended -0.1% down, while the China Enterprises Index was unchanged.

In China, it was a similar story. The market waits for some positive news from the Sino/U.S. trade talks where both sides are believed to be still far apart. The blue-chip CSI300 index fell -0.8%, while the Shanghai Composite Index lost -0.7%.

In Europe, regional bourses trade mixed Indices trade mixed following the recent run up, as U.S futures rebound following weakness in yesterday’s session.

U.S stocks are set to open in the ‘black’ (+0.1%).

Indices: Stoxx600 flat at 392.3, FTSE +0.1% at 7735.4, DAX flat at 12973, CAC-40 flat at 5551, IBEX-35 -0.7% at 10132, FTSE MIB -1.2% at 23994, SMI -0.2% at 8975, S&P 500 Futures +0.1%

2. Oil dips despite OPEC cuts and Iran sanctions, gold higher

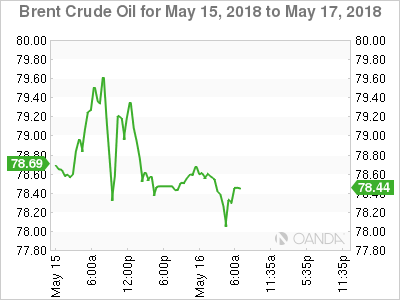

Oil prices fell overnight, weighed down by sufficient supplies despite ongoing output cuts by OPEC and looming U.S sanctions against Iran.

Brent crude futures are at +$78.22 per barrel, down -21c or -0.3% from the close. U.S West Texas Intermediate (WTI) crude futures are at +$71.03 a barrel, down -28c, or -0.4%.

Despite the dips, both benchmarks remain close to their four-year highs.

Expect investors to take their cues from today’s U.S inventory reports. Official U.S government fuel storage data is due for release by the EIA this morning (10:30 am EDT). The market is expecting the report to display ‘bearish’ results amidst higher rig counts and production levels in the U.S.

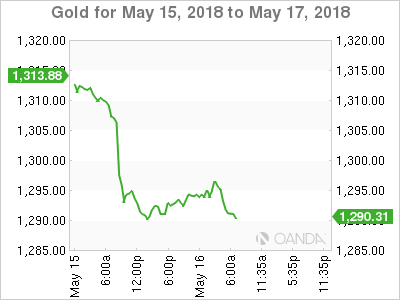

Ahead of the U.S open, gold prices have recovered some lost ground on short-covering after prices fell to the lowest level this year in yesterday’s session on surging bond yields and a stronger dollar.

Spot gold has rallied +0.3% to +$1,294.30 per ounce, after shedding -1.7% and marking the lowest price this year at +$1,288.31 on Tuesday. U.S gold futures for June delivery are up +0.2% at +$1,293.60 per ounce.

3. Italy 10-year bond yield at two-month high

Italian bonds have slumped as populists struggle to reach an agreement to govern, but core European notes remain stable.

The 10-year Italian government bond yield has backed up +7 bps to a two-month high of +2.027%. The draft program of the League and of the Five Star Movement – the two populist parties in negotiations to form Italy’s next government, has triggered the move.

A leaked draft version of the agreement shows the parties sought the creation of a mechanism to exit the E.U. They have called for the ECB to forgive billions of EUR’s in Italian debt.

Stateside, strong U.S retail sales and factory data yesterday has pushed the U.S 10-year yield through a key level to hit +3.095%, its highest yield in seven-years.

Elsewhere, Germany’s 10-year Bund yield has declined -2 bps to +0.63%, the biggest decrease in almost two-weeks, while in the U.K the 10-year Gilt yield has dipped -1 bps to +1.508%.

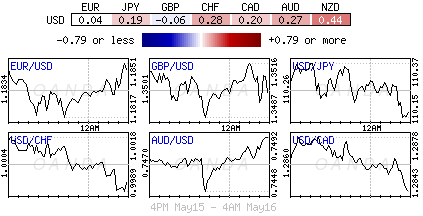

4. Dollar flat after sharp rise, EM currencies fall

Ahead of the U.S session, the ‘big’ dollar continues to hover atop of its five-month highs against G10 currency pairs, supported by yesterday’s surge in the benchmark 10-year Treasury yield above +3.05%.

EUR/USD (€1.1796 -0.31%) continues to trade within striking distance of some key support levels atop of the psychological €1.1800 handle. USD/JPY (¥110.14 -0.12%) is above ¥110 with the yen largely shrugging off data that showed Japan’s economy shrank more than expected in Q1, while the pound (£1.3472 -0.22%) has finally penetrated the £1.3500 handle.

Emerging market currencies are nearly all falling against the dollar, with the TRY and IDR rupiah taking the biggest hit. USD/TRY is up +0.5% at $4.4708 and USD/IDR up +0.5% at $14,103.

5. Euro area annual inflation falls

Data this morning from Eurostat showed that the Euro area annual inflation rate was +1.2% in April, down from +1.3% in March. A year earlier, the rate was +1.9%.

The European Union (EU) annual inflation was +1.4% in April, down from +1.5% in March. A year earlier, the rate was +2.0%.

Digging deeper, the lowest annual rates were registered in Cyprus (-0.3%), Ireland (-0.1%) and Portugal (+0.3%), while the highest annual rates were recorded in Romania (+4.3%), Slovakia (+3.0%) and Estonia (+2.9%).

Compared with March 2018, annual inflation fell in twelve Member States, remained stable in one and rose in fourteen. In April, the highest contribution to the annual euro area inflation rate came from food, alcohol & tobacco, followed by services, energy and non-energy industrial goods.