Here are the latest developments in global markets:

FOREX: The US dollar index is higher on Wednesday but by less than 0.1%, extending the notable gains it posted yesterday, when it advanced against all major currencies. Solid US retail sales data pushed the yields of longer-term US bonds to fresh multi-year highs, breathing a second wind into the dollar’s latest rally.

STOCKS: Major US indices tumbled yesterday, as the renewed rise in US yields sapped demand for stocks. Rising borrowing costs could hinder the ability of some of these companies to buy back their own stocks and refinance their old debt, thereby squeezing profits. The Nasdaq Composite led the way down, declining by 0.81%, while the Dow Jones and the S&P 500 followed in its tracks, closing lower by 0.78% and 0.68% respectively. Futures tracking the Dow, S&P, and Nasdaq 100 are currently in positive territory, albeit only marginally so. Asia did not escape unscathed either, with most indices being in the red today. Japan’s Nikkei 225 and Topix fell by 0.44% and 0.27% correspondingly, while the Hang Seng in Hong Kong declined 0.36%. In Europe, futures following most major benchmarks are close to neutral territory, with the exception being the Italian FTSE MIB, which is expected to open around 0.6% lower.

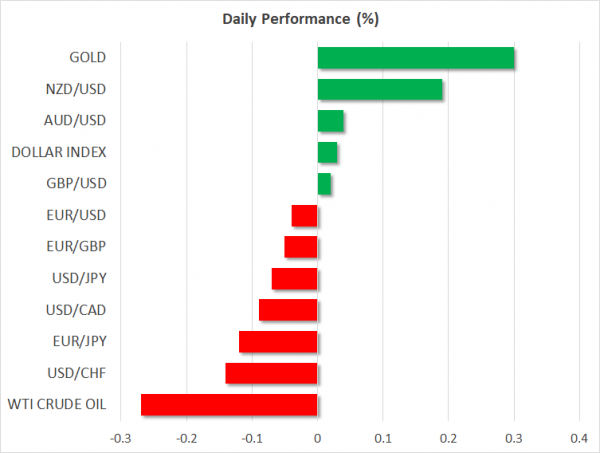

COMMODITIES: Oil prices are lower today, with WTI and Brent falling by nearly 0.3% each. Both benchmarks touched fresh multi-year highs yesterday, before the surge in the US dollar curbed demand for the dollar-denominated liquid, leading to a pullback in prices. Today, attention will turn to the official EIA crude inventory figures at 1430 GMT, with any major moves in the dollar also having the capacity to impact the precious liquid. In precious metals, gold prices are 0.3% higher today, recovering some of the remarkable losses they recorded yesterday on the back of an appreciating US currency. The yellow metal broke below both its 200-day moving average and the psychological $1,300 zone, recording a fresh low for 2018 and turning the short-term technical outlook to negative.

Major movers: Dollar marches higher after retail sales, supported by rising yields

The US dollar index got its cue from the bond market yesterday, and surged in tandem with US Treasury yields, to reach a fresh five-month high. Yields on 10-year US bonds climbed to 3.09% – a high last seen in 2011 – before pulling back to 3.06%, increasing the appeal of the US currency. Interestingly, while the relationship between the dollar and longer-term US yields had faded in late-2017 and early-2018, that correlation seems to have returned in the second quarter of 2018.

Most of the dollar’s gains came after US retail sales for April were released. Although the core figure was a touch softer than expected, last month’s prints were revised higher, painting an overall upbeat picture for consumer spending. Euro/dollar and pound/dollar touched fresh five-month lows, while dollar/yen managed to power through the elusive 110.00 territory, recording a near four-month high.

On another interesting note, markets are becoming slightly more confident in the Fed delivering three more rate increases this year. Two more 25bps rate hikes are already fully priced in, and the probability for a third one climbed to 36% according to the Fed funds futures, up from roughly 20% last week.

In Japan, GDP data released overnight showed the economy surprisingly contracted in Q1, ending a two-year streak of positive growth readings. Nonetheless, the yen barely noticed, and is even higher against the dollar and euro today.

In emerging markets, the Turkish lira continued to plummet yesterday, touching fresh all-time lows against both the dollar and euro. The latest leg lower came after Turkish President Erdogan suggested he would take greater control of monetary policy should he win the upcoming election. His remarks cast fresh doubts on the central bank’s independence, as well as on its ability to raise interest rates as much as needed in order to rein in double-digit inflation.

Day ahead: Eurozone inflation, US housing starts & industrial production on the agenda

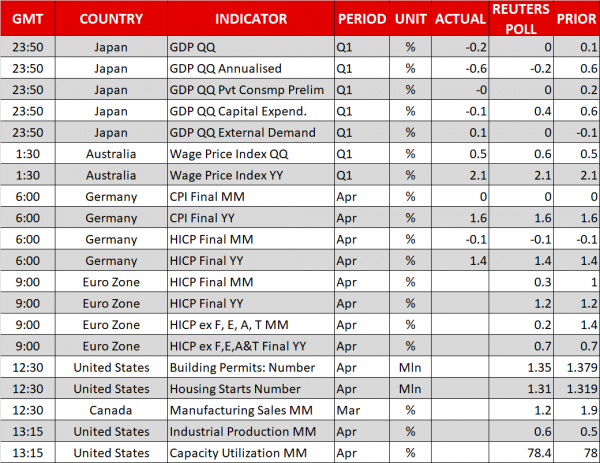

Wednesday’s calendar features the release of inflation numbers out of the eurozone, as well as US housing starts & industrial production figures.

Final inflation figures out of the eurozone for the month of April will be made public at 0900 GMT. Headline inflation, as gauged by the Harmonised Index of Consumer Prices (HICP) that uses a common methodology across EU countries, is anticipated to have grown by 0.3% m/m and 1.2% y/y, confirming the slowdown relative to March’s readings that was reflected in the preliminary release. For perspective, the ECB’s target for annual inflation is below but close to 2%. The measure of inflation that excludes food, energy, alcohol and tobacco will also be monitored.

The attention will next turn to the US which will see the release of data on April’s housing starts and the number of building permits for the same month at 1230 GMT. Housing starts are projected to have fallen by 1.1%, following a rise by 1.9% in March.

Canadian manufacturing sales for March are also scheduled for release at 1230 GMT.

Another important data point out of the US is the one pertaining to April industrial production figures, due at 1315 GMT. Industrial output is expected to have expanded by 0.6% m/m, a higher pace relative to March’s 0.5%. Manufacturing output, a subset of industrial production, will also be closely monitored, while data on capacity utilization will be released at the same time as well.

Of interest to oil traders will be EIA weekly data on US crude inventories. Crude stockpiles are projected to decline by around 0.8 million barrels during the week ending May 11, recording their second straight weekly drawdown. That said, the private API data released overnight missed their forecast for a similar drawdown and instead posted a notable build, suggesting that investors may take the forecast for today’s figures with a pinch of salt.

Cisco is one of the companies releasing quarterly results today; the firm will be reporting after the US market close.

Numerous ECB policymakers, including President Mario Draghi (1200 GMT), will be speaking at a conference in honor of departing ECB Vice President Vitor Constancio. Meanwhile, Atlanta Fed President Raphael Bostic will be talking about the US economy at 1230 GMT, and Bank of Canada Deputy Governor Lawrence Schembri is scheduled to give a speech at 1415 GMT.

In geopolitics, North Korea decided to suspend talks with South Korea in response to common military drills between the US and South Korea. It will be interesting to see how this plays out and the extent it will affect the planned June summit where Kim Jong Un and Trump are expected to meet.

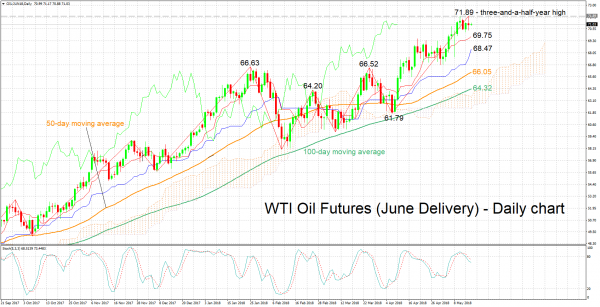

Technical Analysis: WTI oil futures close to 3½-year high; bearish signal by stochastics in very short-term

WTI oil futures for June delivery are trading not far below the three-and-a-half-year high of 71.89 hit yesterday. The Tenkan- and Kijun-sen lines remain positively aligned in support of a bullish picture in the short-term. The stochastics, however, are giving a bearish signal in the very short-term: the %K line has moved below the slow %D one and both lines are heading lower.

If today’s EIA report shows a larger-than-anticipated drawdown in crude inventories, then prices could move higher. Resistance to advances might come around yesterday’s three-and-a-half-year high of 71.89, including the 72 round mark. An upside break may meet an additional barrier around the 73 handle.

On the downside and in case of a smaller-than-expected drawdown in crude stocks (or a buildup), support could come around the current levels of the Tenkan- and Kijun-sen lines at 69.75 (including the 70 handle) and 68.47 respectively, given that the region around the 71 handle, which seems to be providing immediate support, is violated first.