Tuesday May 15: Five things the markets are talking about

Risk-off trading action and higher sovereign yields dominated capital markets overnight session.

Euro stocks continue to struggle for traction following Australasia mixed equity session as investors grappled with worries around global trade, growth and geopolitics.

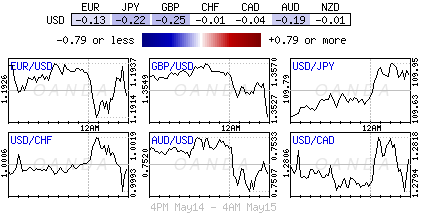

This week’s U.S Treasury bond sell-off continues to deepen and is allowing the dollar to find support against G10 currency pairs on rate differentials. Crude oil prices are on the precipice of exploding higher.

In the U.K, data this morning showed that employment jumped, but strong wage growth remains elusive. While in Germany their economy cools a tad.

On tap: China’s Vice Premier, Liu He, is expected in Washington for more trade talks today. U.S retails sales are due at 08:30 am EDT.

1. Equities see ‘red’

In Japan, stocks pulled back from atop of their four-year highs overnight, hit by profit taking, although financials staged a rally on hopes of strong earnings for the sector. The Nikkei share average ended -0.2% lower, while the broader Topix was unchanged.

Down-under, Aussie stocks slide deeper into the close and ended more than a week of broad gains. The S&P/ASX 200 fell -0.6% to register only its fifth decline in 22-sessions. The index was driven down mostly by the resource sector. In S. Korea, more selling in Samsung helped the Kospi fall -0.7% – the electronics giant dropped -1.4% to a one-month closing low.

In Hong Kong, stocks snapped a six-day winning streak to end lower overnight, amid renewed fears of a Sino-U.S trade war and worries about China’s economy. The Hang Seng index ended -1.2% down, while the China Enterprises Index closed -0.8% lower.

In China, stocks ended higher on Tuesday, supported by optimism towards MSCI inclusion of 234 Chinese large caps – this has helped some investors to overcome worries about China’s economy and Sino-U.S trade war. The blue-chip CSI300 index ended +0.4% higher, while the Shanghai Composite Index closed up +0.6%.

In Europe, regional bourses trade little changed, following a plethora of earnings this morning and weaker U.S futures.

U.S stocks are set to open in the ‘red’ (-0.3%).

Indices: Stoxx600 flat at 392.3, FTSE +0.2% at 7725.4, DAX -0.2% at 12955, CAC-40 +0.1% at 5545, IBEX-35 -0.3% at 10229, FTSE MIB +0.3% at 24305, SMI flat at 8999, S&P 500 Futures -0.3%

2. Iran sanctions, tight supply send oil to new multi-year high, gold unchanged

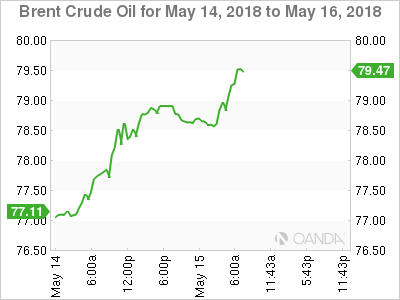

Oil prices trade atop of their four year high this morning, supported by tight supply and planned U.S sanctions against Iran that are likely to restrict crude oil exports from one of the biggest producers in the Middle East.

Benchmark Brent crude oil reached +$78.60 a barrel, up +37c and its highest since November 2014. U.S light crude (WTI) is +5c higher at +$71.01 a barrel.

U.S crude continues to trade at a hefty “discount” to Brent due to the sharp rises in domestic production to +10.7m bpd, which has left the U.S market well supplied.

Note: World oil prices have surged by +70% over the last year as demand has risen sharply and OPEC has restricted production.

Data yesterday from OPEC showed that oil inventories in OECD industrialized nations in March fell to +9m barrels above the five-year average, down from +340m barrels above the average in January 2017.

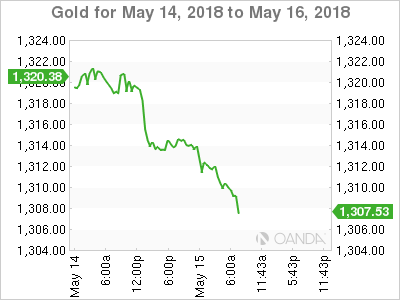

Ahead of the U.S open, gold has been trading little changed overnight, buoyed by Middle East safe-haven demand with the upside potential restricted by a stronger U.S dollar and outlook for higher interest rates stateside. Spot gold is unchanged at +$1,311.51 per ounce. U.S gold futures for June delivery are down -0.5% at +$1,311.30 per ounce.

3. Sovereign yields back up

Behind the divergence of E.U/U.S interest rates has been the divergence of inflation. Last year, U.S inflation was +30 bps on top of the E.U in April, and 12-months on, the spread has widened even further to +120 bps.

Hawkish comments yesterday from some FOMC members have again helped to back up U.S 10-year yields above their psychological +3% handle.

Note: Fed fund odds indicate that U.S policy makers will raise rates three more times this year – they have rallied to +50%, up from +39% a month ago.

Other G7 sovereign yields have also being getting a helping hand from the Banque De France (BoF), whose governor, François Villeroy de Galhau, hinted that the ECB might raise rates next year.

Overnight down-under, the Reserve Bank of Australia (RBA) released their monetary minutes. Members agreed that it was more likely that the next move in the cash rate would be up, rather than down. However, RBA Deputy Governor Debelle sees “no pressure to raise rates” as the Aussie economy is on a slowly improving trajectory, but that doesn’t make a case for raising interest rates in the near term.

The yield on U.S 10’s has gained +1 bps to +3.02%, the highest in almost three-weeks. In Germany, the 10-year Bund yield climbed +1 bps to +0.62%, also the highest in almost three-weeks. In the U.K, the 10-year Gilt yield increased +1 bps to +1.482%.

4. Sterling pares losses despite wage growth miss

The ‘mighty’ USD is steady as market participants continue to focus on yields. The U.S 10-year yield has moved back above the +3% territory, again steepening the U.S curve, which is giving the greenback some support.

The EUR/USD (€1.1929) hovers near its four-month low as various European Q1 GDP data (see below) confirmed the anticipated deceleration in growth.

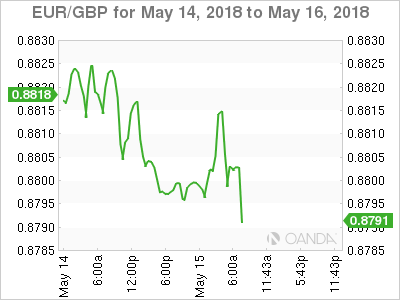

The pound (£1.3557) has pared most of its losses ahead of the U.S open after data this morning showed that U.K wage growth picked up further in March, though the currency’s gains are limited as the figures were in line with expectations (see below). EUR/GBP is at €0.8796, down from €0.8813 beforehand.

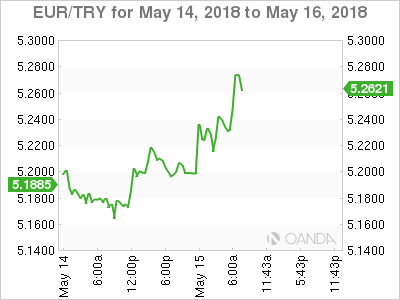

EUR/TRY (€5.2420) hit a new high after Turkish President Erdogan said he intends to tighten his grip on the economy and take more responsibility for monetary policy if he wins an election next month.

5. U.K wage growth disappoints, while German economy cools

Data this morning showed that U.K employers hired many more workers than expected at the start of 2018, but wage growth has yet to accelerate sharply – today’s releases will probably do little to alter the outlook for Bank of England (BoE) interest rates.

Employment in Britain rose by +197k during Q1. It’s the biggest jump in three years and far exceeding the +130k consensus. U.K average earnings growth ex-bonuses in Q1 was +2.9%, comfortably above the inflation rate of +2.5%. Unemployment also remained low at +4.2%.

Elsewhere, Europe’s largest economy cooled sharply in Q1 due to high levels of illness and labor disputes. Germany’s annualized growth rate slowed to +1.2% from +2.5% in Q4, 2017.

Note: Market expectations were looking for E.U Q1 GDP growth to decelerate, but, is the effect temporary?

Digging deeper, the “Beats” – Norway, Hungary and Poland and the “Misses” – Germany, Netherlands, Portugal Romania, Czech Republic and “in-line” was the Euro Zone.