Here are the latest developments in global markets:

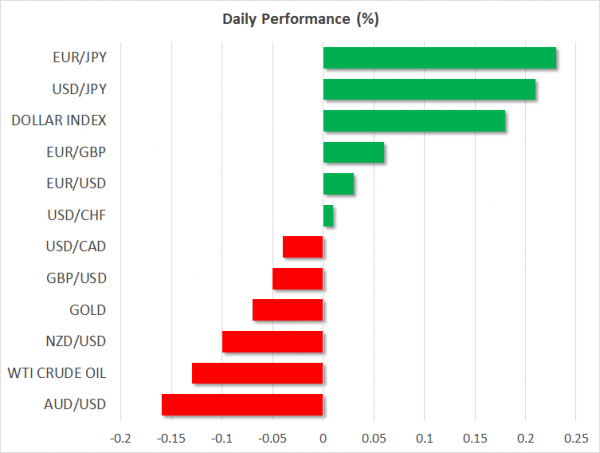

FOREX: The US dollar index is nearly 0.2% higher on Tuesday, building on the gains it recorded yesterday on the back of a surge in longer-term US bond yields. The Japanese yen, which is seen as a safe haven asset, is on the back foot as trade risks have moved out of the spotlight and focus has turned to potential solutions through negotiations.

STOCKS: Wall Street closed higher on Monday, though the gains were only modest. The Dow Jones led the way, rising by 0.27%, while the Nasdaq Composite and the S&P 500 climbed 0.11% and 0.09% respectively. Futures tracking the Dow, S&P, and Nasdaq 100 are all currently flashing red, pointing to a lower open. In terms of events today, traders will look to the release of US retail sales, as well as testimonies by two Fed nominees. In Asia, market sentiment soured after some relatively soft data out of China. In Japan, the Nikkei 225 and the Topix declined by 0.21% and 0.04% correspondingly, while in Hong Kong, the Hang Seng fell 1.04%. Europe was a similar story, with futures following the major benchmarks being a sea of red, suggesting these indices may open lower.

COMMODITIES: Oil prices are marginally lower today, with both WTI and Brent declining roughly 0.1%, giving back some of the gains they posted yesterday after OPEC raised its 2018 forecast for global crude demand. Prices remain elevated near the three-and-a-half year highs reached last week, as markets are still scrambling to determine how much impact the US sanctions on Iran will have on global supply, and whether other major players will “fill the gap” by raising their own production. In precious metals, gold is 0.07% lower today, extending losses from yesterday. It is trading just above the $1,311/ounce zone and looks to be headed for a test of its 200-day moving average at $1,307, which has halted several declines this month.

Major movers: Dollar gains ground ahead of key events; ECB’s Villeroy briefly boosts euro

The US dollar index was on the back foot during yesterday’s European session but managed to pare all its losses and finish the day higher overall, buoyed by a surge in longer-term US bond yields. The yield on 10-year Treasuries jumped back above the psychological 3.0% handle, and currently rests at 3.02%, hovering just below the four-year high reached in early April.

Today, the dollar will probably get its cue from US retail sales data. Of equal importance may be some remarks before the US Senate from Richard Clarida and Michelle Bowman, who have been nominated to become Fed Vice Chair and Board Governor respectively. Markets will attempt to gauge where they lean on the hawk-dove spectrum, and what their appointments might mean for upcoming Fed decisions, since both positions hold permanent voting rights in the FOMC.

Euro/dollar started to move higher after some hawkish-perceived comments from ECB Governing Council member Francois Villeroy de Galhau, but met resistance just below the round figure of 1.2000, and turned back down as the dollar started to recover. Villeroy said the first ECB rate hike may come some quarters and not years after the Bank ends its QE program. While his comments were more or less in line with previous ECB guidance and current market pricing, investors still reacted by pushing the euro higher. That said, the common currency erased all its gains to finish the day lower versus the dollar and sterling, but not the yen, which has been on the back foot lately as trade risks appear to be fading.

In the antipodean sphere, aussie/dollar is 0.15% lower today, following the release of the minutes from the latest RBA policy gathering and a speech by RBA Deputy Governor Guy Debelle. The minutes revealed nothing new, reaffirming the Bank will remain patient as it waits for wages to pickup. Meanwhile, Debelle erred on the side of caution, saying he does not see a “strong case” for a near-term rate increase. Elsewhere, kiwi/dollar was down by 0.1%, trading not far above a five-month low of 0.6890.

Day ahead: UK wage growth and US retail sales in focus; German ZEW survey, eurozone GDP & industrial production also on the horizon

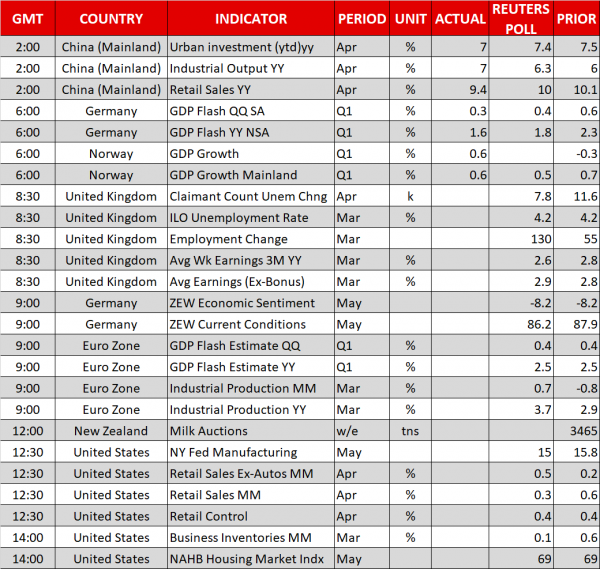

Tuesday’s calendar is a rather packed one, with UK employment data and US retail sales being among the releases expected to attract most attention.

At 0830 GMT, UK employment data for March, as well as the unemployment benefits claimant count for April will be made public. The unemployment rate is anticipated to remain at the multi-decade low of 4.2% in March. Wage growth figures will be closely watched, as maybe they have the greatest capacity to stoke expectations for a rate hike by the Bank of England sooner rather than later. In this respect, the three-month average of average weekly earnings is projected to grow by 2.6% y/y, easing from February’s 2.8%. Still, if expectations materialize, this would mark the second straight month of positive real wage growth. Excluding bonuses, average earnings are expected to edge higher, expanding by 2.9% y/y, versus February’s 2.8%. The BoE next meets in late June, with markets currently assigning a less than 15% chance for an increase in rates, according to UK overnight index swaps.

Updated Q1 GDP figures out of the eurozone at 0900 GMT are forecast to confirm growth at 0.4% on a quarterly basis and 2.5% on an annualized basis. There are fears of easing economic activity in the euro area and in this respect the ZEW surveys gauging business morale in Germany, the eurozone’s largest economy, will be of interest. Further weakness in the surveys will add to worries, whereas strong numbers might start changing the narrative, pointing to a transitory slowdown. The institute’s economic sentiment index is expected to remain in negative territory in May – it turned negative for the first time since July 2016 in April – while the current conditions index is anticipated to decline for the fourth straight month.

Eurozone industrial production figures for March will also be released at 0900 GMT; an acceleration in activity is expected.

Kiwi traders will be paying attention to the bi-weekly milk auction due later in the day – it carries a tentative release time of 1200 GMT; New Zealand is a major diary exporter.

Out of the US, the main data point of the day are retail sales for the month of April (1230 GMT), which are expected to moderate on a monthly basis, expanding by 0.3%, half the pace recorded in March. Core retail sales that exclude automobiles will also be monitored. A disappointment in the data could further put off the table a fourth rate hike in total during 2018 by the Federal Reserve – following last week’s weaker CPI numbers – leading to a weakening US currency. The New York Fed manufacturing survey for May as well as data on April’s retail control are scheduled for release at the same time.

Also out of the US, are business inventories data for March, as well as the National Association of Home Builders housing market index. Both are due at 1400 GMT.

In relation to bilateral trade talks between the US and China, Liu He, the latter’s Vice Premier who also serves as President Xi’s top economic adviser, will be in Washington today.

As the markets attempt to gauge the situation following the Trump administration’s decision to walk away from the Iran nuclear deal, a meeting between EU foreign policy chief Federica Mogherini and the foreign ministers of Britain, France and Germany might be of interest.

API data on crude oil stocks are due at 2030 GMT.

Policymakers sharing remarks include Riksbank First Deputy Governor Kerstin af Jochnick (0725 GMT) who will be talking on the Swedish central bank’s monetary policy, Dallas Fed President Robert Kaplan (non-voting FOMC member in 2018 – 1200 GMT) who will be talking on “Energy, Trade, and Economic Growth”, and San Francisco Fed President John Williams who will be speaking at 1710 GMT – Williams will take over the role of New York Fed chief in June (the New York Fed President holds permanent voting rights within the FOMC). Moreover, the Senate Banking Committee will be holding a hearing on the nominations of Richard Clarida as member and vice chairman of the Federal Reserve Board of Governors, and Michelle Bowman as member of the Federal Reserve Board of Governors at 1400 GMT.

Lastly, regional tensions after the Trump administration’s decision to move the US embassy to Jerusalem are not to be ignored. Protests took place following the move yesterday, with Israeli forces killing dozens of Palestinians.

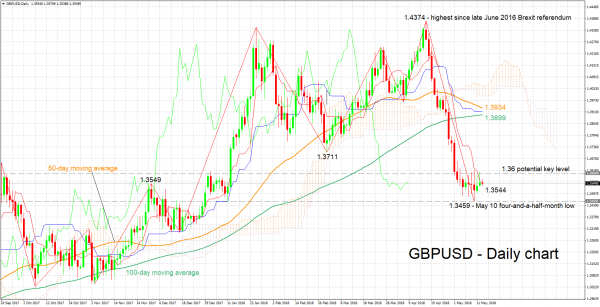

Technical Analysis: GBPUSD short-term bearish; possibly oversold

GBPUSD has recorded considerable losses since around mid-April and after rising to its highest since June 2016’s Brexit referendum (1.4374). On Thursday, it touched a four-and-a-half-month low of 1.3459. The negatively aligned Tenkan- and Kijun-sen lines are attesting to the negative bias. However, the Kijun-sen has halted its decline and the Chikou Span may be pointing to an oversold market; a reversal in the near-term should not be ruled out.

Stronger-than-expected UK data later in the day are likely to boost the pair, with resistance potentially coming around the 1.36 round figure and further above from the region around 1.3710 (this being a previous bottom, with the area around it encapsulating the 1.37 handle).

On the downside, and in case of weaker-than-anticipated figures, support could come around last week’s low of 1.3459, given that the range around the Tenkan-sen at 1.3544 which seems to be providing immediate support, is conclusively violated first.

US releases also have the capacity to move the pair.