Capital markets are back to full capacity after yesterday’s May Day celebrations in parts of Europe.

Euro stocks are drifting lower despite the broad advances in Asia overnight, while crude prices come under some pressure ahead of President Trump’s decision on the Iran nuclear deal at 02:00 pm EDT.

The ‘mighty’ dollar again has found some traction as Treasury prices steadied despite the amount of U.S debt supply hitting capital markets this week (approx. +$73B, 3-, 10- and 30- year bonds).

Expect oil trading to dominate proceedings today amid speculation the U.S. may pull out of a nuclear accord with Iran, escalating tensions in the Middle East and potentially disrupting supplies from OPEC’s third-largest producer.

On Tap this week: Nafta talks resumed yesterday – it remains a critical period for the tri-nations, and its no surprise that the U.S is still pushing a hardline. On Thursday, the BoE takes center stage with its rate announcement, while U.S inflation data for April is due the same day.

1. Stocks mixed results

In Japan, the Nikkei share average rallied on Tuesday as banking stocks found support while Takeda Pharmaceutical climbed ahead of news the drug maker had agreed to buy London-listed Shire. The Nikkei ended +0.2%higher, while the broader Topix gained +0.4%.

Down-under, Aussie shares ended mostly flat overnight, coming off a three-month high as investors attempted to reduce their exposure before today’s federal budget. The S&P/ASX 200 index rose +0.12%. In S. Korea, tech shares also lifted the Kospi index, which rose +0.4%.

In Hong Kong, stocks end higher as Sino-U.S trade war fears ease. The Hang Seng index ended +1.4% higher, while the China Enterprises Index closed up +1.5%.

In China, stocks posted robust gains overnight, amid hopes that resumption of Sino-U.S talks next week in Washington could help avert a trade war. The blue-chip CSI300 index rose +1.2%, while the Shanghai Composite Index gained +0.8%.

In Europe, the Stoxx Europe 600 Index declined after two days of gains, dragged lower by oil and gas companies and miners. In Italy, stocks have been the worst performers in the region as the country-looks set for new elections, while in the U.K; the FTSE 100 index has found some support as it reopened following a long weekend.

Indices: Stoxx600 -0.4% at 388.5, FTSE +0.1% at 7577, DAX -0.7% at 12864, CAC-40 -0.5% at 5506, IBEX-35 -0.2% at 10124, FTSE MIB -2.1% at 24027, SMI -0.4% at 8944, S&P 500 Futures -0.3%

2. Oil prices fall as market awaits Trump decision on Iran, gold lower

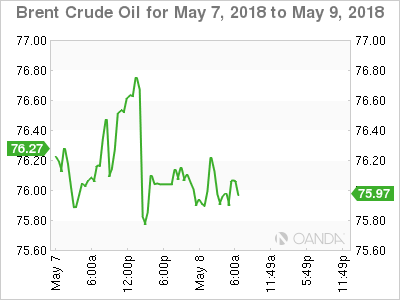

Oil prices have retreated from their four-year highs overnight as the market waits on an announcement by President Trump on whether the U.S will reimpose sanctions on Iran.

If Trump pulls the U.S out of the multi-nation agreement, Iranian crude exports will be hit, adding to tightness in the oil market.

Brent crude futures are down -67c, or -0.9%, at +$75.50, having jumped +1.7% to settle at +$76.17 in yesterday’s session. U.S West Texas Intermediate (WTI) crude futures have dropped -78c, or -1.1%, to +$69.95 a barrel. They settled above +$70 for the first time since November 2014 on Monday.

Investors will take their cues from today’s announcement at 02:00 pm EDT – dealers believe that if President Trump goes back to the 2012 sanctions, the estimated loss of -0.4m barrels a day of Iranian supply based would be ‘bullish’ for the commodity market.

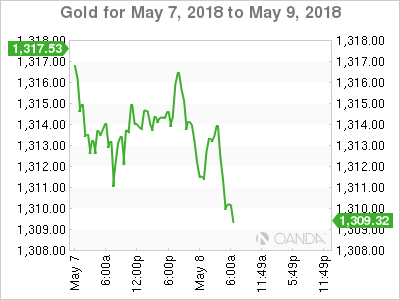

Ahead of the U.S open, gold prices remain subdued as the ‘big’ dollar hovers around its four-month peak. Spot gold is down about -0.1% at +$1,313.20 per ounce, after closing marginally lower in the previous session. U.S gold futures for June delivery are unchanged at +$1,314.10 per ounce.

3. Chances of BoE rate hike this week fade sharply

A lack of a Bank of England (BoE) interest-rate rise on Thursday – previously widely expected – the resumption of Brexit negotiations, and a slowing U.K economy is expected again to put the pound (£1.3510) under renewed pressure. Many do not foresee a rate rise this year, while the last phase of Brexit negotiations are likely to raise new concerns.

Even PM Theresa May’s government has been able to cast some doubt over the timing, as too have U.K rate ‘hawks,’ who suggest that the recent set of soft U.K data also appears to speak against a rate raise anytime soon.

The yield on U.S 10-year Treasuries has decreased less than -1 bps to +2.95%. In Germany, the 10-year Bund yield advanced less than +1 bps +0.53%, while in the U.K, the 10-year Gilt yield has dipped -1 bps to +1.391%.

Also of note, it’s a busy week with U.S supply. There is a combined +$73B of 3-, 10-, and 30-year securities to be taken down by Friday.

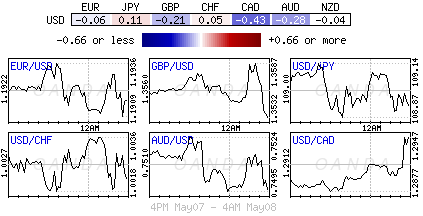

4. Dollar trades atop of its four-year highs

The DXY dollar index is expected to trade between 92 and 93 for the time being, while USD/JPY (¥108.94) is expected to come under some renewed pressure ahead of today’s Iranian nuclear deal announcement. If President Trump does happen to pull the U.S out of the pact or say he wants a renegotiation, there will be a flight to quality by some investors.

The pound (£1.3510) is under renewed pressure ahead of the U.S open after U.K Secretary of State for Foreign Affairs Boris Johnson criticized a proposal for a post-Brexit customs arrangement, favoured by PM Theresa May. GBP/USD is last down -0.4% at £1.3502, partly also due to broad-based dollar strength.

Note: Techies believe that a drop below £1.3487 would mark its lowest since Jan.

EUR/USD (€1.1889) has not been able to sustain initial gains above the psychological €1.19 handle despite Germany having presented some decent economic data. Italian political concerns seemed to be weighing on market sentiment. President Mattarella has called for a neutral government to be in place until the year-end to put together a 2019 budget plan before any new election.

The loonie (C$1.2975) is under pressure outright, as investors remain unsure that higher oil prices will lead to additional investment in infrastructure in energy production. Higher crude oil prices have yet to convince investors that demand for crude will persist at levels that will make additional spending on more production economically sensible.

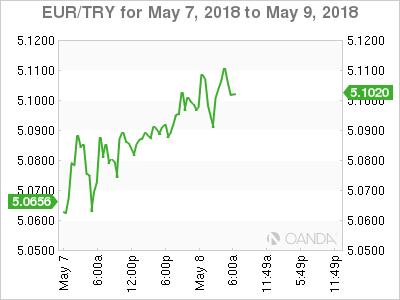

In emerging markets (EM), the Turkish lira ($4.2939) has slumped to a fresh record low outright. Yesterday’s tweak of the reserve option mechanism (ROM) by the central bank (CBRT), lowering the upper limit for the forex maintenance facility to +45% from +55%, in a bid to tighten lira liquidity, has done little to help the currency.

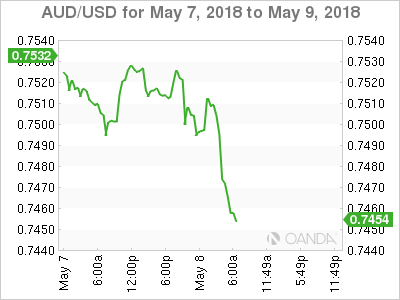

5. Australian retail sales stall in March

Data overnight from Australia showed that the retail sales report for March came in below expectations.

According to the Australian Bureau of Statistics (ABS), sales were flat in seasonally adjusted terms, coming in below the +0.2% gain forecasted by the street. February’s increase was left unchanged at +0.6%.

Despite the soft March report, annual growth in sales actually accelerated, lifting to +3.2% from +3% m/m, the fastest increase since July last year.

Digging deeper, cafes, restaurants and takeaways, at +0.8%, led the falls, but other retailing (+0.6%), household goods retailing (+0.3%), department stores (+0.5%) and clothing, footwear and personal accessory retailing (+0.2%) also fell.

Note: The result was almost the opposite to that seen one month earlier, hinting that record Chinese tourist arrivals in February may have helped to temporarily boost spending levels during that period.