Here are the latest developments in global markets:

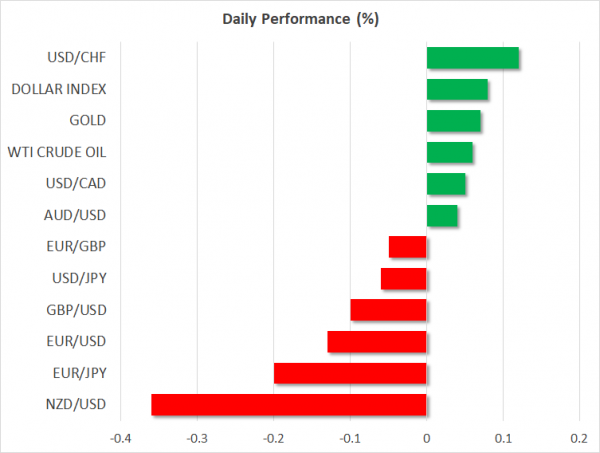

FOREX: The US dollar index is higher on Friday, but by less than 0.1%, recouping some of the losses it posted yesterday. Today, all eyes will be on the US employment data for April, and particularly on the wages component of that report. Sterling/dollar is down by 0.1%, with the British pound remaining under pressure as markets continue to price out expectations for a BoE rate hike next week.

STOCKS: Wall Street closed mixed yesterday. Following some substantial losses posted early in the session, the major indices staged a decent recovery and managed to finish the session only a little lower, or even marginally higher. The rebound was likely aided by some optimistic comments from Treasury Secretary Steven Mnuchin, who noted the US and China had “very good conversations” on trade issues. The S&P 500 and the Nasdaq Composite declined by 0.23% and 0.18% respectively, while the Dow Jones rose, but only by 0.02%. Futures tracking the Dow, S&P, and Nasdaq 100 are all currently pointing to a slightly lower open today. In Asia, Japanese markets remained closed for a second straight day, while in Hong Kong, the Hang Seng fell by 0.9%. In Europe, futures tracking the major indices were a sea of green, signaling a higher open today.

COMMODITIES: Oil prices are practically flat on Friday, with both WTI and Brent crude being lower, but by less than 0.05%. That said, both benchmarks posted solid gains yesterday, buoyed by a tumble lower in the dollar, as well as continued speculation that the US will impose fresh sanctions on Iran. The self-imposed US deadline for making a decision on Iran is May 12. In precious metals, gold is higher though by less than 0.1%, last seen near the $1311/ounce hurdle. The dollar-denominated yellow metal also jumped yesterday, helped by a correction lower in the greenback.

Major movers: Dollar dips ahead of NFP, sterling remains under selling interest

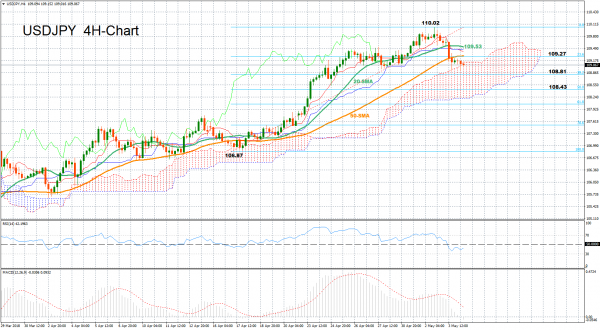

The US dollar corrected lower yesterday, easing off its four-month highs, perhaps as traders took some profits on their prior long-dollar bets and decreased their exposure ahead of today’s main risk event, the US employment report. Assuming that there are no major surprises in the NFP print and the unemployment rate, attention will fall primarily on wages. Policymakers and investors alike will be looking at whether the tight US labor market has finally started to produce higher wages, which would signal higher inflation down the road and consequently, a more hawkish Fed. The dollar is likely to move in tandem with any surprise in earnings; higher in case of a beat, and lower should they disappoint.

The British pound remained under pressure yesterday, after the all-important services PMI for April rose by less than expected. Coming on top of a disappointing manufacturing PMI, it confirms that the soft patch the economy experienced in Q1 has likely rolled over into Q2. The implied probability for a BoE rate hike next week has declined to a mere 8%, as markets continue to bet policymakers will postpone any tightening until later in the year, once they’ve had the opportunity to monitor whether this slowdown reflects transitory, or persistent factors.

The euro, meanwhile, barely responded to a worse-than-expected slowdown in Eurozone’s core inflation for April. Market chatter suggests the weakness may be owed mainly to seasonal phenomena, such as the timing of Easter this year, and that the ECB is likely to pay less attention to it as a result.

On the trade front, US Treasury Secretary Steven Mnuchin said on Thursday that the US and China are having “very good conversations”. US equity indices had been on the back foot, but Mnuchin’s optimism helped them to pare some earlier losses. Importantly, the S&P 500 managed to close above its 200-day moving average (MA) once again, after it crossed below it early in the session. What is worrisome, though, is that each successive bounce from the 200-day MA is becoming smaller and smaller in recent weeks, which signals weakening bullish momentum. For that to change, markets may need a fresh positive catalyst, such as the US-China negotiations bearing fruit.

Day ahead: US nonfarm payrolls take the stage; Eurozone services & composite PMIs in focus

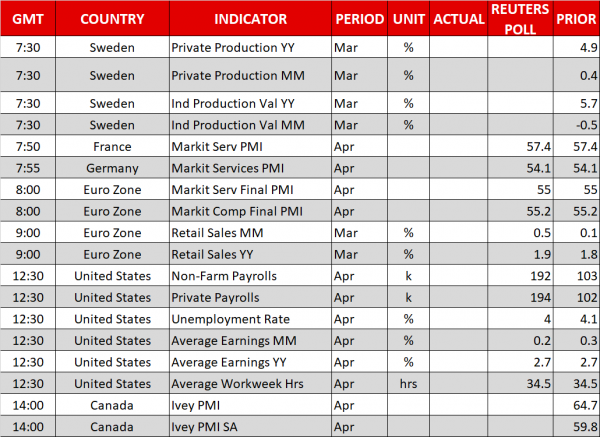

On Friday, all eyes will turn to April’s nonfarm payrolls report out of the US at 1230 GMT and once again the focus will be placed on the wage component, although Wednesday’s FOMC rate statement signaled that the Fed was willing to allow inflation to rise above the 2.0% target without any policy response. Still, investors will be eager to see whether the US labor market has tightened enough to push for larger pay rises and therefore for higher inflationary pressures.

According to analysts, the US economy is expected to have created 192k new job positions in private and public nonfarm sectors in April, surpassing the increase of 103k in March which was the lowest since October. The unemployment rate is anticipated to ease from 4.1% to a fresh 17-year low of 4.0%, distancing further below the full-employment level of 4.5-5.0%. But growth in average hourly earnings is projected to inch down by 0.1 percentage points to 0.2% on a monthly basis, leaving the annual gauge unchanged at 2.7%. In the event of an upward surprise, especially on the wage front, the dollar could rally back to the 110 handle versus the yen as this could increase the odds for the Fed to deliver three more rates hikes this year. However, if the numbers fall short of expectations, the greenback would more likely follow a downward path.

Earlier in the Eurozone, retail sales for March (0900 GMT), as well as the final Markit Services and Composite PMIs for April (0800 GMT), will have the potential to move the euro. Forecasts are for retail sales to have risen by 1.9% on a yearly basis, slightly faster than in February when the measure increased by 1.8%. The Markit Services PMI is said to remain unchanged at 55. Note that on Wednesday the Manufacturing equivalent beat projections, therefore, unless the Services PMI turns lower, the composite PMI should climb as well.

Canada will also see its Ivey PMI readings at 1400 GMT.

In oil markets, Baker Hughes will deliver its weekly US oil rig count report at 1700 GMT and it would be interesting to see whether the report will post another gain, marking five consecutive weeks of increases.

As for today’s public appearances, New York Fed President William Dudley will be participating in a conversation hosted by Bloomberg at 1445 GMT, while at 1730 GMT, San Francisco President John Williams will be making comments on CNBC before his speech at the Hoover Institution/Stanford University where he will discuss currencies, capital and central bank balances at 1900 GMT.