At 07:55 GMT, German Markit Services PMI (Apr) is expected to be unchanged at 54.1. After reaching a multi-year high of 57.3 in February, this data has come back into its range under 56.0. German Markit PMI Composite (Apr) is also expected to be unchanged at 55.3. Traders will be watching for the numbers to deviate from expectations and create volatility in EUR pairs.

At 08:00 GMT, Eurozone Markit Services PMI (Apr) is expected to be unchanged at 55. This figure had fallen last month, after hitting a high of 58.0 in February. Markit PMI Composite (Mar) is also expected to be unchanged at 55.2. EUR crosses may be impacted by this data release.

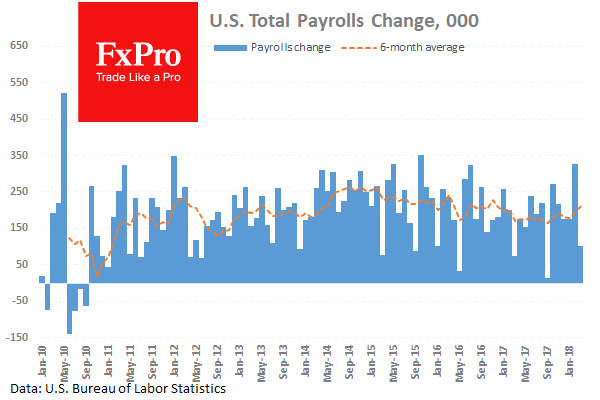

At 12:30 GMT, US Non-Farm Payrolls (Apr) is expected at 192K v a prior 103K. This measures the change in the number of employed people in April. The Unemployment Rate (Apr) is expected at 4.0% with a prior of 4.1%. This measures the percentage of the total workforce unemployed and actively seeking employment during April. Average Hourly Earnings (YoY) (Apr) is expected to be unchanged at 2.7%. Average Hourly Earnings (MoM) (Apr) is expected to be 0.2% against 0.3% previously. Average Weekly Hours (Apr) is expected to be unchanged at 34.5. Labour Force Participation Rate (Apr) is expected to be unchanged at 62.9%. This data may have a large impact on the financial markets, as the tight labour market has yet to lead to an increase in earnings. This would lead to an increase in inflation, which markets have reacted negatively to recently. USD crosses may experience volatility around these data releases.

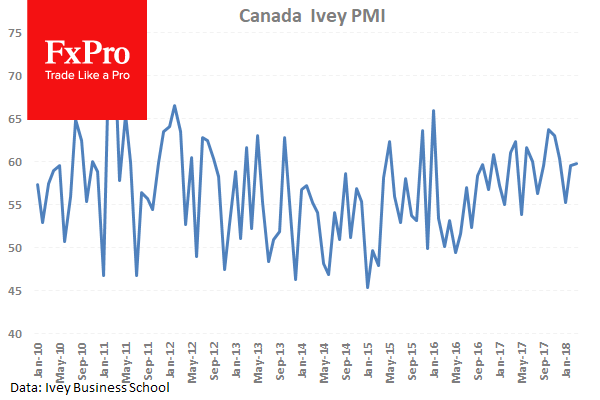

At 14:00 GMT, Canadian Ivey Purchasing Managers Index s.a. (Apr) is expected to be 60.2 against a previous 59.8. Ivey Purchasing Managers Index (Apr) was 64.7 previously. This data is showing robust growth, continuing one of the longest positive runs, having remained above 50.0 for over 20 months. CAD crosses may be moved by this data release.

At 16:00 GMT, US FOMC Member Dudley is due to discuss financial turmoil and the challenges ahead in an interview conducted by Matthew Winkler with Bloomberg News. This event may result in moves in USD crosses.

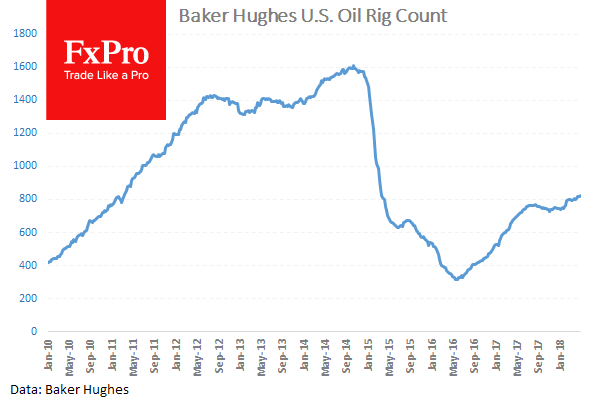

At 17:00 GMT, Baker Hughes US Oil Rig Counts is due to be released with a headline number from last week of 825. WTI Oil may become volatile around this data release and will be in traders’ minds when trading resumes on Monday.

At 19:00 GMT, US FOMC Member Williams is due to deliver brief remarks at the Hoover Institute’s Monetary Policy Conference, hosted by Stanford University. This event could result in moves in USD crosses.