Market odds of an interest rate rise by the Bank of England in May have fallen dramatically over the past month from over 90% to less than 20% after a run of weak UK data. BoE chief, Mark Carney, also cast doubt about the prospect of a May move in recent remarks. However, after strongly signalling a rate increase earlier in the year, the Bank may have cornered itself into raising rates as it risks losing credibility if it doesn’t hike at its next meeting on May 10. The April services PMI on Thursday could provide the BoE’s hawks with enough reason to push for a rate hike.

The British economy grew by just 0.1% quarter-on-quarter in the three months to March, slower than the consensus forecasts of 0.3%. In addition, the inflation overshoot caused by the pound’s depreciation after the Brexit referendum is subsiding much more quickly than anticipated, with headline CPI falling to 2.5% in March. The labour market remains a bright spot but it’s too early to bet on wage growth being on a sustained path upwards.

While the Bank of England expected some softness in the economy at the start of the year, policymakers may now be worried that growth is too weak to withstand a tightening in monetary policy so soon after the November hike. The slowdown is not limited to the UK, however, as across the continent, the Eurozone economy also lost some steam in the first quarter. Faltering demand in Europe does not bode well for UK manufacturers, which export almost half of their goods to the European Union.

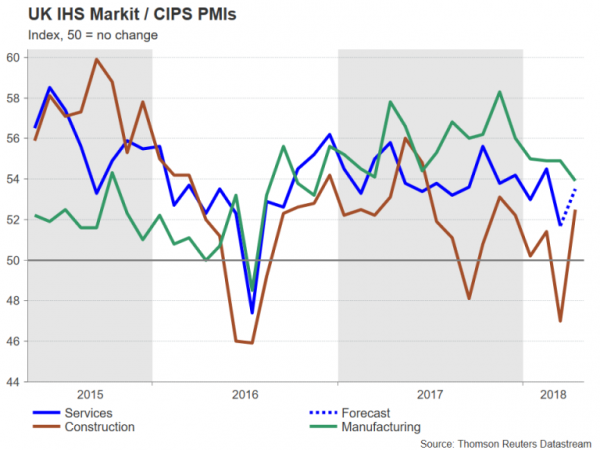

Manufacturing activity declined to a 17-month low in April according to the Purchasing Managers’ Index by IHS Markit/CIPS. In contrast, construction output picked up more than expected in April, but the more important services PMI, due on Thursday, could be the determining factor for the BoE.

The services PMI deteriorated sharply in March, falling to its lowest since July 2016 in the immediate aftermath of the Brexit referendum. During the first quarter, bad weather, as well as the squeeze on households’ incomes from falling real wages weighed on consumer spending, which is a key driver of the services sector as well as the wider economy. But with the income squeeze now starting to ease as inflation moves lower, and as the effects of the cold weather recede, consumer confidence could rebound strongly in April.

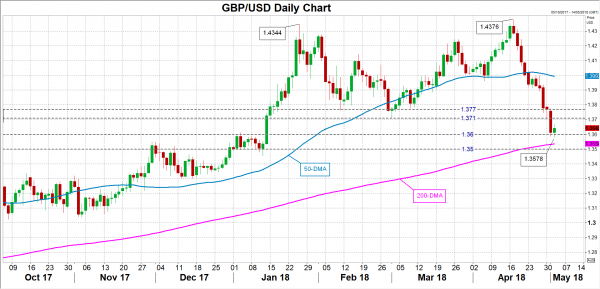

The PMI gauge for services is forecast to increase to 53.5 in April from 51.7 in March. A bigger-than-expected increase could propel the pound higher, which is rebounding from a near 4-month low of $1.3578 ploughed earlier today. An upside surprise in the data could bring the $1.37 handle back into view, with the March low of $1.3710 potentially acting as resistance. A stronger rally could meet resistance around the recently congested area of $1.3770.

Another negative reading though on Thursday could cut today’s recovery short, driving sterling back below the $1.36 level. This week’s low of $1.3578 would likely act as immediate support in such a scenario, while deeper losses would raise the prospect of the pound losing its grip on the $1.35 level for the first time since January.