Economic growth in the UK might have slowed down in the first quarter of 2018 as the heavy snowfall in February and in March kept consumers indoors, weighing on household spending. While this could be proven temporary later in the second quarter, another data miss this month could further cast doubt on whether a rate hike by the BoE next month is possible.

On Friday at 0830 GMT, the Office for National Statistics is expected to show that the British economy has grown by 0.3% q/q in the first three months of 2018, slightly slower than the 0.4% expansion delivered in the final quarter of 2017 due to the unusually cold weather which led retail sales sharply down by 1.2% m/m in March. Year-on-year, however, GDP growth is anticipated to remain unchanged at 1.4%, at the lowest rate seen since Q3 2013.

Earlier this month, the employment report for the month of February brought some good news to policymakers as average earnings increased more than prices did on a yearly basis, while the unemployment rate declined further, hinting that consumption could pick up steam in the upcoming months, at a time when households struggle to repay their debts.

Moreover, inflation numbers in March eased towards the central bank’s target of 2.0%. While this could come as music to policymakers’ ears, the fact that the above data fell short of expectations, in conjunction with retail sales tumbling along with the Markit Services PMI, caused some stress to the BoE Governor Mark Carney. The BoE chief surprisingly played down market expectations of a rate hike in May, saying that “there are other meetings over the course of this year” for a rate rise to be delivered. Furthermore, he cited Brexit risks as a drag to growth prospects.

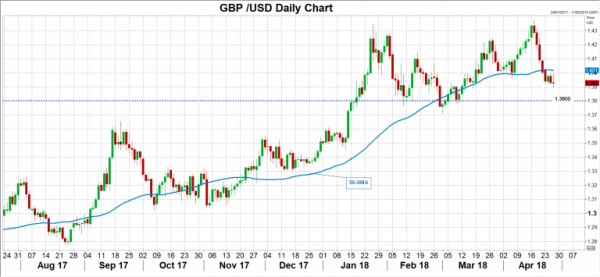

Carney’s comments put in question whether the BoE will finally raise borrowing costs by 25 basis points next month, pushing the odds for this to materialize down to 50% from around 80%. Should Friday’s GDP growth appear weaker than expected, chances for further monetary tightening could drop even lower, driving pound/dollar lower towards the 1.38 key-level. Conversely, an upside surprise could erase today’s losses, leading the pair up to the 50-day SMA, which currently stands at 1.4017.