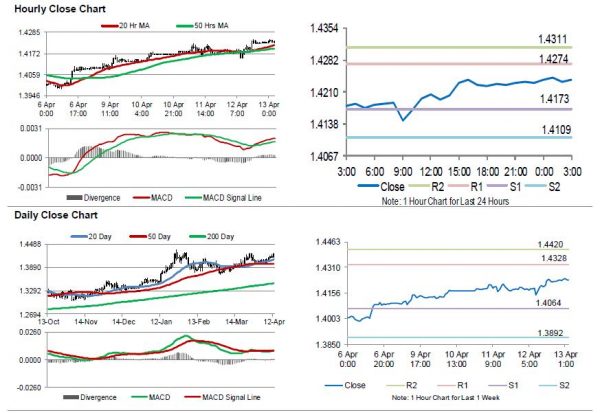

For the 24 hours to 23:00 GMT, the GBP rose 0.36% against the USD and closed at 1.4231.

As per the Bank of England’s (BoE) Credit Conditions survey, the availability of unsecured credit to households dropped “significantly” in the first quarter of the year. Further, it indicated that the availability of unsecured credit expected to remain unchanged in three months to June.

In the Asian session, at GMT0300, the pair is trading at 1.4237, with the GBP trading slightly higher against the USD from yesterday’s close.

The pair is expected to find support at 1.4173, and a fall through could take it to the next support level of 1.4109. The pair is expected to find its first resistance at 1.4274, and a rise through could take it to the next resistance level of 1.4311.

With no macroeconomic releases in UK today, investor sentiment would be determined by global macroeconomic events.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.