The US dollar depreciated against commodity currencies (AUD, CAD, NZD), the EUR and the GBP as China focused on opening its market to more foreign investment easing trade concerns. The euro was further helped by hawkish comments from ECB member Nowotny. The highlights of the Wednesday session on the economic calendar will be the release of US inflation data at 8:30 am EDT and the meeting notes from March’s Federal Open Market Committee (FOMC) where Chair Powell lifted rates by 25 basis points to be released at 2:00 pm EDT.

- Fed to release minutes of March FOMC

- US inflation data expected flat on Wednesday

- Oil rising as Middle East tensions escalate

Nowotny’s Comments Lift Euro

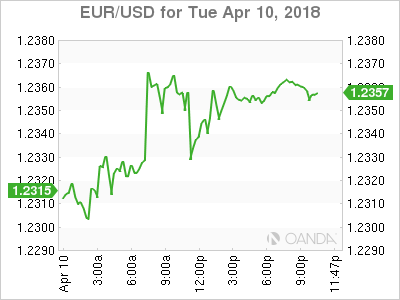

The EUR/USD gained 0.29 percent on Tuesday. The single currency is trading at 1.2356 after comments from European Central Bank (ECB) Governing council member Ewald Nowotny about the end of the QE program. He also proposed rising the deposit rate higher to kickstart the rate hike process. A speech by Chinese President Xi Jinping at an annual economic summit eased trade concerns as Mr Xi focused on providing higher market access. The USD lost some of the support as investors sold the currency with equities one of the main beneficiaries

The greenback did receive good news on Tuesday as the Producer Price Index (PPI) came in higher than expected at 0.3 percent. The higher price of finished goods sold by producers is a leading indicator of consumer inflation. This sets the stage for tomorrow’s release of the monthly CPI data. Headline CPI is expected flat at 0.0 percent, but the more relevant core CPI could rise 0.2 percent. The path of the Fed’s tighter monetary policy could be affected if inflationary pressures continue to be absent.

Loonie Rises as NAFTA Hopes Lifted by Mexican Comments

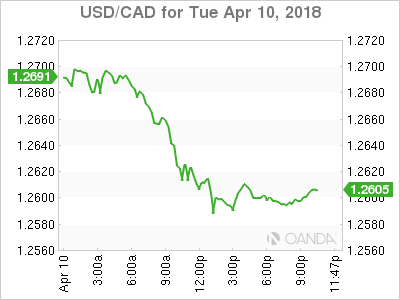

The USD/CAD lost 0.69 percent in the last 24 hours. The currency pair is trading at 1.2608 as commodity prices and a softer tone on global trade from China put the loonie at a six week high. President Trump cancelled his plans to participate in the Summit of the Americas which could potentially be a setback for an announcement of the progress of the NAFTA talks. The negotiations moved very little until last week when the US softened its approach paving the way for the Mexican to say there is an 80 percent chance of the deal being reached in early May.

Although the NAFTA announcement was unlikely this week, supportive comments were expected from President Trump. The Canadian currency still gained as risk appetite returned to markets as the anxiety surrounding an escalating trade war between the US and China subsided after Mr Xi’s speech.

Housing starts in Canada surprise to the upside with 225,000 new residential buildings versus the expected 219,000. The second housing indicator released today was not as positive as building permits took a 2.6 percent loss in February. The gain of 5.2 percent in January partly explains the fall the following month. The biggest declines came in or near Toronto.

The week in Canadian indicators will close with the release of the New House Price Index on Thursday. The biggest mover this week was the Bank of Canada (BoC) Business Outlook Survey that showed a resilient optimistic reading despite trade and economic slowdown concerns.

Oil Rises on Middle East Tension and Soft USD

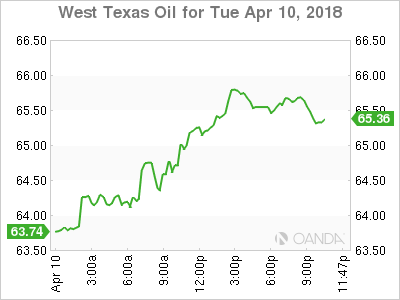

Energy prices headed higher on Tuesday. West Texas Intermediate is trading at 65.57 as geopolitical factors and the US lower forecast on production. The weakness of the USD has also pushed crude prices higher as Middle East tensions took a higher priority after US President Donald Trump cancelled his participation in the Summit of the Americas to work on a response to Syrian chemical weapons attack.

Supply disruptions have been of the biggest factors driving crude prices. The Organization of the Petroleum Exporting Countries (OPEC) and other major producers agreement to limit output has combined with geopolitical events that has set back global supply. US production that was supposed to take advantage of the higher prices has not materialized and if anything today’s US Energy Information Administration (EIA) release of a lower forecast for 2018 has been a boost for crude.

Market Events to Watch this Week

Wednesday, April 11

4:30am GBP Manufacturing Production m/m

8:30am USD CPI m/m

8:30am USD Core CPI m/m

10:30am USD Crude Oil Inventories

2:00pm USD FOMC Meeting Minutes

8:30pm JPY BOJ Gov Kuroda Speaks

Thursday, April 12

3:00pm GBP BOE Gov Carney Speaks