For the 24 hours to 23:00 GMT, the EUR declined 0.35% against the USD and closed at 1.2242, after the services sector activity across the Euro-bloc slowed more than initially estimated in March.

In the Euro-zone, data showed that the seasonally adjusted retail sales rebounded less-than-anticipated by 0.1% on a monthly basis in February, compared to market expectations for an advance of 0.5%. In the previous month, retail sales had dropped by a revised 0.3%. On the contrary, the region’s final Markit services PMI fell more than initially estimated to a level of 54.9 in March, compared to a level of 56.2 in the previous month, while the preliminary figures had recorded a drop to a level of 55.0.

Separately, Germany’s final Markit services PMI was revised lower to a level of 53.9 in March, down from the earlier flash estimate of 54.2. In the prior month, the PMI had recorded a reading of 55.3. Meanwhile, the nation’s seasonally adjusted factory orders rebounded less-than-anticipated by 0.3% on a monthly basis in February, after registering a revised fall of 3.5% in the prior month, while markets were expecting for a gain of 1.5%.

Macroeconomic data showed that first time claims for the US unemployment benefits climbed more-than-expected to a level of 242.0K in the week ended 31 March, jumping to a nearly 3-month high level. Initial jobless claims had registered a revised reading of 218.0K in the prior week, while investors had envisaged for an increase of 225.0K. Additionally, the nation’s trade deficit widened to a more than 9-year high level of $57.6 billion in February, from a revised deficit of $56.7 billion in the previous month and exceeding market consensus for the nation to register a trade deficit of $56.8 billion.

In the Asian session, at GMT0300, the pair is trading at 1.2255, with the EUR trading 0.11% higher against the USD from yesterday’s close.

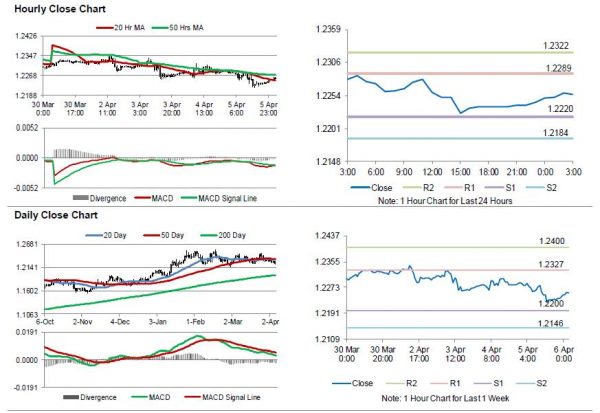

The pair is expected to find support at 1.2220, and a fall through could take it to the next support level of 1.2184. The pair is expected to find its first resistance at 1.2289, and a rise through could take it to the next resistance level of 1.2322.

Ahead in the day, traders would look forward to Germany’s industrial production data for February and Markit construction PMI for March, both due to release in a few hours. Later in the day, investors would focus on the crucial US non-farm payrolls and average hourly earnings data for March, to gauge strength in the nation’s labour market.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.