For the 24 hours to 23:00 GMT, the EUR rose 0.11% against the USD and closed at 1.2285, following impressive set of inflation and employment figures from the Euro-bloc.

Data showed that the Euro-zone’s preliminary consumer price index (CPI) rose 1.4% on a yearly basis in March, at par with market expectations and accelerating for the first time in 4 months, thus suggesting that nascent economic recovery across the common currency region is finally pushing inflation towards the central bank’s 2.0% target. In the prior month, the CPI had climbed 1.1%. Moreover, the region’s unemployment rate declined to a 9-year low level of 8.5% in February, meeting market expectations. In the previous month, the unemployment rate had recorded a reading of 8.6%.

The greenback declined against its major counterparts, after China, in a retaliatory move, announced that it would impose additional tariffs on $50.0 billion worth of US imports.

On the macro front, ADP private sector employment in the US climbed more-than-anticipated by 241.0K in March, after recording a revised gain of 246.0K in the previous month, thus boosting optimism over the health of the nation’s labour market. Markets were expecting ADP private sector employment to increase by 210.0K.

On the other hand, the nation’s ISM non-manufacturing PMI eased to a level of 58.8 in March, more than market consensus for a drop to a level of 59.0. In the previous month, the PMI had recorded a reading of 59.5. Further, the nation’s final Markit services PMI fell more than initially estimated to a level of 54.0 in March, compared to the preliminary print indicating a drop to a level of 54.1. In the previous month, the PMI had recorded a reading of 55.9.

In other economic news, factory orders in the US rebounded 1.2% on a monthly basis in February, undershooting market expectations for a rise of 1.7% and following a revised drop of 1.3% in the prior month. Additionally, the nation’s final durable goods orders grew 3.0% on a monthly basis in February, revised slightly lower from a flash estimate indicating a gain of 3.1%. In the previous month, durable goods orders had recorded a revised drop of 3.5%. Meanwhile, the nation’s MBA mortgage applications in the US slid 3.3% in the week ended 30 March, after recording a rise of 4.8% in the previous week.

In the Asian session, at GMT0300, the pair is trading at 1.2279, with the EUR trading 0.1% lower against the USD from yesterday’s close.

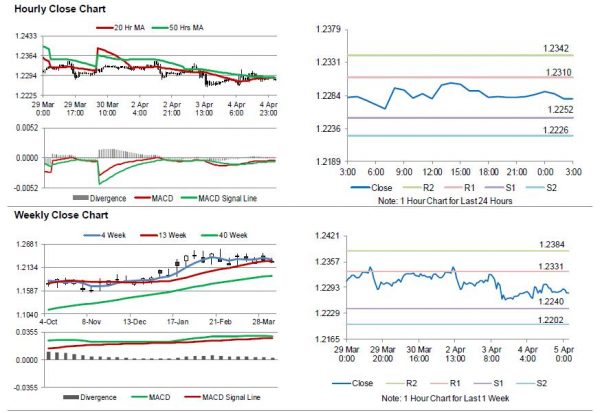

The pair is expected to find support at 1.2252, and a fall through could take it to the next support level of 1.2226. The pair is expected to find its first resistance at 1.2310, and a rise through could take it to the next resistance level of 1.2342.

Moving ahead, investors would focus on the final Markit services PMIs for March, scheduled to release across the Euro-zone in a few hours. Additionally, the Euro-zone’s retail sales and Germany’s factory orders, both for February, will be eyed by investors. Later in the day, the US initial jobless claims as well as trade balance data for February, will be closely monitored by market participants.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.