U.S. Highlights

- Investor optimism recovered following the softening of China’s stance to the recent U.S. tariffs while the renegotiated KORUS trade deal with South Korea also bodes well for stateside producers.

- February’s consumer spending report indicated progress on the inflation front. However, weak consumer spending will weigh on GDP growth in the first quarter which is expected to advance by less than 2%.

- Consumer strength should reassert itself as the year progresses alongside a tightening labor market and tax cuts, enabling the Fed to raise rates two more times this year.

Canadian Highlights

- There were encouraging signs on the NAFTA renegotiations front this week. An innovative approach to motor vehicle content requirements and optimistic statements from U.S. negotiators both bode well for a speedy resolution.

- A number of provincial budgets were released this week, with Ontario and Quebec’s plans standing in stark contrast to one another.

- Monthly GDP contracted slightly in January on weakness in oil and gas and real estate. Some of the weakness can be put down to ‘one offs’, but clearly the robust growth of 2017 is now in the rear view mirror.

U.S. – Soft Spending Suggests Another Weak Q1

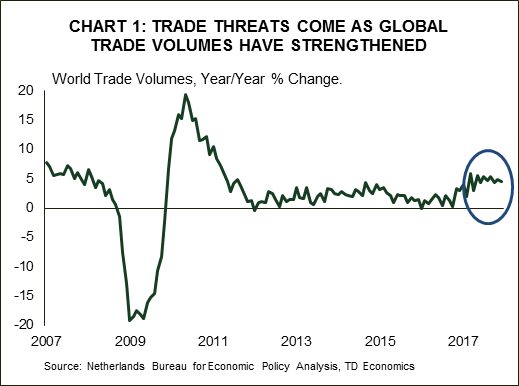

It was a relatively quiet week for economic data with investors turning their attention to political developments. Investor optimism recovered following the softening of China’s stance to the recent U.S. tariffs. The Middle Kingdom appeared to be backing down from retaliatory tariffs previously threatening U.S. cars, wine, and food products, instead appearing increasingly open to improving U.S. access to Chinese markets. This should benefit several regional economies that rely on exports to China. As we noted in our recent State Economic Forecast, over one third of South Carolina’s auto exports are destined for China, and their share is rising. Furthermore, the renegotiated KORUS trade deal with South Korea doubles the number of vehicles allowed to be exported from American carmakers and contains a commitment from South Korea to reduce steel exports to the U.S. by 30%, adding to the positive prospects for domestic producers. The constructive trade developments led the greenback higher over the week, but gains in major equity indices were restrained by tech sector induced volatility.

Global equity markets fared better as trade tensions thawed. However, trade uncertainty still lingers in Europe, with only four weeks until a temporary exemption from U.S. imposed steel and aluminum tariffs expires. The EU is contemplating lowering tariffs on a range of U.S. goods including cars, machinery, pharmaceuticals, and food in hopes of averting a trade war. However, the “carrot” approach is not favored by all members of the EU, including France. That could result in higher volatility in global equity markets in the weeks ahead.

Long-term yields fell this week in the U.S., while yields on two-year Treasury notes rose. Short-term yields are poised to rise further over the medium-term as the Federal Reserve continues along its tightening path amidst higher government spending. President Trump’s $1.3 trillion spending bill, signed last Friday, adds to the early-February commitment of $288 billion in domestic and military spending over the next two years which will amplify fiscal pressures. These will lead to higher Treasury issuance and should lift bond yields that will be further supported by rising inflation expectations and interest rates as the global economic recovery continues.

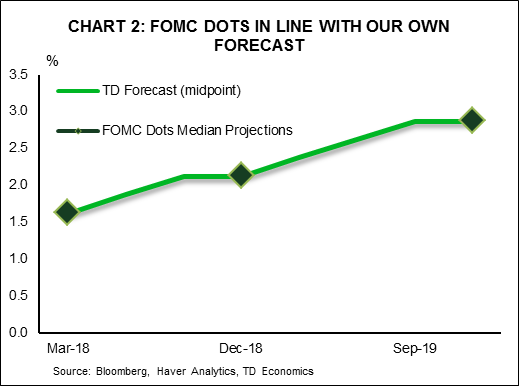

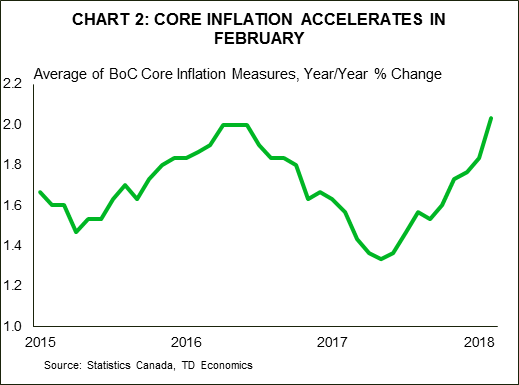

February’s consumer spending report indicated progress on the inflation front. Core PCE inflation ticked up slightly (Chart 1), with price gains over the recent three months averaging 2.3% in annualized terms. We expect this strength in inflation to continue, supported by diminishing slack in the U.S. economy, rising global economic activity, a relatively weak USD, and the fading of idiosyncratic factors. However, other details of the report were less encouraging. Consumer spending came in soft (Chart 2), adding to January’s disappointment, and weighing on GDP growth in the first quarter, which is still expected to advance by less than 2%. Still, we believe that consumer strength will reassert itself as the year progresses alongside a tightening labor market and tax cuts. Such a backdrop should enable the Fed to continue gradually raising interest rates this year, with another two hikes expected this year before 75 basis points of increases during 2019.

Canada – Weak Data Caps a Quiet Week

It was a relatively quiet week in Canada. At the national level, NAFTA renegotiations remained front and centre. Developments were generally positive. Reports have emerged of a creative solution to content rules for autos: the U.S. proposal is said to include workers’ wages in the calculation – that is, cars produced by higher paid workers would avoid tariffs. This clearly benefits Canadian and U.S. producers, while at the same time encouraging higher wages in Mexico (and hopefully creating more demand for imported goods there). How such a proposal would be received by Mexican negotiators is yet to be seen.

Also encouraging were indications that the U.S. hopes to wrap discussions up in coming months, however, the fact that the conclusion remains tied to exemptions from steel and aluminum tariffs is less positive. Given the distance between parties on contentious issues such as dispute resolution and supply management, achieving a quick conclusion is a lofty goal. That said, the recent positive tone from U.S. officials and refocusing of ire towards China both suggest that a timely resolution is not out of reach.

Sticking to politics, this week also saw two key provincial budgets released. Ontario and Quebec took different approaches: Quebec used its relative fiscal strength (fiscal surpluses have been delivered for several years in a row) to deliver ‘the best of both worlds’ – a balanced budget that provides for increased spending and tax reductions as well as paying down the provincial debt. In contrast, the Ontario government is no longer aiming for near-term balance, introducing a slew of spending measures that move the province back into the red (Chart 1). For further details, please see our analyses (Quebec; Ontario, Newfoundland and Labrador also released its latest budget this week).

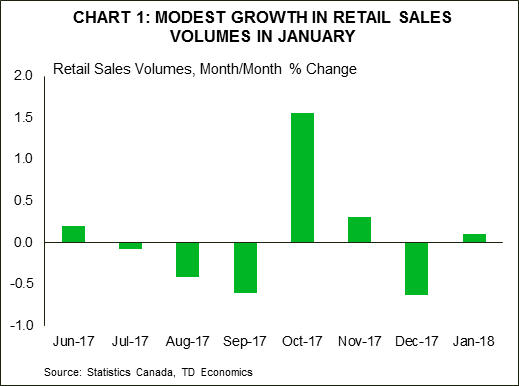

With little other economic data out this week, the star of the show was monthly GDP for January. In the event, Canada started the year on the back foot: output contracted 0.1% month-on-month. Weakness was fairly widespread, as 10 of 20 major sectors saw activity decline, but a few stood out. Mining, quarrying, and oil and gas extraction pulled back 2.7% on unplanned maintenance activities. Government changes to mortgage underwriting regulations led the real estate sector to a 0.5% contraction as activity at the offices of real estate agents and brokers saw the second largest decline on record. Despite this, the service side of the economy as a whole was able to eke out the slightest of gains (+0.007%), making the current expansion the second longest on record (Chart 2).

January’s number should be put into broader context. Monthly noise aside (a rebound in oil and gas seems likely given temporary factors held January back), Canada was set for a moderation of growth after an unsustainably strong start to 2017. This should not be a cause for concern. Growth around Canada’s longer-term trend of 1.5% to 1.9% per year is consistent with ongoing (modest) job gains, and wage and inflation pressures. It is also consistent with higher policy interest rates. The noise in the data, together with still elevated economic risks will likely stay the Bank of Canada’s hand in the near term, but absent a material negative shock, the direction of future interest rates remains clear: up.

U.S.: Upcoming Key Economic Releases

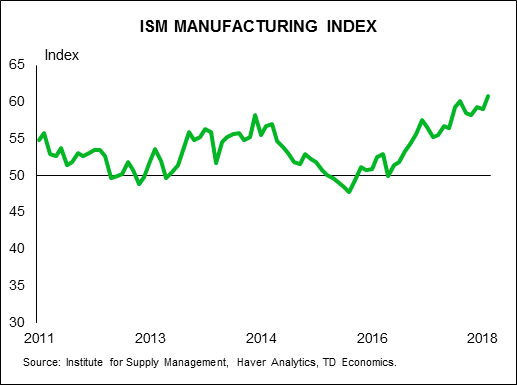

U.S. ISM Manufacturing Index – March

Release Date: April 2, 2018

Previous Result: 60.8

TD Forecast: 59.8

Consensus: 60.0

We expect the March PMI to pull back a point to 59.8, putting the index at a level consistent with regional manufacturing surveys. The recent slowing in new orders also signals some giveback. We expect the survey to keep a solid level, but markets will be attentive to a more pronounced correction which could be linked to market volatility and tariff concerns.

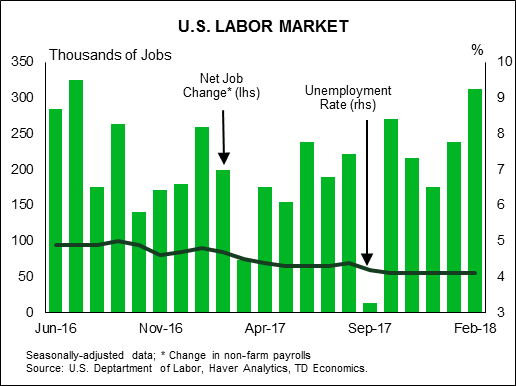

U.S. Employment – March

Release Date: April 6, 2018

Previous Result: 313k, unemployment rate: 4.1%

TD Forecast: 170k, unemployment rate: 4.0%

Consensus: 185k, unemployment rate: 4.0%

We expect nonfarm payrolls to pull back to 170k in March after recording a 313k jump in February. The previous gain was outsized due to unseasonably warm weather, which likely boosted construction payrolls. We view this pace as unsustainable at this stage of the business cycle and see scope for a sizeable pullback, given that prints above 300k on average correct by 150-175 the subsequent month. Payrolls in the month of March also disappoint on average by -48k, the most next to May.

Given the recent pace of job gains, we expect the unemployment rate to move lower to 4.0%. We expect average hourly earnings to rise 0.3% m/m, leading the y/y pace higher to 2.8% y/y. Day-of-the-week effects (with the 12th landing on a Monday) together with mean reversion point to a strong m/m print.

Canada: Upcoming Key Economic Releases

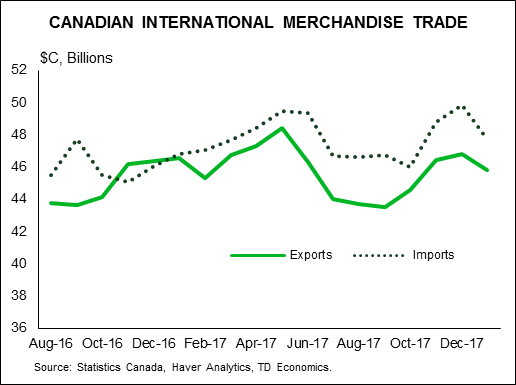

Canadian International Trade – February

Release Date: April 5, 2018

Previous Result: $-1.9bn

TD Forecast: -$2.2bn

Consensus: N/A

TD expects the international merchandise trade deficit to widen to $2.2bn in February from $1.9bn the prior month, reflecting a rebound in imports offset by a more modest increase in exports. Exports will benefit from a weaker CAD after peaking in late January. Elsewhere, a partial rebound in motor vehicles should help support headline exports after plant shutdowns led to a 13.1% decline in January. Real energy exports should rebound from a sharp decline in January but further declines in crude oil prices will weigh on nominal exports. Meanwhile, imports should see a broad rebound after falling over 4% in January.

Canadian Employment – March

Release Date: April 6, 2018

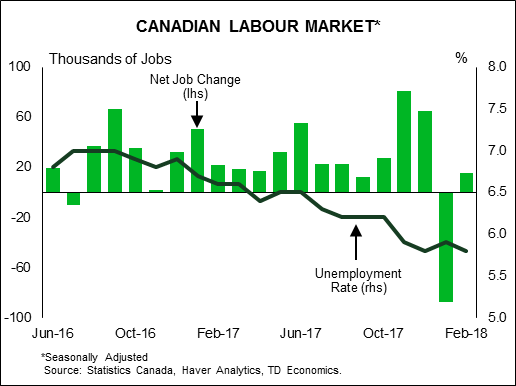

Previous Result: 15k, unemployment rate: 5.8%

TD Forecast: 20k, unemployment rate: 5.7%

Consensus: N/A

TD looks for job growth of 20k in March, which should push the unemployment rate to a new post-crisis low of 5.7%. Full-time employment should see a modest rebound after falling 40k last month but we still see scope for part-time to outperform. The six month trend of full -time job growth is still running at a robust 40k while part -time job losses have averaged -21k per month. After the sharp increase in February CPI, markets will pay close attention to measures of wage growth, which is already running at 3.1% y/y for permanent employees. We expect this to drift higher in March on muted base effects and the overall tightness of the labour market, but it is unlikely we surpass the January high of 3.3% without more support from the demand side. Overall, this should make for an upbeat report and provide further evidence of diminishing labour market slack.