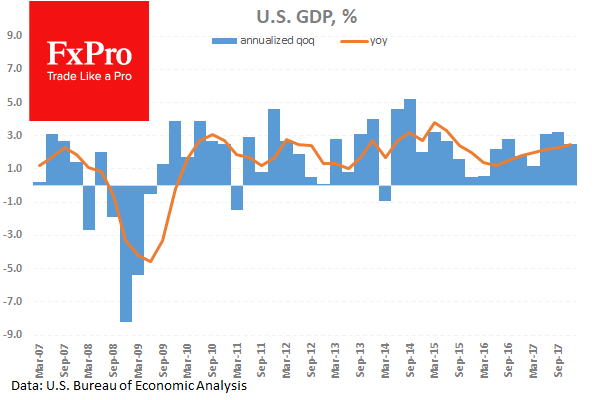

At 13:30 GMT, US Gross Domestic Product Annualized (Q4) data will be out, with the headline number expected to be 2.7%, from a previous 2.5%. Gross Domestic Product Price Index (Q4) data is expected to remain unchanged at 2.3%. Also at this time, Core Personal Consumption Expenditures (QoQ) (Q4) is expected to be unchanged from the Q3 reading at 1.9%. Personal Consumption Expenditure Prices (QoQ) (Q4) is also expected to be unchanged at 2.7%. USD crosses may see moves, as traders take Dollar positions in reaction to the numbers released.

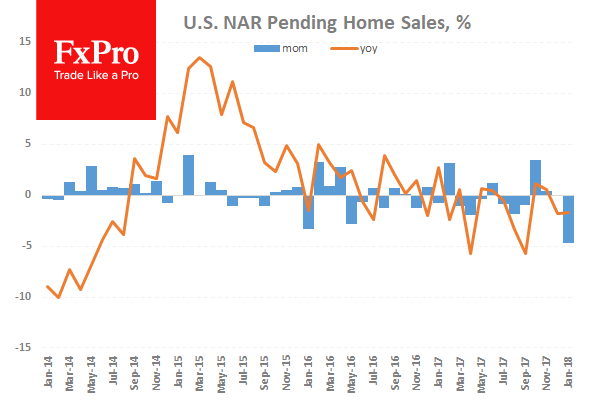

At 15:00 GMT, Pending Home Sales (YoY) (Feb) is expected to be -0.2% against a prior reading of -1.7%. Pending Home Sales (MoM) (Feb) is expected to be 2.1% against a prior reading of -4.7%. These data points are expected to rebound after declining to -4.7% last month, the lowest level in four years. The New Year is usually the worst time for US home sales, with a strong rebound taking place in February. USD pairs could move due to this data release.

At 18:30 GMT, FOMC Member Bostic is due to speak at the Atlanta Society of Finance and Investment Professionals luncheon. Comments may result in moves in USD crosses.

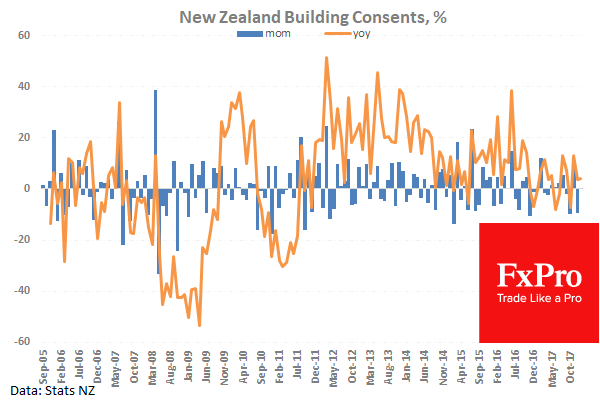

At 21:45 GMT, New Zealand Building Permits s.a. (MoM) (Feb) will be released, with a prior reading of 0.2%. This data series can be quite volatile, having swung between 20 and -10 over the last six years. The November reading was 10.8%, while December was -9.6%. NZD crosses may experience volatility during this time.