Here are the latest developments in global markets:

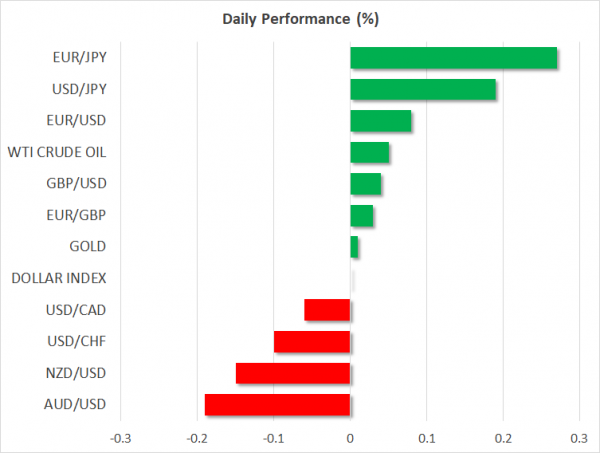

FOREX: The dollar was not much changed against a basket of currencies on Tuesday, consolidating its losses from yesterday that saw it lose 0.5%, recording a more than one-month low along the way. Elsewhere, the yen was extending its losses from yesterday on the back of risk appetite returning to the markets.

STOCKS: US markets staged a spectacular comeback yesterday, as headlines of progress being made in US-China trade talks helped to diminish concerns of an imminent trade war and revive risk appetite. The Nasdaq Composite led the recovery, gaining a whooping 3.3%, while the Dow Jones and S&P 500 followed closely in its tracks, climbing by 2.8% and 2.7% respectively; the Dow recorded its third-biggest point gain in its history on Monday. This positive shift in sentiment looks set to continue today, as futures tracking the Dow, S&P and Nasdaq 100 are all currently pointing to a higher open. Asia was a sea of green today as well, with Japan’s Nikkei 225 and Topix surging by 2.65% and 2.75% correspondingly. In Hong Kong, the Hang Seng was 0.8% higher. Demand for riskier assets seems to have returned to Europe as well, with futures tracking all the major benchmarks currently flashing green.

COMMODITIES: Oil prices are marginally higher today, with both WTI crude and Brent being up by roughly 0.1%. The main theme driving the oil market appears to be speculation around new sanctions being imposed on Iran soon, which would remove a significant chunk of oil supply from the market. Besides any news on Iran, oil prices will also remain sensitive to changes in risk appetite, any major movements in the dollar, as well as the weekly API crude inventory data due out later today. In precious metals, gold prices surged yesterday, breaking above the $1350 resistance hurdle to currently trade at $1355, even despite the risk-on market environment. The safe haven’s gains are probably owed to the decline in the US dollar. Since gold is denominated in dollars, it tends to benefit when the greenback depreciates as investors using foreign currencies find it cheaper to buy the yellow metal.

Major movers: Dollar consolidates losses while yen continues declining as positive risk sentiment makes a comeback

The dollar’s index against a basket of currencies was close to flat, trading not far above 88.98, its lowest since February 19 recorded yesterday. Majors including the euro and sterling posted notable gains versus the greenback on Monday and today they were consolidating those gains. At 0630 GMT, euro/dollar and pound/dollar were trading within breathing distance of yesterday’s near six-week and near eight-week highs of 1.2462 and 1.4244 respectively.

China and the United States appearing willing to enter into discussions on trade, deviating from the inflammatory rhetoric of recent days, acted as a major boost to risk sentiment, supporting equities and diverting funds out of traditional safe-havens such as the Japanese currency. The dollar, euro and sterling were all building on yesterday’s advances versus the yen, with their gains ranging from 0.2-0.3%. Dollar/yen was at 105.60, around a yen above Monday’s 16-month low for the pair, while pound/yen was trading close to a one-month high of 150.42 recorded earlier in the day. It is notable that euro/yen added an impressive 1.4% on Monday, for the common currency to post its best daily performance versus the yen since June 2017.

The euro was broadly higher yesterday, in part being helped by remarks from Jens Weidmann, the Bundesbank’s president and Germany’s likely candidate to replace Mario Draghi as the European Central Bank’s next chair in late 2019. Weidmann said market expectations of an ECB interest rate increase towards mid-2019 were “not completely unrealistic”. While these comments were not new, the repetition may have added some further credibility to that prospect.

Elsewhere, the yen did not react much to the testimony of the former Japanese tax agency chief before parliament; the former official’s comments did not implicate PM Shinzo Abe or anybody from his environment in the land scandal that has been troubling his administration in recent weeks.

Interestingly, the commodity-linked aussie and the kiwi which tend to gain on rising risk appetite were losing ground versus their US counterpart, having advanced the previous day though. Still, the two currencies were gaining versus the yen.

In emerging markets, dollar/yuan was 0.2% lower, having earlier hit a two-and-a-half-year low of 6.2352 on the back of a firmer exchange rate fix by the PBOC. The South Korean won was also a major winner versus other currencies, gaining on reports that North Korea’s Kim Jong Un was planning a visit to Beijing, this marking his first known trip outside North Korea since leading the country in 2011.

Day ahead: Second-tier indicators on the agenda, trade developments still in focus

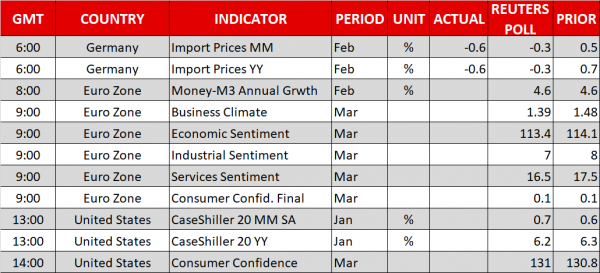

The economic calendar is filled with second-tier economic data releases today out of the eurozone and the US.

In the euro area, the most noteworthy indicator will be the economic sentiment index for March, due out at 0900 GMT. The index is anticipated to tumble to 113.4 from 114.1 in the previous month, in line with similar declines in other gauges of economic activity and sentiment, like the Markit PMIs and the ZEW survey. While this is usually not a major market mover, such a pullback would be yet another sign that the eurozone’s growth momentum may be losing steam. The bloc’s M3 money supply growth for February is also due for release at 0800 GMT.

In the UK, the BoE’s Financial Policy Committee minutes from the March meeting are due out at 0830 GMT.

Over in the US, the main publications will be the S&P/Case-Shiller house price index for January and the Conference Board consumer confidence print for March. House prices in 20 of the largest US cities are expected to have risen at a slightly slower pace in yearly terms. Meanwhile, consumer optimism is expected to have ticked up again, which would mark a fresh high last seen in 2000 for the index, painting a rosier picture for American consumption.

In energy markets, the private API weekly crude inventory data will be in focus at 2030 GMT. More broadly, the prospect of new sanctions on Iran will probably remain a key driver for the oil market. Such expectations have largely been fueled by the visit of the Saudi Crown Prince to the US, as well as the replacement of several moderate figures in the Trump administration with Iran-hawks.

Equity markets will likely continue to focus on the possibility of a trade war, which is currently seen as becoming less likely amid signs of progress in talks. Nonetheless, risk sentiment remains very fragile despite the latest recovery, and price action is likely to remain very much headline-driven.

In terms of policymakers’ appearances, we have two on the schedule. ECB Governing Council member Erkki Liikanen will deliver remarks at 0800 GMT, while Atlanta Fed President Raphael Bostic (voter) is due to speak at 1500 GMT.

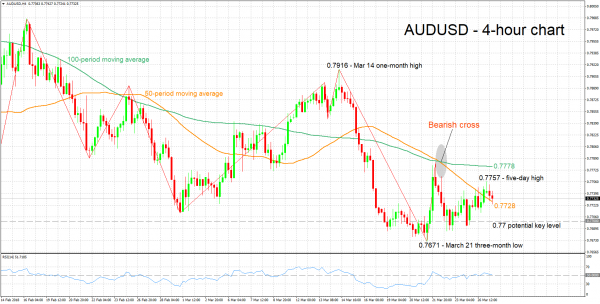

Technical Analysis: AUDUSD looking neutral in the short-term

AUDUSD recorded a five-day high of 0.7757 earlier on Tuesday but it has since retreated from that level. The pair has in large part been moving sideways over the last few trading days, with the RSI which is hovering around the 50 neutral-perceived level pointing to the absence of momentum in either direction in the short-term. Australia’s economy heavily relies on commodity exports and its currency tends to benefit on upbeat views on global trade and the global economy; the implication being that the country’s economy stands to gain from higher exports.

An escalation of trade tensions that consequently weigh on positive views on global growth could hurt AUDUSD. Support to declines might come around the current level of the 50-period moving average at 0.7728, with steeper declines turning the focus to the 0.77 round figure; the area around this handle was one of congestion recently. Further below, additional support could come around the three-month low of 0.7671 from March 21.

Conversely, should concerns over global trade ease further and boost risk appetite, then AUDUSD is likely to be supported. Resistance to advances could take place around the 100-day MA at 0.7778, given that price action first clears the five-day high of 0.7757 posted earlier in the day.