For the 24 hours to 23:00 GMT, the USD declined 0.8% against the JPY and closed at 104.88.

The Japanese Yen gained ground against the USD, as investors piled into safe haven currency, after the US President, Donald Trump signed a $50.0 billion in trade tariffs on Chinese imports, thus sparking fresh fears of a trade war between the world’s two biggest economies.

In the Asian session, at GMT0400, the pair is trading at 104.77, with the USD trading 0.1% lower against the JPY from yesterday’s close.

Data released overnight showed that Japan’s national consumer price index (CPI) rose 1.5% on an annual basis in February, in line with market expectations. In the previous month, the CPI had risen 1.4%.

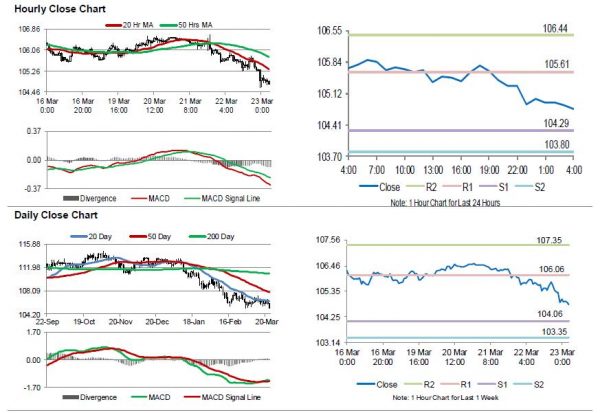

The pair is expected to find support at 104.29, and a fall through could take it to the next support level of 103.80. The pair is expected to find its first resistance at 105.61, and a rise through could take it to the next resistance level of 106.44.

Next week, Japan’s jobless rate, industrial production, retail trade and large retailers’ sales data, all scheduled to release next week, will be on investors’ radar.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.