For the 24 hours to 23:00 GMT, the EUR rose 0.69% against the USD and closed at 1.2342.

The US Dollar declined against a basket of major currencies, after the US Federal Reserve (Fed) raised the key interest rate for the first time this year but retained its view for 3 rate hikes in 2018.

The Fed, at its latest monetary policy meeting, voted unanimously to lift the benchmark interest rate by a quarter percentage point to a range of 1.50% to 1.75%, citing an improving economic outlook. Further, Fed’s Chairman, Jerome Powell, stated that the US economy has strengthened in recent months and inflation appears to be moving towards the central bank’s 2.00% goal. In its quarterly economic outlook, the central bank stuck to its prior forecast of three rate hikes in 2018 but lifted its 2018 economic growth projection from 2.50% to 2.70%, while growth forecast for 2019 was raised to 2.40%, from 2.10% estimated earlier in December. However, inflation estimate was left unchanged at 1.90% for this year.

On the macro front, existing home sales in the US rebounded 3.0% on a monthly basis, to a level of 5.54 million in February, advancing for the first time in three months. In the previous month, existing home sales had recorded a level of 5.38 million, while investors had envisaged for a rise to a level of 5.40 million. On the other hand, the nation’s MBA mortgage applications declined 1.1% in the week ended 16 March, after recording a rise of 0.9% in the previous week.

In the Asian session, at GMT0400, the pair is trading at 1.2364, with the EUR trading 0.18% higher against the USD from yesterday’s close.

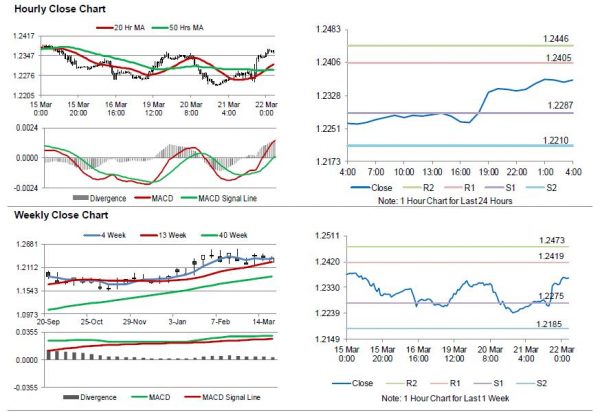

The pair is expected to find support at 1.2287, and a fall through could take it to the next support level of 1.2210. The pair is expected to find its first resistance at 1.2405, and a rise through could take it to the next resistance level of 1.2446.

Moving ahead, traders would eye the flash Markit manufacturing and services PMIs for March, scheduled to release across the Euro-zone in a few hours. Moreover, Germany’s Ifo business climate and expectations indices for March, will also keep investors on their toes. Later in the day, the US Markit manufacturing and services PMIs for March as well as initial jobless claims data, will garner significant amount of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.