Wednesday March 21: Five things the markets are talking about

Global equities have traded mixed overnight despite the U.S dollar operating under pressure as the market waits for the Federal Reserve’s first policy decision since Jerome Powell took the wheel. Treasuries prices have rallied and oil has touched a six-week high.

At 02:00 pm ETD the market will tune in to Jerome Powell’s first Federal Open Market Committee (FOMC) meeting as chairman, with close scrutiny of whether monetary policy might become more “hawkish” under his tenure. Also of interest will be the future guidance given by him during his scheduled press conference (02:30 am EDT).

Recent U.S data and Fed speeches would suggest the median of FOMC participants’ assessment of the appropriate pace of policy firming (the dots) will unite around +2.125% or three-hikes for 2018, with an outside risk the median dot will move to +2.375%.

Elsewhere, the Bank of England (BoE) is expected to keep interest rates and its asset-purchase program unchanged tomorrow (8:00 am EDT). Attention will be on language and the odds for a May hike.

Also, down-under, the Reserve Bank of New Zealand (RBNZ) has a monetary policy decision today at 04:00 pm EDT.

1. Stocks mixed results

In Japan, many investors have stayed on the sidelines ahead of today’s Japanese public holiday and the two-day Fed meeting expected to produce a rate hike.

Down-under, Australia’s ASX closed +0.2% higher, while indexes in Indonesia and India rose by +1% and +0.7%, respectively. In New Zealand, the main benchmark closed +1.4% higher at a record high.

In Hong Kong, stocks were little changed overnight, as the market braces itself for Fed Chair Powell’s first policy meeting and amid concerns that President Trump could impose additional punitive trade measures against China. The Hang Seng index rose +0.1%, while the China Enterprises Index lost -0.5%.

In China, stocks erased early gains and ended lower, weighed down by start-up firms, as investors booked profits mostly in the tech sector. At the close, the Shanghai Composite index was down -0.3%, while the blue-chip CSI300 index was down -0.38%.

In Europe, regional indices trade mostly lower across the board led by the FTSE 100 which trades lower on a stronger pound (£1.4074) on the back of stronger jobs data (see below) out of the U.K.

U.S stock futures are pointing to a -0.1% fall for the S&P 500 and the Dow.

Indices: Stoxx600 -0.2% at 375.0, FTSE -0.5% at 7026, DAX -0.1% at 12298, CAC-40 -0.3% at 5235, IBEX-35 +0.1% at 9688, FTSE MIB +0.1% at 22829, SMI -0.2% at 8834, S&P 500 Futures -0.1%

2. Oil prices edge higher on Middle East tension, gold supported

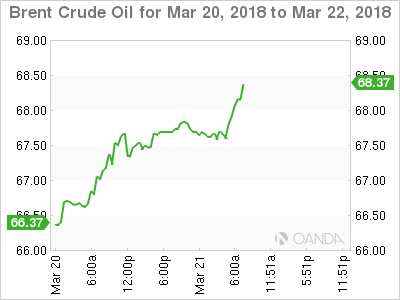

Oil prices are better bid, lifted by a mixed dollar, tensions in the Middle East and concerns of a further fall in Venezuelan output.

Brent crude futures are at +$67.56 per barrel, up +14c, or +0.2%, while U.S West Texas Intermediate (WTI) crude futures are at +$63.69 a barrel, up +15c, or +0.2% from Monday’s close.

The IEA said last week that Venezuela, where an economic crisis has cut oil production by almost -50% to well below +2m bpd was “clearly vulnerable to an accelerated decline”, and that such a disruption could tip global markets into deficit.

Capping prices somewhat is U.S crude oil production, which has risen by more than a fifth since mid-2016, to +10.38m bpd.

Note: U.S output is now higher than that of top exporter Saudi Arabia. Only Russia produces more, at around +11m bpd, although U.S output is expected to overtake Russia’s later this year.

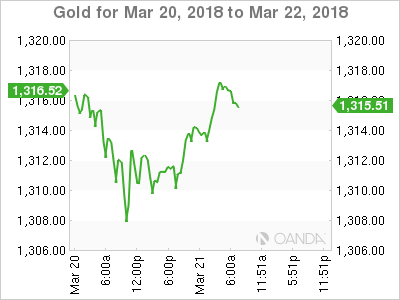

Ahead of the U.S open, gold prices gains on the ‘big’ dollar decline as market awaits the Feds rate outlook. Spot gold is up +0.4% at +$1,315.84 per ounce. Prices fell to a nearly three-week low of +$1,306.91 in yesterday’s session.

3. Sovereign yield to be guided by Fed decision

U.S government bond prices fell yesterday as investors look forward to the conclusion of today’s Fed meeting and clear space in their portfolios for new corporate bond offerings.

Note: As often happens in the lead-up to Fed meetings, yields have been trending higher. Fed officials are widely expected to lift short-term interest rates by +25 bps this afternoon.

There is the risk that the Fed will sound a little bit more ‘hawkish.’ Nevertheless, the majority is anticipating that the Fed’s median projection of rate increases for this year will remain at three. There is a slight possibility that officials could lift their projections for 2019, 2020 and over the longer term

The yield on U.S 10-year Treasuries -1 bps to +2.88%, the first retreat in a week. In Germany, the 10-year Bund yield fell less than -1 bps to +0.58%. In the U.K, the 10-year Gilt yield has declined -1 bps to +1.482%.

4. The dollar’s mixed results

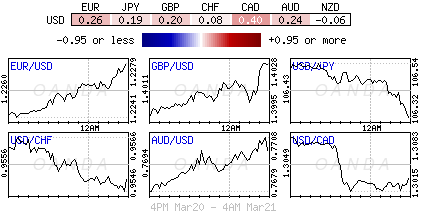

FX markets remain mostly in a “wait-and-see mode” ahead of today’s Fed meeting decision.

The USD is a tad softer against the major pairs and has moved off its recent three-week highs.

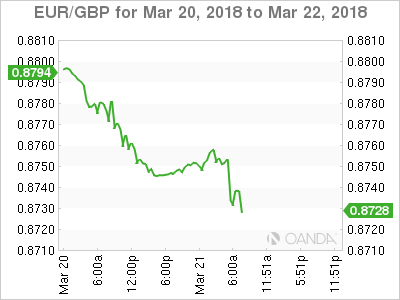

GBP/USD (£1.4074) is firmer todays after stronger than anticipated U.K wage data (see below) has given the MPC more latitude to display a more ‘hawkish” tone after yesterday’s disappointing CPI print.

The EUR/USD is higher by +0.3%, just shy of the psychological €1.2300 level, while USD/JPY is off by -0.3% at ¥106.29

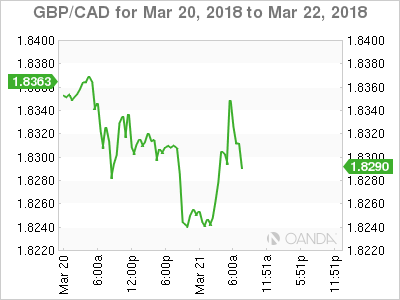

Elsewhere, constructive NAFTA news that the U.S government is contemplating dropping demand on Canada and Mexico autos in NAFTA talks saw the MXN and CAD currencies firm up. The CAD (C$1.3040) dollar has rallied overnight, hitting its best levels in about a week.

5. U.K data in focus

Data this morning, across the pond, showed that the U.K unemployment rate held steady in January, while wage growth ticked a tad higher.

The jobless rate in the three-months through January was +4.3%, the same rate as the previous three-months and lower than the +4.7% for the same period a year earlier.

Other data showed that annual wage growth accelerated to +2.6%, from +2.5% previously, driven by higher pay settlements in construction and manufacturing.

Today’s U.K wage data keeps door ajar for a possible B0E hike in May.