It is going to be a crucial week for the British pound, with a Bank of England (BoE) policy decision on Thursday and an EU summit that will determine whether the UK will finally obtain a transitional Brexit deal. Ahead of these events though, the UK will also release a raft of key economic data that could affect expectations around monetary policy, with the first on the list being the nation’s CPI figures for February, due out on Tuesday at 0930 GMT.

The BoE will announce its rate decision on Thursday, and while no change in policy is expected, markets will be looking for signals regarding the likelihood of a near-term rate hike, perhaps as early as at the May meeting. Whether the Bank will provide such signals though is likely to depend on the quality of incoming data, and the updated inflation numbers are among the most important ones to watch ahead of the gathering.

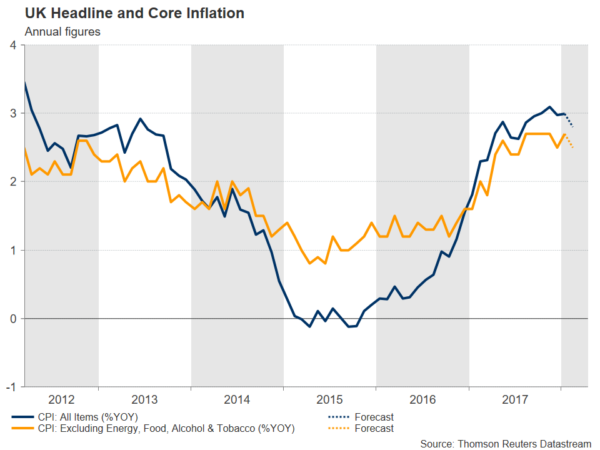

In February, UK inflation is forecast to have slowed somewhat in yearly terms, but to still remain well-above the BoE’s 2.0% target. The headline CPI rate is projected to have declined to 2.8% from 3.0% previously, while the core rate that excludes food and energy items is anticipated to have eased to 2.5%, from 2.7% in January.

Such prints would likely be encouraging news for the BoE, as they would signify that inflation is moving back down towards its target. What is good news for the BoE though, will probably be bad news for sterling bulls, as such a slowdown in inflation would reduce the pressure on the Bank to hike interest rates soon. Remember that raising interest rates applies downward pressure on inflation, so if inflation is edging lower on its own, the BoE can afford to stay patient for longer and keep rates unchanged. In other words, if inflation is converging towards the target by itself, it makes little sense to hike borrowing costs and risk all the unwanted consequences of higher rates, like slower consumption and economic growth.

Such prints would likely be encouraging news for the BoE, as they would signify that inflation is moving back down towards its target. What is good news for the BoE though, will probably be bad news for sterling bulls, as such a slowdown in inflation would reduce the pressure on the Bank to hike interest rates soon. Remember that raising interest rates applies downward pressure on inflation, so if inflation is edging lower on its own, the BoE can afford to stay patient for longer and keep rates unchanged. In other words, if inflation is converging towards the target by itself, it makes little sense to hike borrowing costs and risk all the unwanted consequences of higher rates, like slower consumption and economic growth.

Expectations that the BoE will raise rates by 25bps at its May meeting are currently riding high, with markets attaching a 70% probability to that scenario according to the UK overnight index swaps. Should the UK CPIs – particularly the core rate – decline by more than expected, that could push the probability for a May rate hike lower, and sterling is likely to follow suit. In this scenario, sterling/dollar could edge lower and aim for another test of the 1.3910 territory, marked by the March 19 lows. Further declines after that would bring the 1.3780 zone in play, identified by the troughs of March 9.

A positive surprise in the CPIs on the other hand, for example a smaller-than-anticipated decline in the core rate, could push the probability for a May rate increase higher, and sterling alongside it. In this case, Cable would likely surge and challenge the 1.4150 hurdle, marked by the highs of February 16. If buyers manage to overcome that barrier, then sell orders may be found near 1.4280, the February 2 peak.

As for which scenario is more likely, the UK services PMI for February showed that prices charged by service companies increased at the weakest rate for six months, supporting the forecast for a slowdown in the CPIs. Considering that services account for roughly 80% of UK GDP, this PMI is typically considered a decent gauge of the broader economy.

As for which scenario is more likely, the UK services PMI for February showed that prices charged by service companies increased at the weakest rate for six months, supporting the forecast for a slowdown in the CPIs. Considering that services account for roughly 80% of UK GDP, this PMI is typically considered a decent gauge of the broader economy.