Here are the latest developments in global markets:

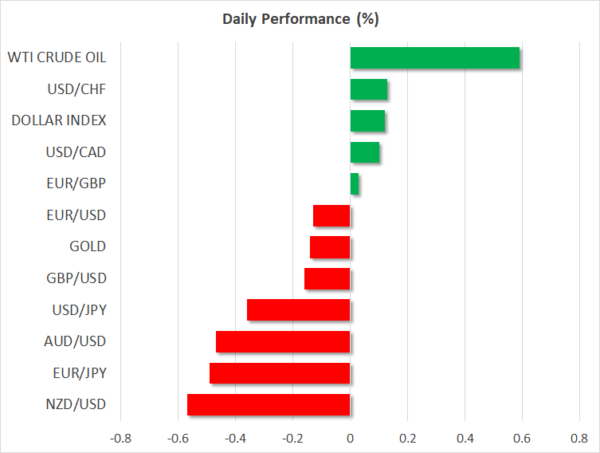

FOREX: Dollar/yen hovered near one-week lows, last trading at 105.90 (-0.35%) as investors continued to look for safer assets amid worries that the incoming US economic adviser, Larry Kudlow, who previously criticized US-China trade relations could back Trump’s plans to impose further import tariffs to China. This comes ahead of a crucial G20 meeting next week where world leaders are expected to denounce unfair trade practices. Pound/dollar extended losses towards 1.3928 (-0.14%) as the UK Brexit Minister, David Davis, said he would accept EU’s offer of a 21 months transition period rather than two years. Note that Brexit negotiating teams will meet during the weekend, with markets being optimistic that a deal on the transition period will likely happen. Euro/dollar inched down to 1.2352 (-0.12%), weighed by concerns on the future of the US-EU trade partnership although today’s remarks by officials out of the bloc were supporting that a tit-for-tat retaliation is not the answer to US protectionism, including the German Chancellor. Meanwhile in Norway, the Norges Bank kept interest rates steady but announced unexpectedly that a rate hike would probably come “after summer”, somewhat earlier than previously thought. Dollar/Krone dived to 7.6862 (-0.66%) and euro/krone retreated to 9.49 (-0.62%). The Swiss National Bank, also left interest rates unchanged today, reporting that it will maintain an accommodative monetary policy and remain active in foreign exchange markets given the appreciation of the local currency in the face of a weaker dollar. Dollar/swissie inched up to 0.9462 (+0.13%) following the decision.

STOCKS: Positive corporate results continued to support European stocks on Thursday, despite worries about Trump’s trade policy implications. The pan-European STOXX 600 and the blue-chip Euro STOXX 50 were up by 0.17% and 0.30% respectively, with the majority of the sectors being in the green. The German DAX 30 climbed by 0.22%, with the German carmaker Volkswagen and the largest world reinsurer Munich Re being the best performers. The former saw significant gains during the week due to its plans to broaden production to electric cars, while the latter saw its shares jumping by 2.0% after it upgraded its 2018 profit forecasts. On the other hand, the shares of the French Bank Societe Generale tumbled by 3.0% after the unexpected resignation of the deputy CEO. Still, gains in healthcare and industrials were enough to send the French CAC 40 higher by 0.28%. The UK’s FTSE 100 managed to rise by 0.17% despite sharp losses in technology sectors, while the US stock futures were mixed.

COMMODITIES: Oil prices headed higher after the Energy International Administration said that global demand is expected to rise this year, but oil supply is increasing at a faster pace, reporting that inventories could pick up in the first half of 2018. WTI crude and Brent were last seen at $61.32 (+0.59%) and $65.19 (+0.46%) per barrel correspondingly. In precious metals, gold extended declines towards $1322.66 (-0.13%) per ounce.

Day ahead: US initial jobless claims & business indices attract attention

Day ahead: US initial jobless claims & business indices attract attention

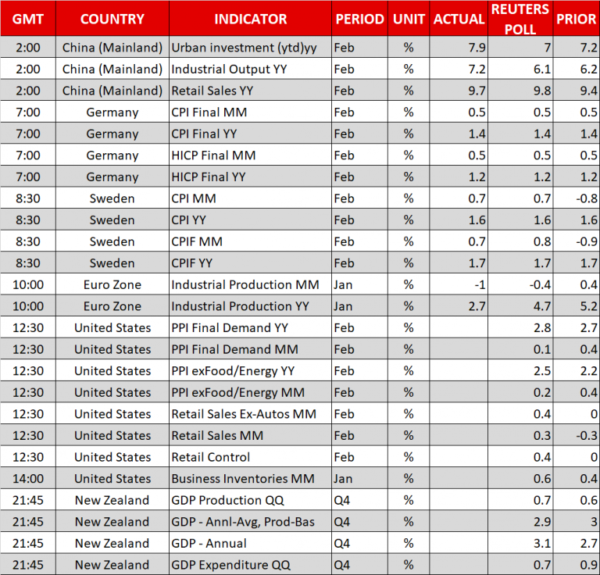

The US will release another bunch of economic data today, though, positions on the dollar might be on the defensive as investors continue to price risks stemming from Trump’s protectionist appetite which could drive global trade on edge.

At 1230 GMT, the New York Fed will publish readings on manufacturing conditions in the New York state, with the index expected to improve in March after four months of falling. The Philadelphia Fed will also report on regional business conditions at the same time, however, in this case, projections are for the business index to weaken.

US initial jobless claims for the week ending March 9 and March import prices will be published along with the above data as well. A few hours later at 1400 GMT, the National Association of House Builders will issue its Housing Market Index which tracks the relative level of current and future single-family home sales. A print above 50 is considered a positive sign for the housing market.

Trump’s politics will remain in the center stage during the day after the resignation of the chief economic adviser, Gary Cohn, last week and the firing of the Secretary of State, Rex Tillerson on Tuesday which increased speculations that the president is serious about his punitive legislative plans. Early today news confirming Larry Kudlow to be the new economic adviser, pushed the dollar lower as the CNBC’s economic analyst is known for his tough stance against US-China trade relations. On the other hand, he has been critical of Trump’s tariff approach.