Early today, Statistics New Zealand released retail sales data that beat analysts’ forecast. Data from the agency showed that core retail sales grew by 1.8% against the expected 0.7% while the retail for Q4 rose by 1.7% compared to the forecasts of 1.4%. Following the release, the kiwi fell 0.35% against the dollar, continuing a downward trend that started yesterday when the pair hit a three-day high of 0.7632. Today, no major dollar economic data will be released. As such, the pair could continue its downward momentum, pushing it to below 0.7240.

Today, we will receive inflation data from Canada, which will be very important for the Canadian Dollar. A disappointing number could see a sharp decrease in the Canadian dollar. Traders expect the annualized CPI to grow by 1.4%, down from the previously reported 1.9%. They expect the monthly CPI to grow by 0.4% compared to last month’s -0.4%. Other data to be released are the Common CPI and Core CPI.

In Europe, we will receive GDP data from Germany, the largest economy in the region. Traders expect the data to show that the economy expanded by an annualized rate of 2.3%. They also expect the data to show that the economy expanded by 0.6%, down from last month’s 0.8%. We will also receive inflation data from the EU. Traders expect the core CPI to grow by 1.0% while the annualized CPI to remain at 1.3%. A surprise beat to the upside will lead the EUR to more gains as traders anticipate a rate increase before the end of the year.

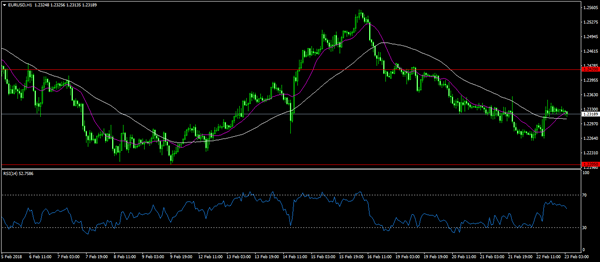

EUR/USD

Today, the EUR/USD is little moved following yesterday’s sharp fall from the 1.2556 level. Traders are waiting for the inflation data from the EU and the GDP numbers from Germany. The first scenario today is where the pair reverses its downward trend and reaches the important resistance area of 1.2420. The alternative scenario is where the pair continues to fall and reaches the 1.2205 level.

NZD/USD

The pair fell to a new weekly low of 0.7032, even as the retail data showed significant improvements. Using the Relative Strength Index, there is a likelihood that the pair could reverse as traders take profits. The likely scenario is where the pair tests the 0.7323 resistance level.

USD/CAD

The Canadian dollar has weakened significantly against the dollar. It is now trading at a near two-month low. The upward trend in the pair could change today when Canada releases its inflation data. Bullish data could see the pair reverse to the 1.2450 level while bearish data could see the pair’s momentum continue to rise to 1.2925.