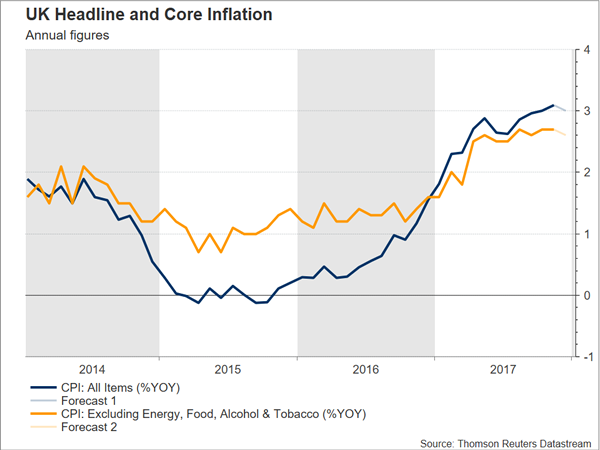

UK inflation figures for the month of December will be made public on Tuesday at 0930 GMT. Annual inflation is expected to grow by 3.0%, easing a bit from the near six-year high of 3.1% recorded in November, which given that it was by more than 1% above the Bank of England’s target for inflation of 2% meant that Governor Carney had to write a letter to the Chancellor of the Exchequer Philip Hammond to explain the overshoot.

Month-on-month, December CPI is forecast to expand by 0.4%, above November’s respective figure of 0.3%. Core inflation, which excludes energy, food, alcohol and tobacco items, is anticipated to grow by 2.6% y/y in December, this being a slightly softer pace relative to the 2.7% in the preceding two months which constituted the highest rate of growth for the measure since late 2011.

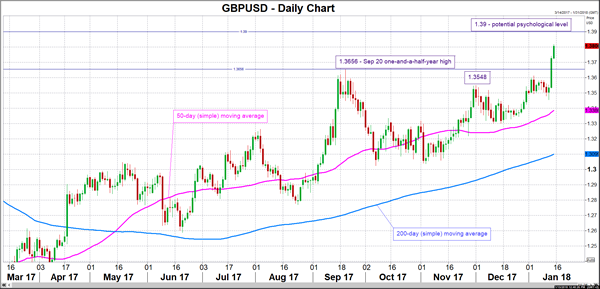

Should inflation figures come in excess of analysts’ projections, then forex market participants could propel pound/dollar higher in expectation for another interest rate increase by the BoE – after the one in early November – to be delivered sooner rather than later. In this case, the area around the 1.39 handle could act as a psychological barrier to the upside. The pair is currently trading at its highest since June 2016’s Brexit referendum and could be meeting some resistance around 1.38 – 1.38 itself being broken – which is roughly where the 61.8% Fibonacci retracement of the decline that followed the referendum is situated. For the record, markets currently expect another quarter percentage point interest rate increase by the BoE – for the bank’s target rate to reach 0.75% – by year-end.

If, on the other hand, inflation numbers come in below expectations, then sterling might weaken, as it could be perceived by market participants that the UK’s central bank would face less pressure to soon deliver additional rate hikes. A falling sterling versus the dollar could meet support around 1.3656, a top recorded in late September.

How fierce the market reaction would be, will also depend on the extent of the deviation from analysts’ forecasts. But another caveat should be mentioned: in the case of the UK, the analysis is not as “binary” as it might be in the US, the eurozone and Japan for example, where inflation is running short of the respective central banks targets and where a higher reading would definitely be welcome. In the UK, higher-than-anticipated inflation might raise hopes for interest rate hikes to be delivered earlier in time, but is also weakening the outlook for growth as inflation outpaces wage increases, setting a negative backdrop for consumer spending as UK households are seeing their purchasing power getting shrunk. In fact, last month’s inflation overshoot beyond market expectations led to gains in sterling that were short-lived.

BoE policymakers would likely be reluctant to deliver additional rate hikes when faced with a possibly grimmer economic environment. Add into the equation Brexit and other political uncertainty – with PM Theresa May seen as gradually getting weaker – and the attempt to predict the monetary policy outlook becomes an even more complicated endeavor.

Data on producer prices and retail price inflation – a measure used to calculate payments on instruments such as index-linked government bonds and other contracts such as indexed-pensions – for December will also be released alongside CPI figures, while numbers on UK retail sales for the month of December will be made public on Friday at 0930 GMT.